Trevor Milton just has to wait four years to collect his fortune...

Trevor Milton just has to wait four years to collect his fortune...

Back in October 2022, Milton – the founder and former CEO of electric-vehicle maker Nikola (NKLA) – was found guilty of defrauding investors. As of this past December, he's facing a $1 million fine, up to four years in prison, and the forfeiture of one property.

Milton's 4% stake in Nikola is still worth $34 million... So he'll have plenty of cash once he gets out. Meanwhile, investors were left in the dust. Nikola's stock is down almost 100% since peaking in June 2020.

With Milton out of the picture for now, some investors are wondering if they ought to stick around in the hopes of recouping their losses. However, just because one bad egg is out of the nest, that doesn't mean Nikola is in the clear...

Milton didn't only manipulate investors... He allegedly took advantage of his own hand-selected leadership team.

Milton didn't only manipulate investors... He allegedly took advantage of his own hand-selected leadership team.

Milton took his company public back in 2020, when electric-vehicle sales reached a record 3 million. Nikola's market cap briefly surpassed legacy automaker Ford Motor's (F) that year... even though it had less than $100,000 in revenue.

As part of Nikola's efforts to go public, Milton brought on a new CEO, Mark Russell. And it was during Russell's tenure that one of Nikola's most infamous controversies came to light...

The company previously released a fake promotional video showcasing one of its new hydrogen trucks driving down a slope. Except in reality, it was just rolling... because the truck didn't have working power.

Russell says he had no clue that the trucks being developed had no power until after he was hired. He ended up leaving Nikola in 2022 and let go of at least one-third of his shares in the company.

Russell was replaced by Michael Lohscheller... who had to let investors know that although Nikola delivered a record 63 vehicles in the third quarter of 2022, it lost $230 million in the process.

And in the third quarter of 2023, the company produced zero trucks and delivered just three. Revenue was negative for the quarter.

If that isn't bad enough, the executive revolving door has kept on spinning...

If that isn't bad enough, the executive revolving door has kept on spinning...

Lohscheller stepped down last August, with current CEO Steve Girsky taking his place. Two chief financial officers followed Lohscheller out last year.

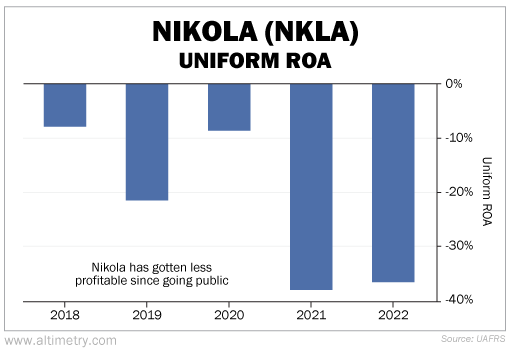

It doesn't help that the company hasn't even turned a profit since it went public. Uniform return on assets ("ROA") has been negative since 2018, and has only gotten worse...

Nikola has never been a profitable business... even after parting ways with its shady founder.

Investors may have considered Milton to be the issue – and he was certainly part of it – but the business itself hasn't been making money. The stock hit almost $80 per share back in 2020. As the market has caught on to Nikola's sham, it has fallen below $1 per share.

A turnaround will be hard without stable leadership. And with little substance to show for its many promises, there's no reason for the stock to recover.

Nikola is an important lesson... Beware of businesses that overstate their optimism with no plan to turn a profit.

Regards,

Joel Litman

January 23, 2024

Trevor Milton just has to wait four years to collect his fortune...

Trevor Milton just has to wait four years to collect his fortune...