The days of Microsoft (MSFT) tracking headcounts may be over...

The days of Microsoft (MSFT) tracking headcounts may be over...

At a recent investment conference, a member of JPMorgan Chase (JPM) senior leadership talked about a very important conversation between CEO Jamie Dimon... and the CEO of Microsoft, Satya Nadella.

Nadella said Microsoft has been incredibly busy with the latest artificial-intelligence ("AI") work. He also said he hasn't been getting any requests to increase headcount... across any of his businesses.

The executive was puzzled at first. After all, Microsoft is spending billions of dollars to make sure it comes out on top of the AI race.

And it has customers banging down its doors... Revenue is forecast to grow almost $35 billion this year.

Then, Nadella realized Microsoft isn't just a supplier of AI. It has rapidly become a user, too.

It's no secret Microsoft is at the center of the AI universe. However, the company is doing far more with AI than most people realize... and it's already starting to pay off in a big way.

In addition to bringing in new revenue, AI is also making Microsoft more efficient...

In addition to bringing in new revenue, AI is also making Microsoft more efficient...

The company can spend less on headcount for every dollar of revenue it grows.

Microsoft is one of the leading players in the AI race. It benefits from being one of the most trusted tech platform partners. Microsoft Teams and the Office suite are pretty much ubiquitous in the business world.

This is holding true with AI, too. And thanks to Microsoft's relationship with OpenAI, it will have a front-row seat as this market grows.

Microsoft is also at an advantage because of its similarities to its fellow tech giant, Meta Platforms (META).

Like Meta, Microsoft has a massive store of data at its disposal. The company has millions of users on its Microsoft Office platform, including more than 60% of the Fortune 500.

These companies supply Microsoft with a sea of data, which it can leverage as it develops its AI solutions.

AI will be powering both Microsoft's growth and profitability expansion in the coming years. And somehow, the market isn't paying attention...

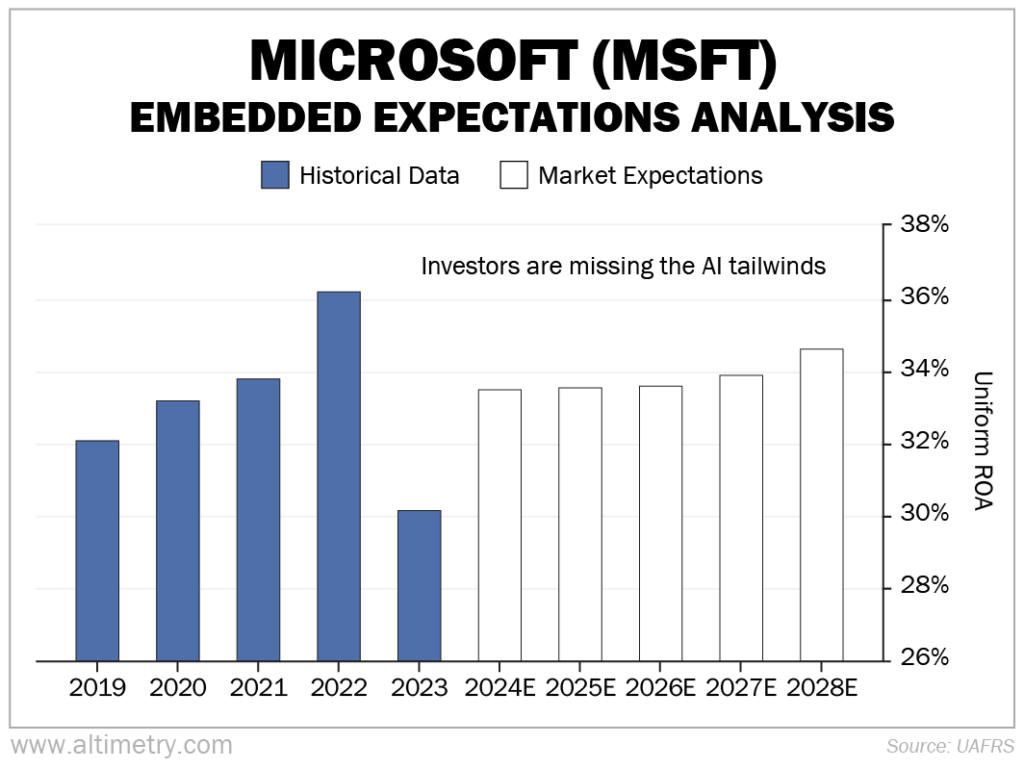

We can see this through our Embedded Expectations Analysis ('EEA') framework...

We can see this through our Embedded Expectations Analysis ('EEA') framework...

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to justify what the market is paying for it today.

Investors expect Microsoft to keep growing around 15% per year, roughly in line with the past five-plus years. They expect Uniform return on assets ("ROA") to stay flat, too.

Take a look...

In short, the market doesn't realize just how transformative Microsoft's AI developments will be for its own business.

Tech advancements will boost efficiency. The AI portion of the business should push Uniform ROA much higher.

Headcount costs are easily more than 50% of Microsoft's total operating costs. If AI can shrink those costs even slightly for each incremental dollar of revenue... and if Microsoft keeps growing 15% per year... returns could rise quickly.

Microsoft is positioned to be an AI leader in the long run. Loyal Microsoft Office customers will be more inclined to use Microsoft AI.

Its relationship with OpenAI and its sea of data will give it the tools to develop a leading AI product. And by using AI to improve internal efficiencies, the company will become more profitable as it grows.

The race for AI isn't over yet. Microsoft keeps presenting more reasons it'll come out on top.

Regards,

Joel Litman

July 25, 2024

Editor's note: Microsoft is a world-class tech giant. It's a clear contender to win the AI race. But for the best shot at outsized gains, you have to look beyond the companies already making headlines...

Joel and his team recently revealed four smaller stocks in the AI ecosystem that are in the right place at the best possible time. There's still plenty of room to buy in (for now)... for huge upside potential.

They also put together a list of the worst AI stocks to avoid at all costs – including a member of the "Magnificent Seven." To access their latest small- and midcap AI research for 50% off the regular price, click here.

The days of Microsoft (MSFT) tracking headcounts may be over...

The days of Microsoft (MSFT) tracking headcounts may be over...