UnitedHealth (UNH) is once again in the regulatory spotlight...

UnitedHealth (UNH) is once again in the regulatory spotlight...

The trouble started with a series of Wall Street Journal reports last month. The reports alleged UnitedHealth has been racking up billions of dollars in extra insurance payments... by over-diagnosing patients with conditions that generate more money.

And now, Congress is getting involved. Senator Chuck Grassley (R-IA) launched an inquiry into whether the company is improperly profiting from its Medicare Advantage business.

He has asked the Department of Justice ("DOJ") and the Centers for Medicare & Medicaid Services to weigh in as well.

This is far from the first controversy UnitedHealth has faced in recent months.

Last year, the DOJ sued to block UnitedHealth's acquisition of home-health provider Amedisys... citing concerns about consolidation and market power.

In short, there's a lot of pressure on UnitedHealth to defend its practices. And it may signal the regulatory environment is about to change...

Lawmakers are starting to wonder if UnitedHealth has gotten too powerful...

Lawmakers are starting to wonder if UnitedHealth has gotten too powerful...

Its deep provider network, massive customer base, and data-driven care coordination have made it a leader in the space.

The company serves more than 7.6 million Medicare Advantage members, by far the biggest share of any provider. That industry alone is worth $500 billion.

Plus, UnitedHealth contracts with more than 1.7 million physicians and health care professionals, and more than 7,000 hospitals and other facilities.

All those factors give it a significant leg up in the health care industry. So it's no wonder UnitedHealth has caught lawmakers' attention.

And competitors, hospitals, and patients are all calling for more transparency in how the business uses Medicare dollars – and what portion of those dollars benefits shareholders.

Investors are already wising up to the end of UnitedHealth's dominant era…

Investors are already wising up to the end of UnitedHealth's dominant era…

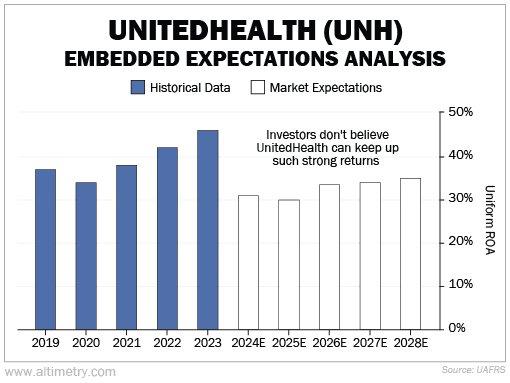

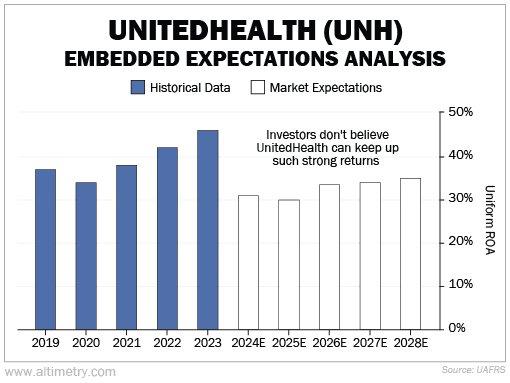

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from the company's future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

UnitedHealth's Uniform return on assets ("ROA") was 46% in 2023. That's almost four times the 12% corporate average... and the company's highest return ever.

That may be part of why operations are under scrutiny from regulators. And investors don't think the standout returns will last. They expect Uniform ROA to fall to about 30% by 2028.

Take a look...

Investors appear to be pricing in a decline, aligning with the broader risk of changing Medicare billing policies.

In health care, size is power...

In health care, size is power...

But it's also a liability. And for UnitedHealth, that liability is becoming harder to ignore.

This company isn't going away. However, even modest changes in Medicare Advantage reimbursement or oversight could ripple through its financials. The days of uninterrupted growth and sky-high margins may be over.

With regulatory risk rising and lawmakers paying closer attention, investors would be wise to adjust their outlook.

The market already expects some moderation in returns – but if regulations tighten further, even those forecasts may prove too optimistic.

Regards,

Joel Litman

March 25, 2025

UnitedHealth (UNH) is once again in the regulatory spotlight...

UnitedHealth (UNH) is once again in the regulatory spotlight...