In most contexts, getting a 'fresh start' is a dream come true...

In most contexts, getting a 'fresh start' is a dream come true...

It's like a real-life mulligan... a chance to put the past away and focus on the future.

The concept of a fresh start also applies to businesses. Companies screw up from time to time and will often ask for forgiveness.

Whether an ad campaign didn't go as planned or the business wants another shot after delivering a subpar product (this always makes me think of when Domino's apologized for its pizza!), companies often ask for a fresh start with consumers.

However, in certain situations, allowing companies a reset can be a real problem for investors.

When I was still consulting, I saw this problem firsthand with a company called Ames Department Stores...

For those who may not remember, Ames had several hundred locations mostly in the eastern half of the U.S. It started strong as one of the better-known department stores, growing steadily throughout the 1960s and eventually listing on the New York Stock Exchange in 1972.

But by the late 1970s and throughout the '80s, Ames made a few missteps. First, it grew too aggressively by acquiring several competitors and jumping from roughly 100 stores to nearly 700 in less than a decade.

Second, in an effort to steal customers from other retailers, Ames converted its company-specific credit card to a Visa card that could be used anywhere, and it pushed these cards aggressively.

Similar to what happened when Bank of America pushed its first credit card, many of Ames' customers defaulted.

These two factors drove the company to Chapter 11 bankruptcy in 1990. Unlike a Chapter 7 bankruptcy, this type usually results in a reorganization of the business. In a very literal sense, Ames was given a "fresh start."

When emerging from bankruptcy, companies have the option to use something called "fresh start accounting", by which the company "marks down" the value of the assets on its balance sheet to "fair value."

The idea of "fair value" is important and puzzling. This markdown comes when the business is in its worst possible financial position, meaning fair value will be as low as possible.

As a result, everything on the company's balance sheet is massively written down and the company is given a "clean slate."

This includes the company's property, plant, and equipment ("PP&E"), the inventory, and everything else. It's a huge issue, because all it does is make a company look more efficient.

I consulted for Ames in the years after its emergence from bankruptcy in 1992. Sadly, the company didn't even last a full decade.

You see, because of fresh start accounting, Ames looked like it was a much better company than before the bankruptcy. Its return on assets ("ROA") was massively overstated, while items like maintenance capital expenditure ("capex") were understated.

With less PP&E on the balance sheet comes lower perceived required capex to keep the lights on.

All this did was drive Ames right back to what doomed it in the first place. Over the next decade, the company made a series of massive acquisitions, including Hills Department Stores and Goldblatt's.

This had the same result as before... Ames filed for bankruptcy in 2002. This time, it was Chapter 7: liquidation. And there's no coming back from that...

More recently, we can see these issues with fresh start accounting surfacing in another major company... auto maker General Motors (GM).

GM was the recipient of a historically large bailout program that allowed the company to restructure under Chapter 11 and undertake its own fresh start accounting.

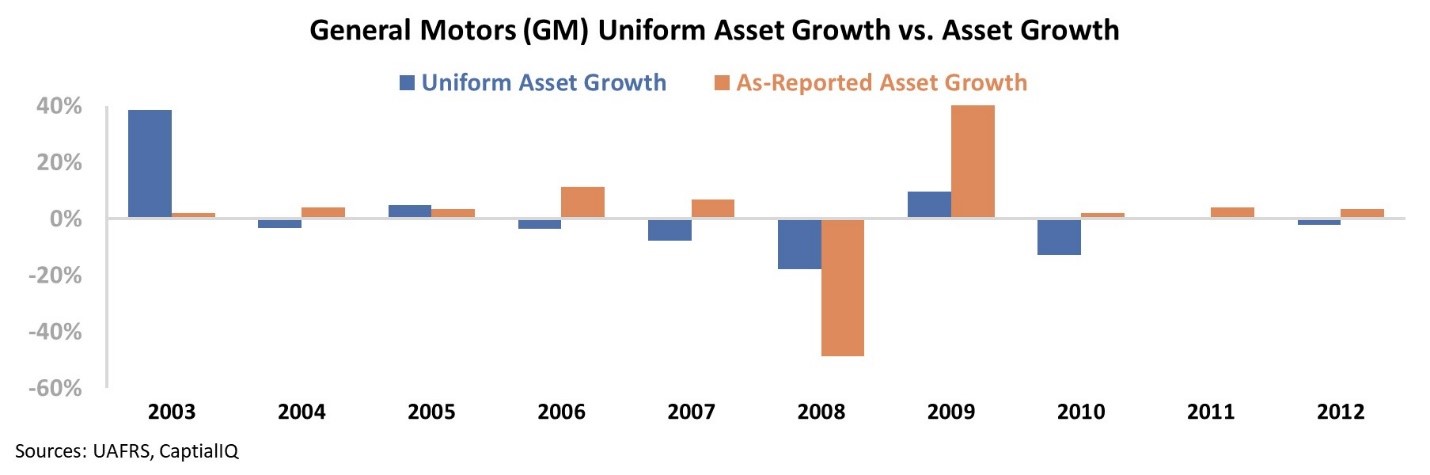

We can see exactly where the fresh start asset write-down occurred. No, General Motors didn't actually shrink its assets by 50% in 2008... Using Uniform Accounting, we have adjusted to see through the noise. Take a look at the company's Uniform asset growth and as-reported asset growth before and after the 2009 restructuring...

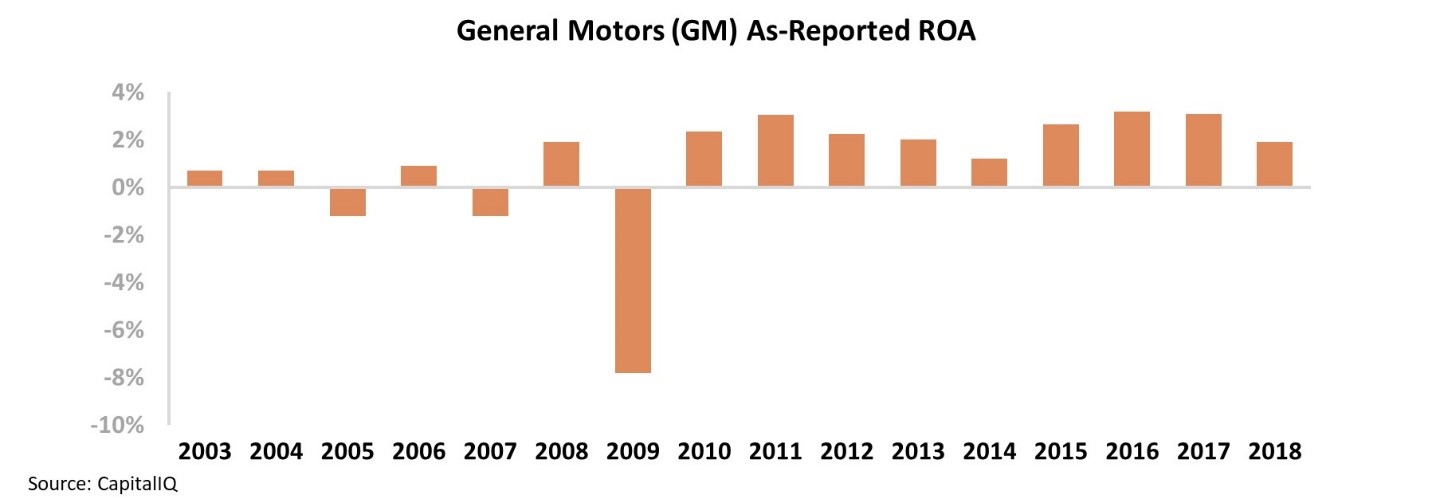

And the fresh start accounting had a similar impact on GM's as-reported ROA. As you can see, while still not a massively profitable business, General Motors achieved a historically high ROA immediately after returning from bankruptcy...

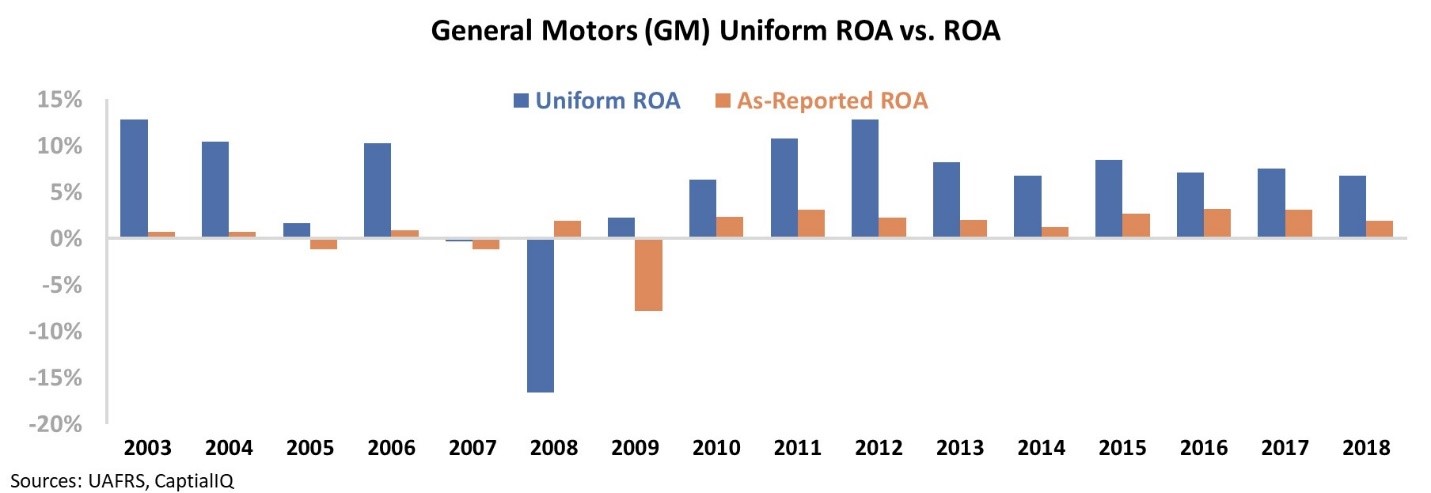

However, once we've made the proper adjustments to clear away the noise created by fresh start accounting, we can see that not much has changed for GM. Prior to the bailout, its ROA reached a high of 13% in 2003. Since the bailout, GM's ROA has reached the same high – hitting 13% in 2012.

Despite looking like a much more efficient company, this is still the same GM from before 2008. Additionally, when we adjust the company's price-to-earnings ("P/E") ratio, we can see that GM isn't as cheap as everybody thinks. While its as-reported P/E ratio is far lower than market averages, its Uniform P/E ratio is nearly 20 – right at market-average levels.

Using Uniform accounting, we can see that nothing has changed for General Motors despite its fresh start. Don't be fooled... when it comes to accounting, a "fresh start" isn't what you think it is.

Tomorrow, we'll discuss another systematic problem with as-reported accounting and its poster child...

Tomorrow, we'll discuss another systematic problem with as-reported accounting and its poster child...

Tech giant Oracle (ORCL) is a prime example of how GAAP and IFRS accounting distort the performance of acquisitive companies.

On Thursday, Oracle reported quarterly earnings – beating analyst earnings-per-share ("EPS") expectations by $0.01. But the company's revenues were flat... causing ORCL shares to fall more than 3%.

Oracle also recently announced that after co-CEO Mark Hurd's passing earlier this year, it won't be keeping the dual CEO role.

Part of the focus on having a co-CEO was because after the company's growth through acquisitions over the past 20 years, Oracle's operations became more diversified. This warranted breaking up the CEO role.

It also made the company harder to manage from an accounting perspective. We'll talk more about this tomorrow... stay tuned.

Regards,

Joel Litman

December 18, 2019

In most contexts, getting a 'fresh start' is a dream come true...

In most contexts, getting a 'fresh start' is a dream come true...