Not too long ago, streaming giant Netflix (NFLX) cracked down on password sharing...

Not too long ago, streaming giant Netflix (NFLX) cracked down on password sharing...

And it worked.

Netflix reported first-quarter earnings in mid-April... and it blew the market away. Earnings per share came in more than 70 cents above expectations. Revenue beat estimates by $100 million.

Better yet, total subscribers jumped by 9.3 million. That's more than double analyst expectations.

With numbers like these, we'd usually expect Netflix's stock to surge. Yet it did the exact opposite. Shares dropped 9% the day after earnings came out... their biggest one-day plunge in two years. They still haven't recovered.

Looking purely at financial results, the drop doesn't make sense whatsoever.

That's because investors were more focused on what management didn't say... or rather, what it won't be saying from now on.

You see, Netflix announced it won't disclose subscriber count in future earnings calls...

You see, Netflix announced it won't disclose subscriber count in future earnings calls...

And earnings beat or not, it wasn't enough to keep investors from panicking...

Subscriber growth is key to understanding Netflix's performance. All of a sudden, investors will be left guessing about subscriber counts every quarter.

That makes it a lot harder to track Netflix's progress.

Any time a company stops sharing data, investors assume the worst. They're now convinced Netflix expects subscriber growth to slow way down.

They might not be far off the mark. The company already has 270 million global subscribers, the most of any streaming service. Its password-sharing crackdown was one of its last remaining tricks to boost that number.

Investors suspect it's only going to get worse from here. The latest full-year numbers aren't exactly reassuring, either...

Netflix grew assets for 15 straight years, frequently by double digits... until 2023. Uniform assets shrank by 2% last year.

The company might have blown its chance to keep investor spirits high...

The company might have blown its chance to keep investor spirits high...

Before first-quarter earnings, investors actually thought Netflix would get back to double-digit annual growth.

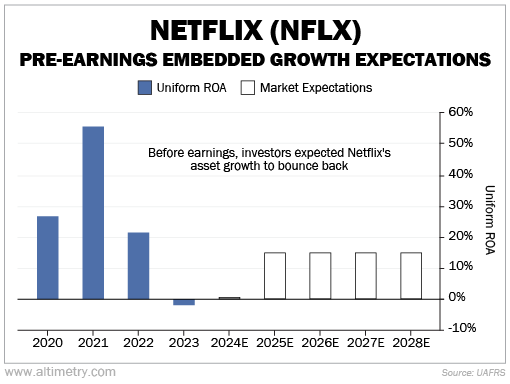

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price – or in this case, Netflix's pre-earnings price.

For this example, we're focused on how much the market thinks the business will grow... which we compare to our own growth and cash flow expectations.

In short, it tells us how much assets have to grow in the future to be worth what the market was paying for Netflix before earnings.

The market previously expected Netflix to rebound to 15% annual growth.

Take a look...

Investors still expected Netflix to recover from recent poor growth... until it made a critical mistake.

The company's decision to pull subscriber data shook the market's confidence.

After the recent sell-off, investors have lowered their growth expectations...

After the recent sell-off, investors have lowered their growth expectations...

They now expect just 9% asset growth going forward. While that's still an improvement from 2023, it's much lower than Netflix's recent averages.

Check it out...

Investors are essentially blind without subscriber data. They've lost confidence in Netflix's recovery story... and abandoned their hope for double-digit growth.

The fallout should be a lesson for Netflix – and any other company that's watching.

Companies often think no news is better than bad news. However, it's usually received the same way by investors... if not worse.

Netflix might want to rethink its new strategy. Until then, it's going to struggle to get investors back on its side.

Regards,

Joel Litman

May 2, 2024

Not too long ago, streaming giant Netflix (NFLX) cracked down on password sharing...

Not too long ago, streaming giant Netflix (NFLX) cracked down on password sharing...