President Joe Biden has been ramping up U.S. military aid to Ukraine...

President Joe Biden has been ramping up U.S. military aid to Ukraine...

Since Russia invaded Ukraine in February, millions of people have lost their homes, livelihoods, and friends and families.

According to the United Nations, more than 5 million people were forced to leave the country. Another 7 million people have been displaced within its borders.

Around the world, nations have rolled up their sleeves to help the Ukrainian people fight back against Russia. The U.S. is reluctant to put "boots on the ground," which could ignite a potential world war. But as a global leader, it has been a prominent figure throughout the conflict... providing Ukraine with a steady stream of supplies and funding.

Through the recently revived Lend-Lease Act – the same law that allowed America to support the Allies during World War II – the U.S. is on track to spend tens of billions of dollars on military, economic, and humanitarian aid.

And the support goes beyond sending materials overseas... Earlier this month, Biden made a point of visiting an Alabama factory that's creating weapons vital to Ukraine's resistance.

That factory, which belonged to defense contractor Lockheed Martin (LMT), produces Javelins. These modern, man-portable missiles have been key to helping Ukraine slow Russian tank attacks.

And support for Ukraine goes far beyond the Javelins. Biden stated during his visit that the U.S. and its allies must ensure that Ukrainians have the weapons, ammunition, and equipment to defend their country.

All of this has meant booming demand for the defense industry...

All of this has meant booming demand for the defense industry...

While the country remains focused on supporting Ukraine, defense stocks can't help but bask in the spotlight. Last week, the U.S. Senate authorized nearly $40 billion in additional military aid to Ukraine. That means more sales and more output from defense contractors' factories.

Biden's visit to Alabama sets Lockheed Martin apart from its competitors and shines a spotlight on it for investors. But before you make any investment decisions, it's always important to understand the underlying business.

Lockheed Martin is the largest defense contractor in the world. It's involved in all aspects of advanced technology systems, from research and design to development and manufacturing. In 2021, the company recorded $56 billion of revenue from product sales alone.

Fighter jets, helicopters, missiles, air-defense systems, and radar systems make up only a handful of the company's advanced weapons platforms. And now, this military-production titan is directing its efforts toward Ukraine.

We can use the Altimeter to see how this company is performing...

Remember, the Altimeter provides easily digestible grades to rank stocks on their real financials.

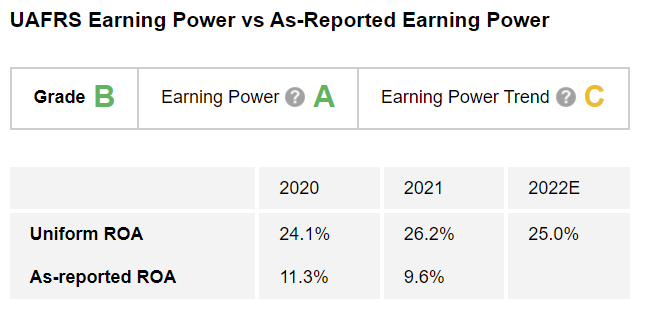

As the Altimeter shows, Lockheed Martin gets an "A" for Earning Power. Its Uniform return on assets ("ROA") sat at stable 24% to 26% levels in 2020 and 2021, and that number is expected to remain at 25% in 2022. These returns are double the U.S. corporate average.

Its Earning Power Trend earns a "C," as Lockheed's returns have been stable but not expanding. These two grades come together to earn the company a "B" Performance grade.

The Altimeter reveals that Lockheed Martin is a highly profitable defense contractor, as evidenced by its stellar performance grades.

Here's what these grades mean for Lockheed Martin...

Here's what these grades mean for Lockheed Martin...

Without a doubt, the company will benefit from the planned increase in military aid to Ukraine. Biden's visit to the factory only strengthens this notion.

However, investors should be careful about jumping headfirst into Lockheed Martin stock...

That's because the market may already be pricing in these war-related developments. Along with the company's performance, we need to understand how it's valued.

Subscribers to the Altimeter can see Lockheed's valuation based on Uniform Accounting by clicking here.

If you aren't yet an Altimeter subscriber, I urge you to sign up today. You'll be able to see how Lockheed Martin stacks up against the rest of the defense industry... and more than 5,000 other U.S.-listed companies. Click here to get started.

Regards,

Rob Spivey

May 26, 2022

President Joe Biden has been ramping up U.S. military aid to Ukraine...

President Joe Biden has been ramping up U.S. military aid to Ukraine...