Dear reader,

Few CEOs have been more influential than Jack Welch of General Electric (GE).

Welch joined the company in 1960 and became CEO in 1981... By that time, GE was an aging, 90-year-old conglomerate that was considered by investors only for its dividend. But the market was unprepared for the sweeping changes that would come with new management...

First, Welch introduced stock options to his upper-level executives – a new compensation structure at the time. Welch also adopted the "Six Sigma" quality-improvement initiative to drive efficiency, and he turbocharged the GE Capital financial-services division in order to fund his changes.

But Welch earned his "Neutron Jack" nickname for his most aggressive strategy...

Welch believed that if a GE division was not the best or near-best in its market, then it should be overhauled or sold. He ended up selling more than 71 business in his first two years alone. Radioactive, indeed.

With all of this liquidity – along with the leverage of GE Capital – Neutron Jack launched a campaign of acquisition, moving GE into insurance, jewelry, and television. The largest acquisition under Welch's reign was the billion-dollar purchase of RCA, which came with the television network NBC... a business far from GE's manufacturing beginnings.

What did this all lead to? A new GE – a growth stock, rather than a dividend play. In honor of his aggressive overhaul of the company, Fortune magazine dubbed Welch the "Manager of the Century" in 1999.

While the S&P 500 rose 2,400% during its longest bull market, GE returned a massive 5,200% under Welch's tenure.

Understandably, the market has been searching for the next GE ever since Neutron Jack stepped down in 2001. While most companies overpay for their acquisitions, under Welch's steady hand, GE's revenues grew five times from $25 billion to $130 billion.

The business that has inherited this legacy from GE has been Danaher. When Larry Culp took over as CEO in 2001, he removed management layers and reduced headcount by 8%. With these cost savings, Culp then embarked on a mission of aggressive acquisition, growing Danaher to five times its size during his tenure.

Culp helped institute the "Danaher Business System" ("DBS") framework to integrate the company's acquisitions. Through this strategy, Danaher has become one of the most respected acquisitive businesses in the world. The company is able to regularly deliver on cost synergies and integrate corporate cultures by applying the DBS framework. It is also able to drive growth.

Danaher has become what many thought GE was in the early 2000s after Welch left. It has institutionalized efficient, acquisitive, transformative growth. What everyone wanted GE to be, Danaher has been.

The company has so captured what GE was meant to be that GE hired Culp to be its CEO in 2018. After the shock to the aviation market in 2001 in the wake of the 9/11 attacks and the serious contraction of GE Capital in 2008 during the financial crisis, GE has become a shadow of its former self. The company needs a "Neutron Culp" to right the ship.

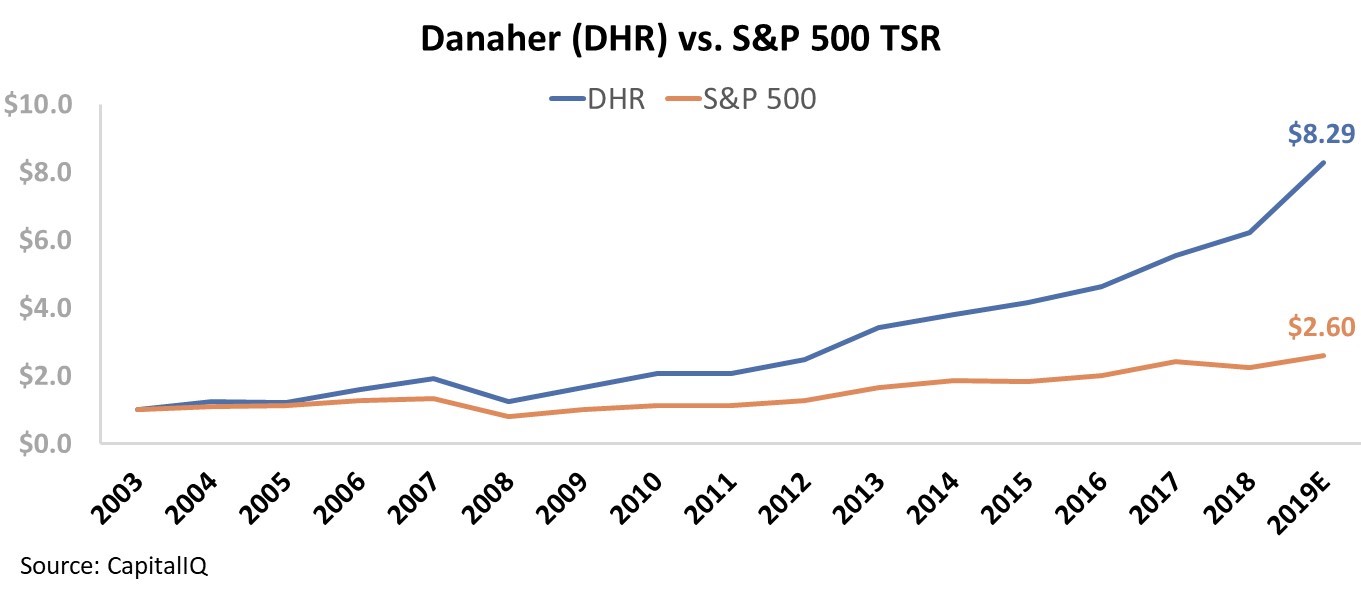

Culp recently left Danaher as a strong company, with a consistent return on assets ("ROA") despite the aggressive expansion. His reign led to a significant total shareholder return, or "TSR" – the total capital gains and dividend earnings an owner would generate by owning the company's stock. Over the last 15-plus years, Danaher has returned more than triple the S&P 500's total return...

However, past performance does not indicate future results. Because the market expects Danaher to keep its historic performance going, investors are likely expecting too much.

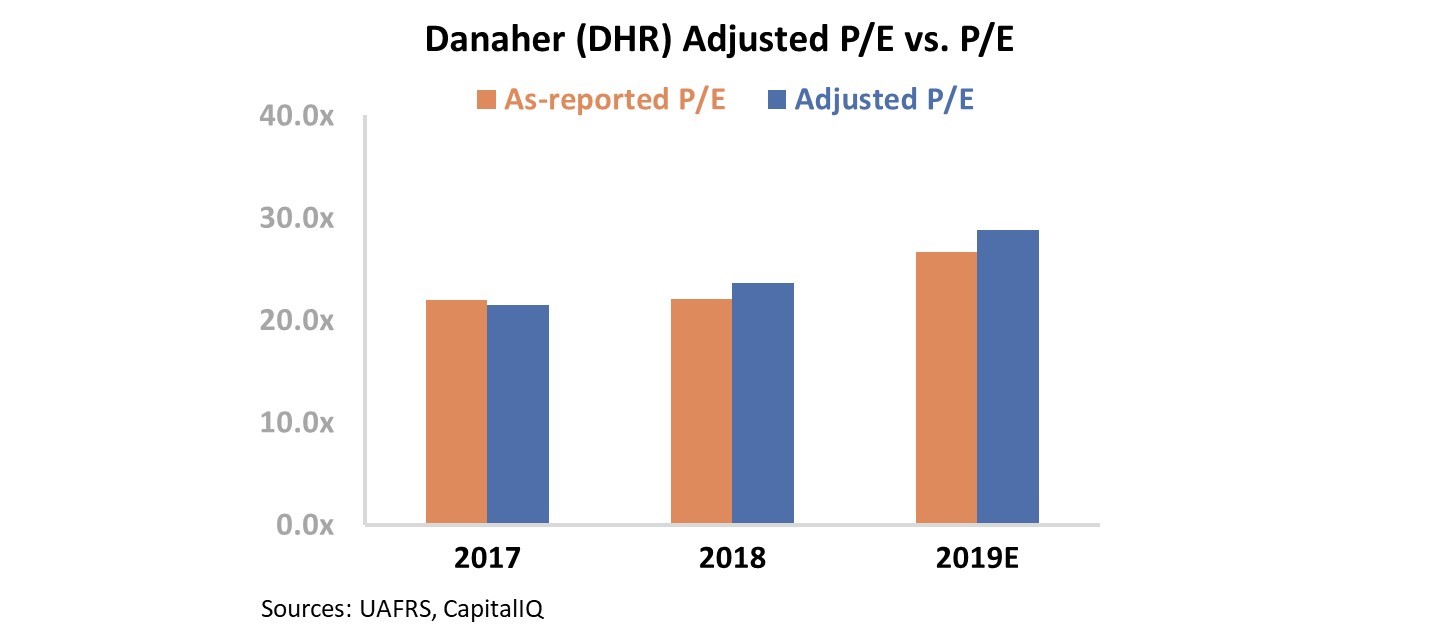

Danaher's as-reported price-to-earnings ("P/E") ratio has risen from 22 in 2017 to 26 last year. The market is willing to pay a premium for a management team in the tradition of Jack Welch. However, due to the distortions in as-reported accounting, investors don't understand how much of a premium they are truly paying for.

Danaher's Uniform P/E ratio has been increasing as well, and at a much steeper rate. The company currently trades for a P/E ratio of 29.3... almost 50% greater than the market average.

Danaher would need returns to nearly double in order to justify its current stock price.

While Culp sustained a healthy ROA as he grew the company, the peak ROA under his tenure was 35%, far below the market's expectation of 59% by 2023. For the last three years, returns have largely remained around those levels. Rather than expand rapidly, they are forecast to continue in 2019 and 2020.

While following a strong management team can be a winning strategy, a great company does not always mean its stock is a great purchase. With Danaher, such a high valuation means that even if management continues to deliver on stellar results, the company has a hard road ahead of it to not disappoint investors.

Regards,

Joel Litman

October 18, 2019