ERCOT is probably the least popular group in Texas...

ERCOT is probably the least popular group in Texas...

For those who don't know, ERCOT – or the Electric Reliability Council of Texas – is the state's main grid operator.

Texas has an independent power ecosystem from the rest of the U.S. Because it's completely separate, ERCOT doesn't regulate energy prices. They change based on supply and demand.

And the parade of issues just won't stop...

Rising temperatures caused more families to turn on their air conditioning in early May. Slow skies caused wind power supply to fall. Texas electricity prices shot up nearly 100 times... from $32 per megawatt-hour ("MWh") to $3,000 per MWh.

Only a few weeks later, the state was hit with multiple brutal thunderstorm clusters that further disrupted supply.

As we'll explain, these "one off" events are becoming a regular part of life. And it's not just the power-plant operators who will benefit...

When the power goes out, the generators turn on...

When the power goes out, the generators turn on...

And with its 70% market share, Generac (GNRC) is one of the biggest backup-power providers in the world.

The company makes power generators for residential use, as well as commercial and industrial. It also has a smaller business that provides home-battery solutions.

What happened in Texas last month was just the tip of the iceberg.

Extreme weather events have started taxing our power grid more often. According to nonprofit organization Climate Central, from 2014 to 2023, weather-related power outages nearly doubled compared with 2000 to 2009.

And budding technologies like AI are putting even more strain on our power infrastructure.

Put simply, Generac's products are going to be in high demand. Society can't function with regular power outages.

Despite these macro tailwinds, investors don't expect a whole lot from Generac...

Despite these macro tailwinds, investors don't expect a whole lot from Generac...

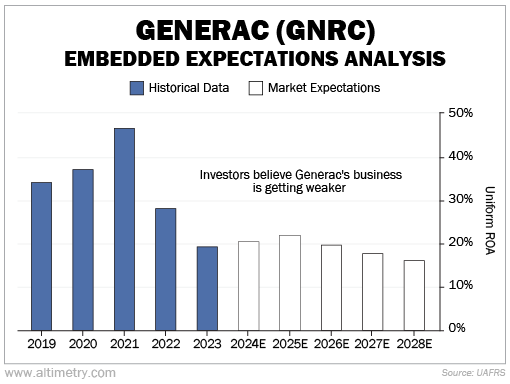

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA works a lot like a betting line in a sports bet. We use Generac's current share price to calculate what investors expect from future performance... and compare those forecasts with our own.

It tells us how well our "team" (the company) has to perform to justify the market's "bet" (the current price).

Generac's Uniform return on assets ("ROA") was above 28% in four of the past five years. Even though 2023 was a "down" year thanks to extremely high interest rates, returns were still 19% – well above the 12% corporate average.

And yet, the market expects Uniform ROA to fall to 16% by 2028. Take a look...

Those returns would be Generac's lowest in 16 years. Unless this business gets weaker than it has ever been, this expectation is unlikely.

Investors are going to have to get more bullish...

Investors are going to have to get more bullish...

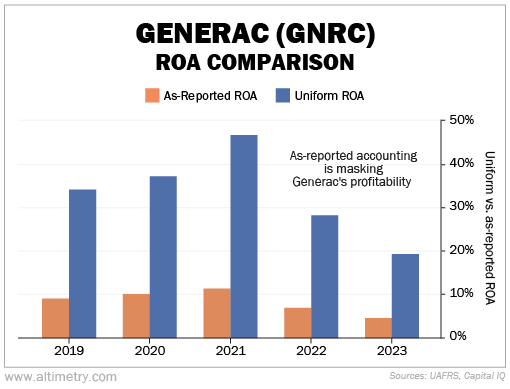

These folks are probably discounting Generac because of shoddy as-reported financials. As-reported ROA never even surpassed the corporate average in the past five years... only peaking at 11% in 2021.

Compare that with the Uniform numbers, and you see where the market is getting mixed up...

Generac is a much stronger business than most investors realize.

Despite market pessimism, the company is in a great position. We'll need more power in the future, not less... and at the same time, our electric grid is being taxed more than ever.

Given its dominance in the market, we expect Generac to maintain – or even improve – its profitability. Shares should rise as this energy beneficiary impresses investors.

Regards,

Joel Litman

June 6, 2024

ERCOT is probably the least popular group in Texas...

ERCOT is probably the least popular group in Texas...