Netflix's (NFLX) streaming success was 10 years in the making...

Netflix's (NFLX) streaming success was 10 years in the making...

Today, it's a household name and an obvious "go to" for binge-watching our favorite TV shows and movies. But it didn't get there overnight.

Netflix was founded in 1997. And in the beginning, it was renting out DVDs by mail...

It had a massive catalogue of roughly 70,000 movie titles for customers to choose from. Folks would go online, select the movie they wanted to watch, and then it'd be delivered right to their door.

For nearly a decade, Netflix focused on its DVD rental service, gradually building its customer base. It eventually offered a subscription model where customers could rent up to three movies at a time for a monthly fee.

It wasn't until 2007 that Netflix introduced its groundbreaking streaming service, allowing users to instantly watch movies and TV shows online. And with the help of its new streaming platform, it managed to break $1 billion in annual revenue for the first time in company history.

By 2010, Netflix had grown its annual revenue to $2 billion. A year later, its revenue surpassed $3 billion. By the end of only its second decade in business, the company had increased its revenue 10-fold.

Anyone who saw its exploding streaming business in 2010 would have thought it was just in the right place at the right time.

But as I'll explain today, a lot of hard work in those early years set the company up for later success. And while a lot has changed since the early days of Netflix, this "keep your options open" approach is still crucial to coming out on top.

Netflix experimented with different business models for years...

Netflix experimented with different business models for years...

It tried everything from changing its delivery methods to multiple types of subscriptions. This gave it a better idea of what customers wanted... and allowed it to expand its offerings.

And it meant Netflix quickly secured its position as a leader in the industry.

Netflix's willingness to test out different business models is what helped build it into the streaming giant it is today. For 10 years, it worked hard to ensure its customers could watch as many movies as they wanted... Then, when it ventured into streaming, it was an overnight success.

It all comes down to something called "optionality."

Netflix could have failed many times since 1997. Had the company never experimented with streaming, it likely would have faded away around the turn of the 2010s.

And if it had never launched its own production studio in 2009, it would have been blindsided when other media companies like Disney (DIS) and NBC pulled their titles off the platform and launched their own competing services.

But Netflix focused on its real competitive advantage – what we call a company's "genuine assets." As we explained last week, knowing your customer is essential to succeeding in business.

And no one understands what folks want to watch better than Netflix...

And no one understands what folks want to watch better than Netflix...

The company has been studying customers' preferences since it began renting out DVDs in 1997. So it has a pretty good sense of where their interests lie. And management kept experimenting based on a simple question...

What business models can I use to get more customers?

That's how Netflix determined its genuine assets.

When it was mailing out DVD rentals, the company could keep tabs on what customers ordered... and what they didn't. That helped it stock the best titles and save money on less-popular options.

And when it launched its streaming service, Netflix didn't have to guess. It used years of data from the DVD model to offer the best streaming content and attract the most customers.

When the big media houses pulled their content from Netflix's platform, it was ready. It had spent years building its own studio to create content customers really wanted.

The competitive landscape is changing fast – not only across streaming, but plenty of other industries...

The competitive landscape is changing fast – not only across streaming, but plenty of other industries...

Companies never know when they might need to lean on their options.

Google parent Alphabet (GOOGL) is another great example of this. Google started as a revolutionary search engine in 1998. It allowed users to efficiently find information on the Internet.

The company became profitable by selling online advertising space and tapping into the vast potential of user data. But Google's success doesn't come from its original business model.

It comes from recognizing and seizing additional opportunities.

As the company grew, it explored different business avenues. It experimented and found new ways to harness user data.

Google expanded its offerings to include services like Google Maps, which transformed navigation for users worldwide. The goal was to effectively bring its search and advertising expertise to navigation.

It ventured into language services with Google Translate. It already had a powerful understanding of how to catalog information around the world, and it used that to improve communication. It even entered the travel industry with Google Flights, an airline booking widget.

And all these ventures increased its ad business.

In 2015, all of Google's different ventures combined under one holding company – Alphabet. And many of Alphabet's pursuits follow that same pattern. The company uses its genuine assets, in the form of user data, to continue growing its business. And that gives it plenty of optionality.

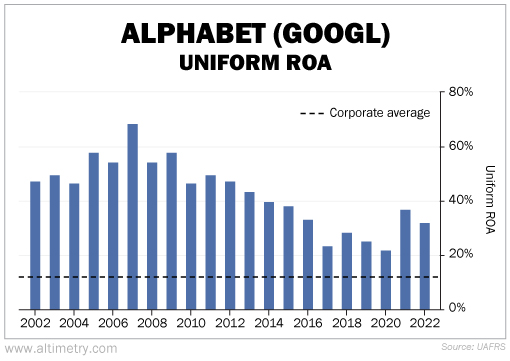

It's no wonder Alphabet's Uniform return on assets (''ROA'') has more than doubled the 12% corporate average for most of the past two decades...

Even during the pandemic, when countless companies trimmed their advertising budgets, Alphabet's Uniform ROA stayed above 20%.

That's the power of knowing what you do best... and using it to create options.

Optionality reduces risks and fosters stability...

Optionality reduces risks and fosters stability...

Ultimately, it enables long-term success in a changing market.

In times of uncertainty, investors should focus on businesses that have multiple revenue streams. You want to look for companies that know their own genuine assets... and understand how to turn them into profit.

This strategy is far less risky than relying solely on one core product or market. Companies with optionality are less likely to fail. And since they have plenty of ways to make money (and appease investors), their shares are likely to be more stable.

We still believe we'll see a recession within the next year. So make sure you're investing in companies that prioritize optionality.

They're less likely to take a punch they can't recover from.

Regards,

Rob Spivey

August 11, 2023

Netflix's (NFLX) streaming success was 10 years in the making...

Netflix's (NFLX) streaming success was 10 years in the making...