Editor's note: The market and our offices are closed on Wednesday, June 19, for Juneteenth. Because of this, we won't be publishing Altimetry Daily Authority. Please look for your next edition on Thursday, June 20.

When Russia invaded Ukraine, most folks thought this war would look like the first half of the 20th century...

When Russia invaded Ukraine, most folks thought this war would look like the first half of the 20th century...

That means trenches and artillery... not high-tech drone assaults and missile strikes. And it would've been great news for Ukraine, which doesn't have enough resources to protect against sky attacks.

Unfortunately, these things never seem to go as expected. Russia has thrown the book at Ukraine, including plenty of aerial warfare tactics. And NATO hasn't been much help.

Most of Eastern Europe's NATO members have little to no air-defense equipment. They can provide less than 5% of the air defenses needed to protect against any potential wars with Russia.

European leaders are even saying that Russia could attack a NATO member state soon.

All of that is certainly concerning for Eastern European geopolitical relations.

However, it also explains why certain U.S. defense companies are doing so well this year... and one specific business could win big as we fill the defensive void left by NATO.

The U.S. spends more on defense than the nine next-largest national military budgets combined...

The U.S. spends more on defense than the nine next-largest national military budgets combined...

And since 2022, we increased spending by nearly $175 billion to help Ukraine.

Eastern Europe won't be able to go much longer with its existing equipment. Our allies need a new wave of air-defense supplies.

That's where RTX (RTX) comes in.

RTX – formerly known as Raytheon Technologies – has three segments. One of those is Pratt & Whitney, a major supplier of aircraft engines for all types of customers.

Another is Collins Aerospace, which offers aerospace and defense (A&D) products for general and defense operations.

More than half of RTX's sales come from the U.S. government and allied foreign militaries. And the U.S. Department of Defense will increase defense spending by a projected 10% over the next decade.

RTX must be thrilled to hear it... considering its missiles and missile control systems will be an essential piece of that spending.

If you relied on as-reported data... you'd have no idea how powerful RTX's business is.

If you relied on as-reported data... you'd have no idea how powerful RTX's business is.

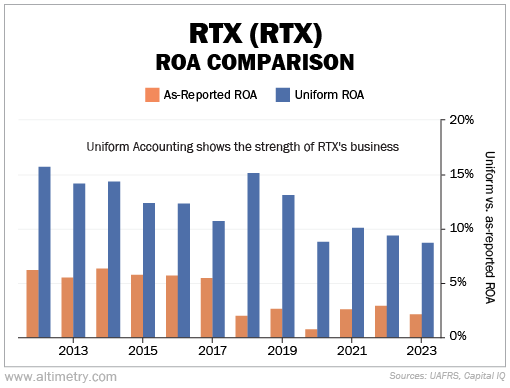

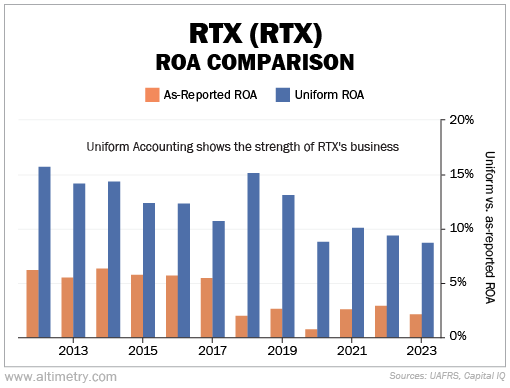

Take a look at the following chart. RTX's as-reported return on assets ("ROA") – the orange bars – has been less than 3% since 2018. Even though it did better from 2012 to 2017, returns were barely above breakeven.

Now focus on the blue bars... RTX's Uniform returns. Uniform ROA was nearly three times higher than as-reported ROA last year.

And Uniform returns have easily beaten breakeven every year for more than a decade...

RTX is already profitable, even in recent "down" years. With the U.S. ramping up defense spending even further, this company is in for some strong returns ahead.

The U.S. defense industry is huge... and RTX is far from the only opportunity.

The U.S. defense industry is huge... and RTX is far from the only opportunity.

A&D companies are flush with cash from supplying the U.S. and its allies. That's why I recently sat down for a fireside chat with Jon Shaffner, a longtime friend and decorated retired U.S. colonel.

Col. Shaffner and I discussed the defense industry... government spending in general... and the companies that will benefit from (or be hurt by) some of today's top trends.

Each day for the rest of the week, I'll feature an in-depth look at one of the topics we covered, exclusively in Altimetry Daily Authority. You can even watch a preview of the first 10 minutes of our chat, absolutely free, right here.

(I recommend watching to the end... We talk about one of our favorite U.S. defense stocks for today's environment.)

The full video – including an additional four stocks set to benefit from today's market tailwinds – is only available to my Hidden Alpha subscribers.

If you're interested, I'm offering 80% off this flagship research service for a limited time only. Learn more (and watch the first 10 minutes of our fireside chat for free) right here.

U.S. defense spending is going nowhere but up... and it will bring a lot of A&D stocks with it.

Make sure you understand what's really going on with these businesses' financials. It's one of the best ways to beat the market at its own game.

Regards,

Joel Litman

June 18, 2024

P.S. Current Hidden Alpha subscribers can view the fireside chat in full right here.

Got a topic you'd like covered in a future video? Write to us at [email protected] with the subject line "Video Topic Request."

(Please note: We can't provide individual investment advice.)

When Russia invaded Ukraine, most folks thought this war would look like the first half of the 20th century...

When Russia invaded Ukraine, most folks thought this war would look like the first half of the 20th century...