First, it was January 1, 2021... then it was July 4, 2021... then Labor Day 2021... January 1, 2022... Labor Day 2022...

First, it was January 1, 2021... then it was July 4, 2021... then Labor Day 2021... January 1, 2022... Labor Day 2022...

And most recently, the so-called "experts" claimed Labor Day 2023 was the turning point for people to return to the office.

They've been wrong with every prediction for nearly three years running. But, hey... maybe the seventh time will be the charm.

It's not just that workers are stubborn and don't want to resume their lengthy commutes (although that certainly plays a part). Numerous studies prove that folks are at least as productive at home as they are in the office. Some reports show employees are up to 47% more productive working from home.

The headlines paint a battle scene, wherein stodgy "traditional" employers drag rebellious workers feetfirst into the office and plant them at a desk. And it's true that many folks now view work from home as a benefit like a pension or health insurance... and have pushed back hard against in-person work.

But the reality is, a lot of employers have long since accepted that work from home is here to stay... like insurance giant Allstate (ALL), which allows 82% of its employees to work remotely. Vacation-rental service Airbnb (ABNB) has committed to a fully remote workplace.

That's bad news for commercial real estate. Businesses are downsizing or doing away with offices entirely.

Today, we'll delve into just how bad it's getting in commercial real estate. As we'll explain, the credit market has caught on to the trouble... and if stock investors aren't worried yet, they should be.

Real estate has been dicey for a while now...

Real estate has been dicey for a while now...

Last month, we warned you that stock investors were making a mistake with their bullish attitude toward office real estate investment trusts ("REITs"). This industry is under pressure from the work-from-home trend... yet investors still expect a miraculous turnaround.

The credit market shares our concerns. It's bidding up office REIT bond yields to nosebleed levels.

Remember that bond yields tend to move in the opposite direction of bond prices. So as yields rise, the bonds themselves are trading at a discount. Higher bond yields signal that credit investors are getting nervous... they demand higher returns to compensate for higher risk.

Right now, there are 32 publicly traded bonds with yields between 10% and 17.5%. The S&P 500 Index returns about 10% per year, on average. So these bonds – usually viewed as the "safer" choice – are yielding as much as more-risky stock investments.

And 11 of those 32 bonds are office REITs. Said another way, about a third of the companies viewed as "high risk" by bond investors are office REITs.

Let's zoom in on one of those bonds to get a better sense of what's scaring investors... and us.

Let's zoom in on one of those bonds to get a better sense of what's scaring investors... and us.

Hudson Pacific Properties (HPP) owns office buildings from Vancouver to Los Angeles. A lot of West Coast tech workers have embraced hybrid and fully remote work setups. That's disastrous for a company that relies on corporate offices for much of its revenue.

Credit investors are taking their fear out on the company's bonds... like its 3.95% bond due November 1, 2027. Despite the bond's roughly 4% coupon rate, it's yielding above 10.8% today.

Hudson Pacific's credit investors are terrified about getting paid. And they should be.

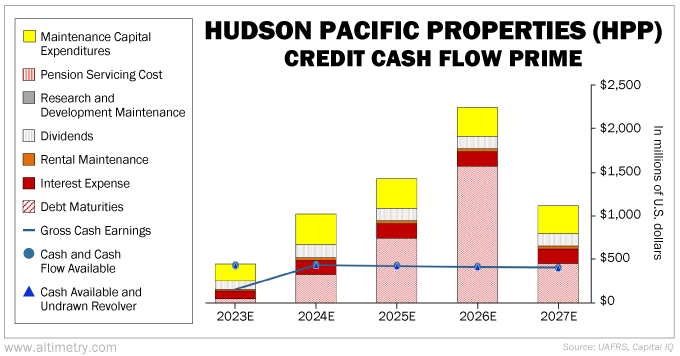

We can better understand the risk surrounding this company by leveraging our Credit Cash Flow Prime ("CCFP") analysis. It allows us to compare Hudson Pacific's obligations against its cash position and cash flows.

In the following chart, the stacked bars represent Hudson Pacific's obligations each year through 2027. We compare these with cash flow (the blue line), cash on hand at the beginning of each period (the blue dots), and available cash and undrawn revolver (the blue triangles).

Take a look...

This year, Hudson Pacific will only have about $430 million in cash and cash flows... not enough to cover its $447 million in obligations. As soon as 2025, it won't even have enough cash to pay its debts, which could lead to default.

No wonder 2027 bondholders are nervous about getting paid.

Whether you're a bondholder or a shareholder, you should be wary of office real estate...

Whether you're a bondholder or a shareholder, you should be wary of office real estate...

In the event of a default, debt investors get the first say on how to proceed... but that doesn't mean they'll get all their money back.

Depending on where their bonds fall in the capital structure, they could be way down the totem pole.

Stockholders are likely to get completely wiped out. They can only claim parts of the business after every lender is paid. In Hudson Pacific's case, the CCFP shows this company could run out of cash long before that happens.

And it's not alone...

This is a common scene for office REITs today. If these companies don't address mounting debt and struggling cash flows soon, plenty of their stocks could come under pressure.

Be careful.

Regards,

Rob Spivey

September 12, 2023

First, it was January 1, 2021... then it was July 4, 2021... then Labor Day 2021... January 1, 2022... Labor Day 2022...

First, it was January 1, 2021... then it was July 4, 2021... then Labor Day 2021... January 1, 2022... Labor Day 2022...