OPEC was once a force to be reckoned with...

OPEC was once a force to be reckoned with...

The oil cartel represents some of the biggest oil-producing nations in the world, including Saudi Arabia, the United Arab Emirates, and Iraq. It had 12 member countries and an additional 10 allies in 2023, including Russia... collectively called OPEC+.

But over the past year, it has cut production several times to keep oil prices higher. Even worse, Angola announced in late December that it's leaving OPEC. That's set to drop its market share below 27%, after averaging 30% to 40% for decades.

And the expanded OPEC+ only made up 51% of the world's oil production as of December... its lowest market share since 2016, when OPEC+ was set up.

The International Energy Agency ("IEA") thinks this change may only be the start of OPEC's decline. You see, U.S. oil production reached a record high in 2023... and it's not showing any signs of slowing down.

OPEC's stranglehold on the market is faltering. And as we'll discuss, it's clearing the way for the U.S. to take control of the global oil market.

OPEC missed its chance to stop the U.S...

OPEC missed its chance to stop the U.S...

While the oil cartel is cutting production, other nations are ramping up as fast as they can. The U.S. already produced a world-leading 20.3 million barrels of oil per day in 2022. And it's expected to have grown production by 7% last year.

The U.S. is able to grow so much because it's getting more efficient at drilling. A lot of U.S. oil is locked up in shale rock, meaning it takes hydraulic fracturing ("fracking") to get it out. The process involves injecting a mixture of solids and liquids into the rock to free trapped oil and gas.

Fracking is more expensive than traditional oil drilling. So for years, OPEC nations had a huge cost advantage over the U.S. But while OPEC kept oil prices low enough to make money while U.S. fracking companies couldn't... it never managed to completely wipe out our oil production.

New drilling techniques mean fracking has gotten a lot more efficient in recent years. Major U.S. shale producers like Pioneer Natural Resources (PXD), Occidental Petroleum (OXY), ExxonMobil (XOM), and Diamondback Energy (FANG) have seen a significant boost in well performance.

These businesses are ramping up shale production as fast as they can... while OPEC is at its weakest point in years.

Expect better oil returns in the coming years...

Expect better oil returns in the coming years...

Take ExxonMobil, for example. It's the largest oil producer in the U.S., and it's still in the early stages of ramping up shale production.

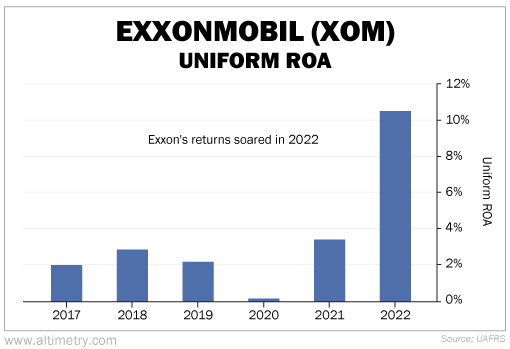

The company suffered through five years of weak Uniform return on assets ("ROA") starting in 2017. Returns were below 4% as Exxon battled low oil prices and figured out how to drill shale profitably. That's about half as high as the industry average.

But starting in 2022, Uniform ROA jumped above 10%. Take a look...

These returns are only the beginning of what Exxon can do. Back in October, it announced it was buying Pioneer – one of the biggest drillers in the Permian Basin – for $60 billion.

At the least, the acquisition should help Exxon's returns stay strong... if not get even stronger. And if OPEC continues to stand down to U.S. production increases, Exxon could capture even more market share.

OPEC is facing challenges... and U.S. shale is growing. The Permian Basin is becoming a key area for oil sector expansion. And since the U.S. is already the top oil-producing country, it looks like it'll keep extending its lead.

The uptick in U.S. oil profitability is here to stay. Investors will be rewarded for sticking around the Permian.

Regards,

Rob Spivey

January 4, 2024

OPEC was once a force to be reckoned with...

OPEC was once a force to be reckoned with...