The work-from-home environment has significantly changed mental health...

The work-from-home environment has significantly changed mental health...

The coronavirus pandemic has forced many employees into remote work. People will still go back to the office after the crisis subsides... but many of the changes will be permanent. A few weeks ago, Bloomberg highlighted some of the big shifts...

According to a study from the Federal Reserve Bank of St. Louis, working from home saved between 1 million and 1.5 million hours of commuting from April to July in three sample suburban counties.

Many employees have also seen a bump in productivity. Workers no longer need to spend hours looking busy for their bosses.

This is a huge shift to office space and work structure. The number of employees who reported they will work at home on a permanent basis more than half the time has doubled since the pandemic began. In total, this means 46% of people say they plan to spend more than half the month working at home.

However, we've also seen dark sides of the work-at-home world. The quarantine has hurt the food-service industry and brick-and-mortar stores. People are spending more time at home and they aren't traveling by car as much.

Additionally, these trends have taken a psychological toll on workers. Remote employees often spend more hours working from home than they do in the office as the boundaries between work and home have become increasingly blurred.

They also have fewer interactions with colleagues, which can make them feel more isolated.

This has led to additional stress and anxiety for employees across the country (and the globe). It will be important to pay attention to mental health support as people spend more time working at home.

One of the potential reasons for companies to get mental health right is due to the potential of lost productivity...

One of the potential reasons for companies to get mental health right is due to the potential of lost productivity...

Mental health issues can lead to employee burnout and decreased work output, so a goal for many companies is to help workers manage their stress. The pandemic has caused a wave of uncertainty for workers across the globe.

For those needing additional help managing this newfound stress, some health care companies offer support. One such example is Acadia Healthcare (ACHC)...

The company operates residential treatment centers and behavioral facilities and provides other psychiatric resources – with nearly 600 facilities in 40 U.S. states, the U.K., and Puerto Rico. Acadia's work is important for helping people manage their mental health.

Investors might think that with a growing focus on mental health – even before the pandemic – Acadia would have strong profitability. This is especially true since Acadia doesn't need to invest as much in high-tech, expensive equipment as traditional hospitals do. It's a more "asset light" business than a regular health care facility.

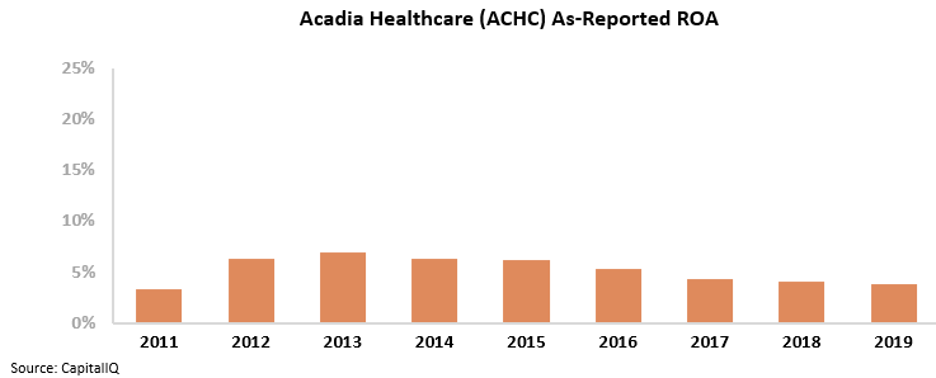

Despite this, if we only look at the GAAP numbers, Acadia has cost-of-capital profitability, at best. The company's as-reported return on assets ("ROA") has fallen from a peak of 7% in 2013 to 4% last year. Acadia appears to have been unable to profitably capitalize on tailwinds in the mental health industry.

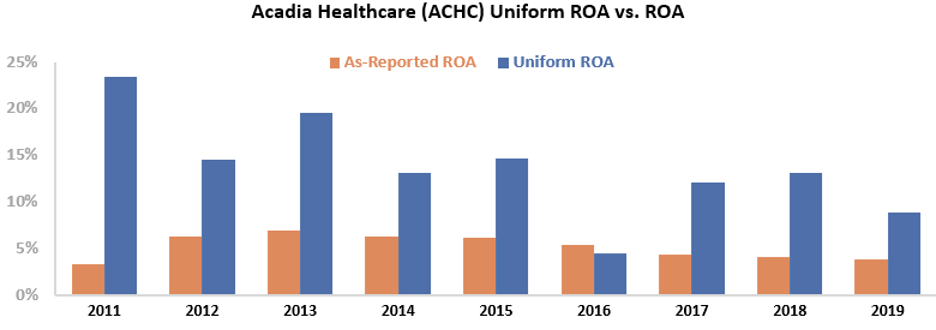

However, this picture of Acadia's performance is distorted by as-reported accounting, including the mistreatment of interest expense. This means that Wall Street has missed the mark on Acadia's profitability.

When we look at the real, Uniform metrics, we can see that the company's returns have been far higher than the as-reported numbers since 2011, except in 2016. During that year, Acadia was working through the integration of its Priory Group acquisition, which it bought in January that year.

Looking at the 2019 numbers, the company's Uniform ROA was 9% – more than double the as-reported figure. Take a look...

Without Uniform Accounting, investors might see Acadia as a firm with below cost-of-capital returns instead of strong profitability.

More important, due to the GAAP distortions, the market is expecting Acadia's returns to continue to decline... and that may create an opportunity for investors.

It breaks down like this...

It breaks down like this...

Most investors determine stock valuations using a discounted cash flow ("DCF") model. Investors build this model using assumptions about the future, and it then produces the "intrinsic value" of the stock.

However, here at Altimetry, we know models with garbage-in assumptions only come out as garbage... so we turn the DCF model on its head with our Embedded Expectations framework. We use the current stock price to solve for what returns the market expects a company to make.

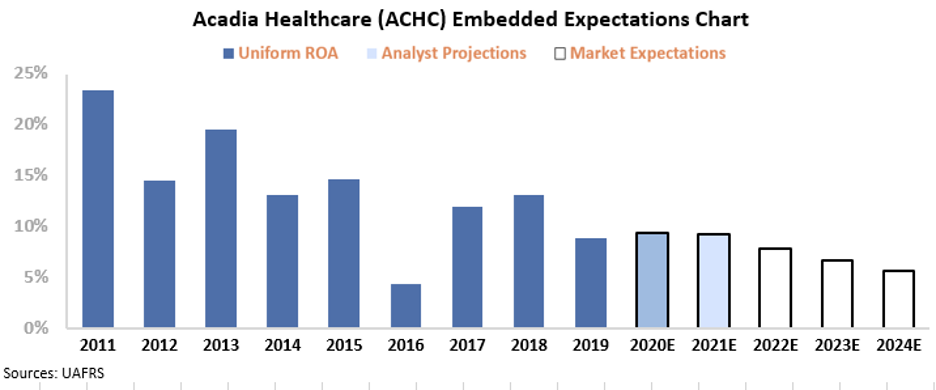

In the chart below, the dark blue bars represent Acadia's historical corporate performance levels in terms of ROA. The light blue bars are Wall Street analysts' expectations for the next two years. Finally, the white bars are the market's expectations for how ROA will shift in the next five years.

Wall Street is currently projecting Acadia's returns to remain at 9%, while the market is pricing in returns to fall to 6%. This means that the market is pricing in the recent dip in ROA to be permanent. However, Acadia has consistently had an ROA of more than 12%.

Acadia should benefit from tailwinds around the rising awareness of the mental health problems in this country. Historically, this has already led to the company generating higher returns than as-reported metrics would indicate.

But the market is pricing in returns to fall to historical lows... even while Acadia stands to benefit from the increased focus on mental health for workers struggling during the pandemic.

If Acadia can provide value to those suffering from mental health issues during the pandemic, these expectations may be too pessimistic... and ACHC shares could be poised for upside.

Regards,

Rob Spivey

November 10, 2020

P.S. Society is changing as more life shifts to the home. It's a trend that we've called the "At-Home Revolution"... and the companies that can capitalize will be poised to see their stocks move higher as the trend continues to unfold.

But not every stock will see the biggest gains. Some will even be outright losers of the At-Home Revolution. In Altimetry's Hidden Alpha, we've identified the ones that are primed for high upside ahead... and the potential gains are turbocharged due to market misconceptions from GAAP accounting. Learn more here.

The work-from-home environment has significantly changed mental health...

The work-from-home environment has significantly changed mental health...