Netflix's (NFLX) desperation to break into the content business knows no bounds...

Netflix's (NFLX) desperation to break into the content business knows no bounds...

Last Thursday, an article in the Washington Post highlighted how the video-streaming behemoth is arguably pushing ethical limits to curry awards favor as Oscar season approaches.

While Netflix appears to be bordering on obsessed with getting recognition for its content initiatives, these are actually pressuring returns lower... We discussed this problem in the September 17 Altimetry Daily Authority.

Using Uniform Accounting, we can see that Netflix's strategy here is likely to hurt Uniform returns and disappoint the market going forward.

Yesterday, we talked about how 'fresh start accounting' from bankruptcy makes it nearly impossible to properly analyze a company...

Yesterday, we talked about how 'fresh start accounting' from bankruptcy makes it nearly impossible to properly analyze a company...

In the General Motors (GM) example, the company almost looked like two different businesses before and after the "fresh start" of Chapter 11 bankruptcy.

Not only did this make it difficult to compare GM over time, but it would be nearly impossible to compare the company to another automaker that never went bankrupt.

Once we cleared away the noise, however... we saw this wasn't the case. GM looked very similar both before and after 2008 and would be comparable to its peers.

While bankruptcy can create massive accounting distortions, there's another major corporate event that can cause similar misrepresentation, and it's far more common than bankruptcy...

Mergers and acquisitions ("M&A") are a huge source of accounting incomparability, and they happen nearly every day.

M&A is particularly problematic for companies with large amounts of research and development ("R&D") and property, plants, and equipment ("PP&E"), but across the board it has the following misleading impacts:

- To balance the books, the acquiring company has to create intangible assets to justify the purchase price. This results in line items like goodwill and brand value overstating the balance sheet. This makes the balance sheets of acquirers incomparable to those of organic growers.

- Similar to "fresh start accounting," the PP&E of the acquired company is restated to a "fair value," which is essentially the current depreciated value of the assets. This has the impact of understating the company's balance sheet and required maintenance.

- One of the major adjustments we make under Uniform Accounting is to bring R&D on the balance sheet as an investment rather than an expense. Traditional acquisition accounting doesn't "recapture" the R&D from the acquired company, thus making it look like it invested less in its business than is accurate.

These issues with standard acquisition accounting make it difficult to compare companies that grow through M&A against companies that prefer to grow organically.

A great example of this is Oracle (ORCL). The software giant has been a serial acquirer over the last 20 years. It has made six acquisitions of more than $5 billion – including PeopleSoft, BEA Systems, Sun Microsystems, and, most recently, NetSuite.

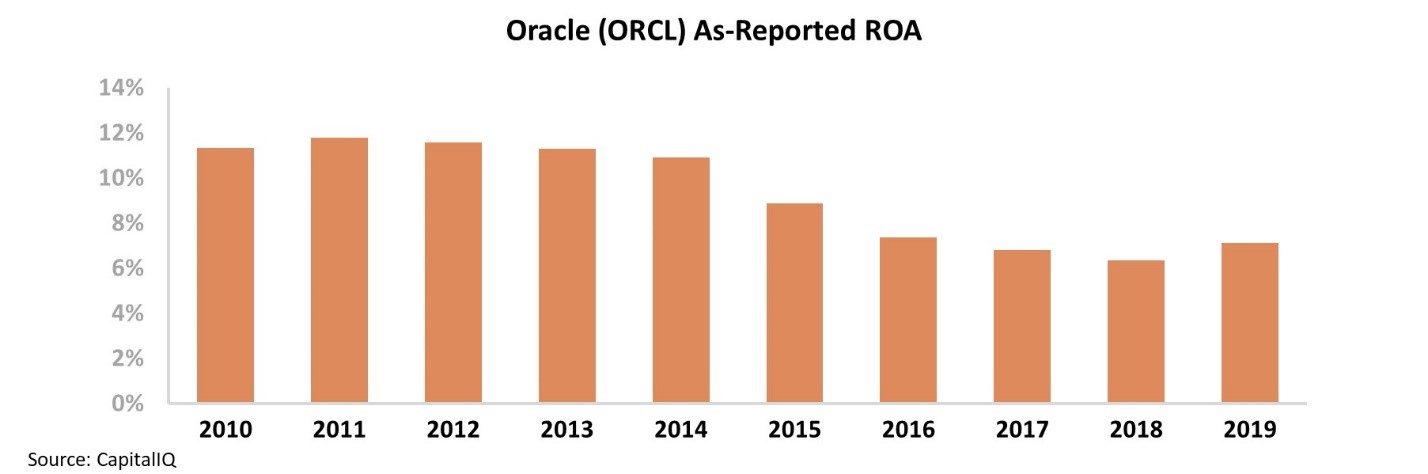

When looking at Oracle's profitability over the last decade, it would appear that its string of acquisitions has actually damaged the business. The company's return on assets ("ROA") has fallen from levels around 12% to just 6% in recent years.

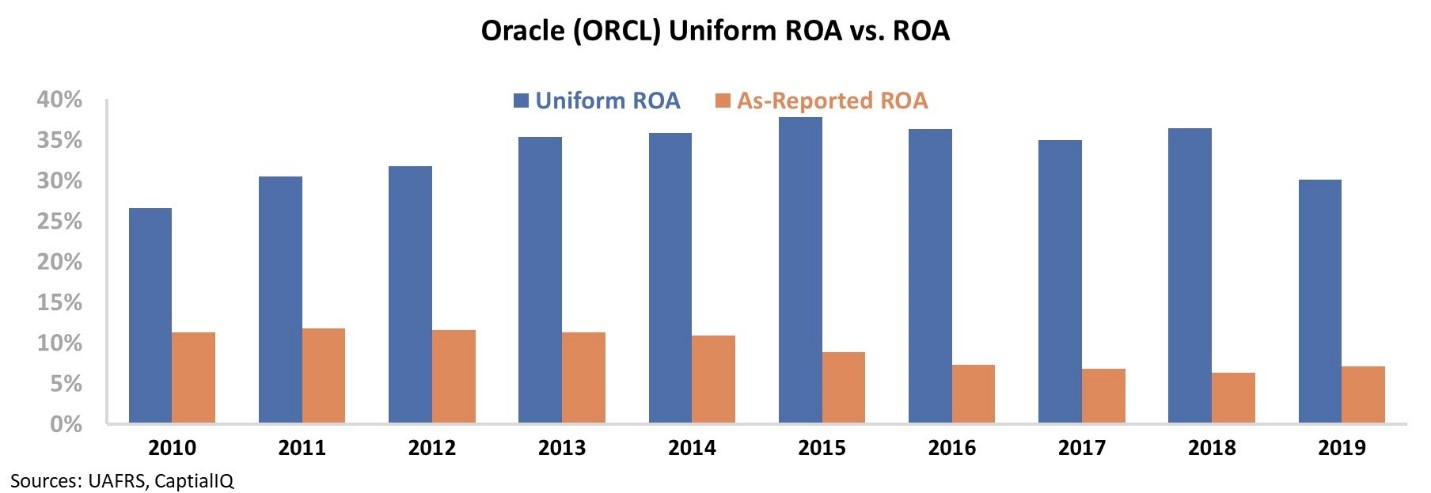

However, once we apply our Uniform Accounting framework – adjusting for M&A inconsistencies like the treatment of goodwill, capitalizing versus expensing R&D, and the impact of "fair value" PP&E calculations – we can see that Oracle's acquisition strategy has been far more successful than traditional metrics highlight.

Not only is the company's ROA far higher, but it has actually expanded over the past decade from levels around 25% to more than 30%...

This is far more consistent with Oracle's strategy of rolling up high-quality companies with strong investments in R&D.

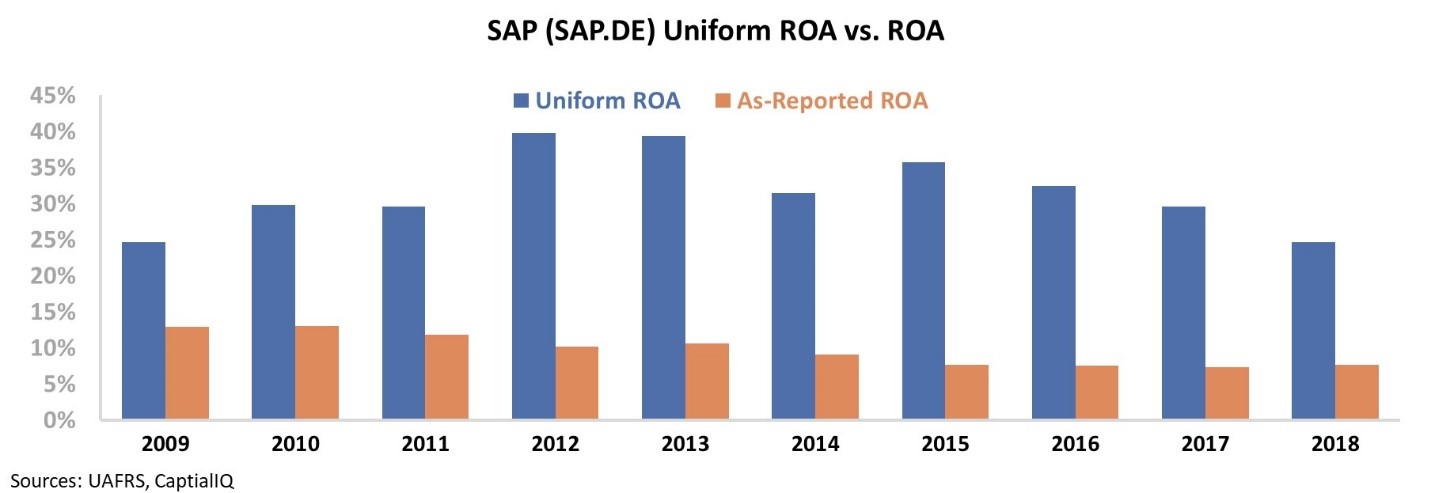

Looking at Oracle through the Uniform Accounting framework also allows investors to effectively compare the company against businesses that prefer to grow organically. For example, let's compare it with another large multinational software company: Germany-based SAP (SAP.DE).

On an as-reported basis, Oracle and SAP have basically the same returns – indicating that Oracle's M&A strategy doesn't add any value. However, when compared to Oracle's 30% ROA, SAP only returns 25% – indicating the value addition from Oracle's acquisitions.

When you're looking at as-reported accounting – especially for acquisitive firms – it's impossible to compare a company's historical returns to the present day... and equally difficult to effectively compare peers.

Regards,

Rob Spivey

December 19, 2019

Netflix's (NFLX) desperation to break into the content business knows no bounds...

Netflix's (NFLX) desperation to break into the content business knows no bounds...