The saga between Elon Musk and Twitter (TWTR) continues...

The saga between Elon Musk and Twitter (TWTR) continues...

In April, the world's richest man sent shockwaves through the social media world when he offered $44 billion to buy the industry giant. He believed that bringing Twitter private would improve profits and free speech.

Of course, it didn't take long for Musk to get cold feet...

He started complaining about the number of "bot" accounts on the platform – meaning, not real people. And over the past several months, he has tried his best to get out of the deal.

Musk's move to end the deal is based on a "material breach" by Twitter. He claims the company didn't disclose enough information about the bot accounts and other negatives.

Soon after Musk announced his plan to pull out of the deal about a month ago, Twitter sued him. Musk then filed a countersuit. And now, Twitter has subpoenaed several people closer to the deal from Musk's side. The trial is set to begin in mid-October.

And over the weekend, the seemingly never-ending saga took another turn...

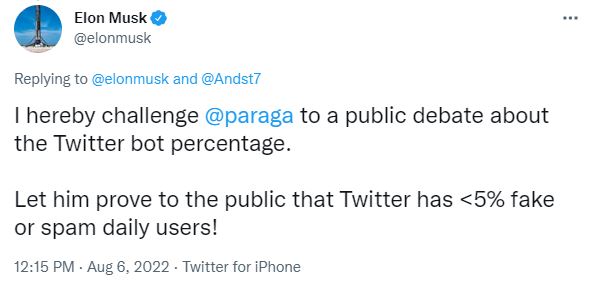

Rather than go to court, it appears that Musk instead wants a public debate with Twitter CEO Parag Agrawal. At least, that's what he posted on Twitter this past Saturday...

We're sure this won't be the last twist in the Musk-Twitter saga. And frankly, we're not interested in picking sides. But as we'll detail today, Twitter seems to be playing with fire...

Twitter now wants the deal to go through, but it might be making a big mistake...

Twitter now wants the deal to go through, but it might be making a big mistake...

The company's board of directors is pushing for the deal thanks to the size of Musk's majority cash buyout. With little other interest in the company, many on the board view the deal as "Musk or bust."

Since Musk has most of the financing he needs, he would only require about $10 billion in debt financing from big banks like Morgan Stanley (MS). But unfortunately for Twitter, even this mostly cash bid would come with risks...

Wall Street loves to use simple ratio analysis to understand the risk of a debt-laden company. These ratios – such as debt-to-equity or earnings-to-interest – are widely used by investors, but they don't always show the full picture.

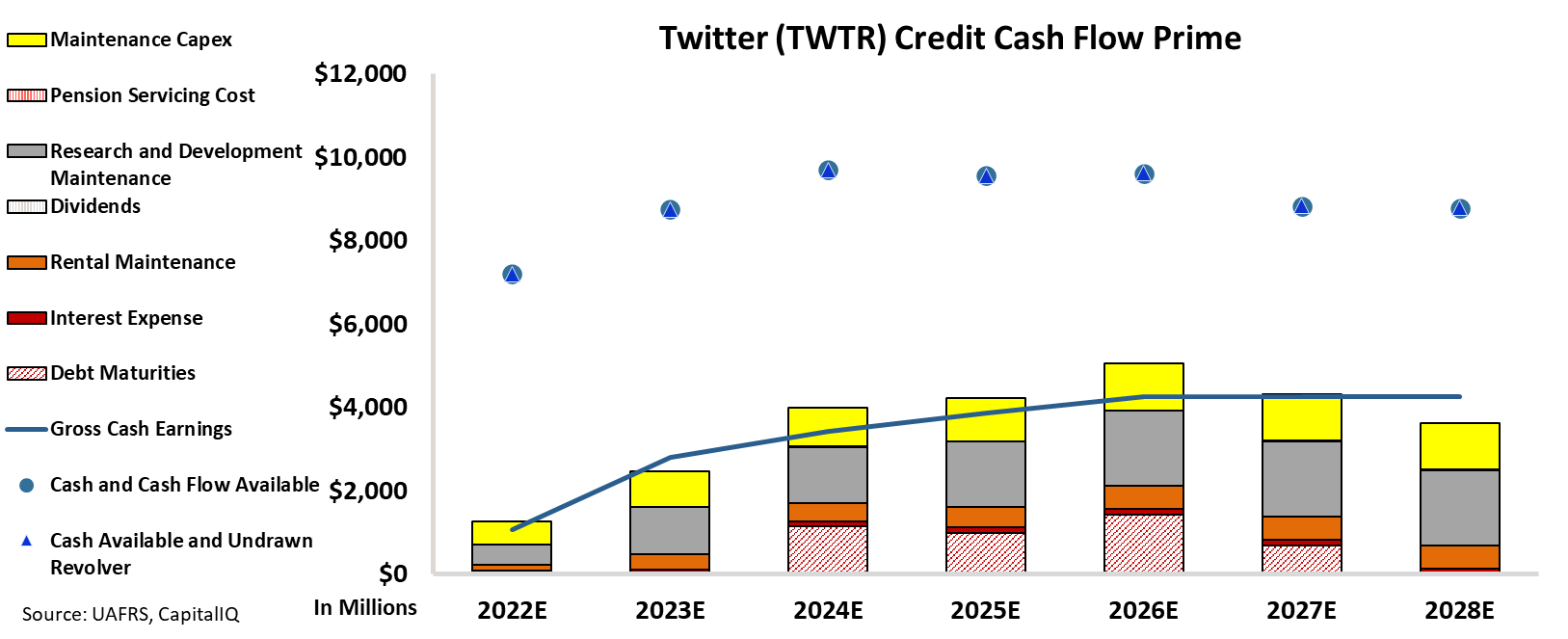

At Altimetry, we use a different, clearer method – our Credit Cash Flow Prime ("CCFP") model.

The CCFP shows us cash flows and all obligations together. That way, we can see how strong corporate balance sheets really are. And in this case, the CCFP helps us see what the $10 billion in debt from Musk's bid would look like on Twitter's balance sheet...

In the following chart, the stacked bars represent Twitter's obligations each year through 2028. Then, we compare these obligations with its cash flow (the blue line), as well as the cash on hand at the beginning of each period (the blue dots) and available cash and undrawn revolver (the blue triangles). Take a look...

Based on Twitter's CCFP, that $10 billion of debt that Musk would load onto Twitter's balance sheet suddenly becomes more of an issue. Notice how after 2024, the company's cash generation (the blue line) would no longer cover all of its obligations.

The $6 billion in cash on Twitter's current balance sheet would likely be used to offset the $10 billion in debt. The company's cash flows barely cover existing operating costs and interest payments today, so it will need this cash to avoid running out of funds by 2024.

In an ideal world, where the company's existing debt is at a 5% interest rate, Twitter would be hard-pressed to manage all the obligations. And again, that's before an extra $10 billion obligation is added.

Furthermore, a 5% interest rate is likely too low if the company does go through with the deal and takes on the additional $10 billion in debt. Since Musk secures his debt financing through his holdings with Tesla (TSLA), creditors will require a higher rate than if the collateral was more stable.

Musk's bid is attractive to Twitter. His offer is made up of mostly cash. And with a lack of alternatives, the company's board might feel like it's "Musk or bust" right now.

But as our CCFP model shows, Twitter might not be able to survive a deal with Musk – no matter how much cash he puts up.

The company's cash pile barely covers its current debt obligations. And if he goes through with the deal, Musk may be saddled with a company doomed to go underwater.

Bot accounts or not, that's likely a big reason why he wants to get out of the deal.

Regards,

Joel Litman

August 10, 2022

The saga between Elon Musk and Twitter (TWTR) continues...

The saga between Elon Musk and Twitter (TWTR) continues...