Editor's note: Every Friday, we showcase a featured topic from our YouTube show, Altimetry Authority.

This week, we tackle themes from our upcoming episode, including recent infrastructure news from Big Tech... and why investors are overreacting to a natural pause.

Read on below...

It didn't take much to send shockwaves through the AI infrastructure market...

It didn't take much to send shockwaves through the AI infrastructure market...

At the start of April, software giant Microsoft (MSFT) hit the brakes on a planned $1 billion data center in Ohio.

Around the same time, reports from Wells Fargo and TD Cowen revealed that Amazon Web Services ("AWS") – the cloud arm of Amazon (AMZN) – was pausing some of its data-center leases.

Shares of cloud, chip, and server suppliers got hammered. The WisdomTree Cloud Computing Fund (WCLD), which tracks a basket of cloud-related stocks, fell 15% in the first week of April.

Analysts wondered if the AI boom had already crested. Investors feared they'd missed the cycle entirely.

But beneath the surface, the story looks very different...

Microsoft didn't cancel its Ohio buildout because demand was falling...

Microsoft didn't cancel its Ohio buildout because demand was falling...

It's coming off two years of hyper-aggressive expansion.

According to UBS, Microsoft's leased data-center capital expenditures ("capex") ballooned 6.7 times in two years. It committed to roughly $175 billion in lease obligations between 2022 and 2024.

Now that it has visibility into how all that capacity will be used, it's cutting the fat. The company is eliminating "early-stage projects" that no longer make sense.

And Amazon didn't retreat from its AI ambitions. It's just reevaluating how fast to scale up in certain locations.

AWS executive Kevin Miller made this point clear in a LinkedIn response to recent concerns about data-center spending. He said, plain and simple, that what Amazon is doing right now is a matter of capacity management.

Some of Amazon's data-center projects didn't pan out as planned... either because a particular center was too expensive to run or the company picked the wrong location.

But Miller's central point was that demand hasn't gone anywhere. AWS plans to keep growing. It's just doing so with more precision after locking in years of massive capacity.

That's the key context Wall Street is missing.

This looks more like a triage after a feeding frenzy than a pullback...

This looks more like a triage after a feeding frenzy than a pullback...

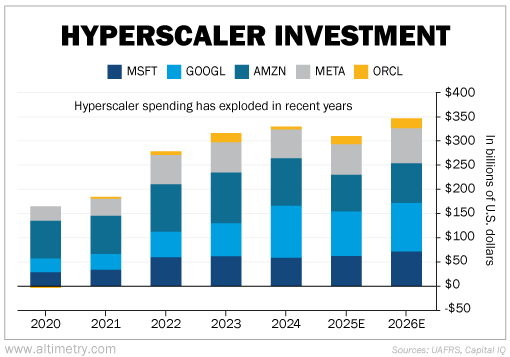

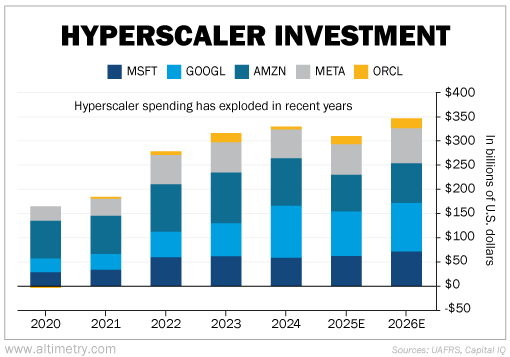

Take a look at the following chart. It shows the combined capital spending of the five major hyperscalers – Microsoft, Amazon, Google parent Alphabet (GOOGL), Facebook owner Meta Platforms (META), and cloud-tech provider Oracle (ORCL).

In 2021, these companies spent just shy of $200 billion. But that number nearly doubled by 2024. It's projected to hit roughly $350 billion by 2026...

Now, not all of this is data-center capacity spending – that data isn't reported specifically. But it's all investment from the biggest data players. They're pouring cash into the future of their businesses.

If the AI boom was cooling, spending wouldn't be exploding.

The tech supply-demand environment is still red-hot...

The tech supply-demand environment is still red-hot...

Alphabet's chief financial officer, Anat Ashkenazi, recently said capacity is struggling to keep up. In other words, demand is outpacing buildout.

AI infrastructure cycles don't move in straight lines. After a historic surge in leased capacity, it's only natural to see a moment of pause and reevaluation.

But the money is still flowing... and the next wave is already forming.

Leadership teams aren't scaling back. They're fine-tuning. And as the infrastructure behind AI becomes more specialized, efficiency gains will only accelerate adoption.

Look at these pullbacks as long-term entry points, not exit signals. The AI arms race is still gathering steam. The companies behind it are building bigger than ever.

Investors who are too focused on near-term project delays will miss what's right in front of them.

Regards,

Joel Litman

May 2, 2025

P.S. We dive deeper into AI-infrastructure spending in the upcoming episode of Altimetry Authority, which airs at 11 a.m. Eastern time today. Check it out on our YouTube channel right here... and be sure to click the "Subscribe" button.

It didn't take much to send shockwaves through the AI infrastructure market...

It didn't take much to send shockwaves through the AI infrastructure market...