Nvidia (NVDA) has been the stock market star of the past two years...

Nvidia (NVDA) has been the stock market star of the past two years...

It even surpassed Apple (AAPL) to become the world's most valuable company in early November. The two have been battling for the top spot ever since.

At this point, it's almost impossible to compare Nvidia with other companies. Some have even joked that it's better to compare its dominance with entire stock markets... and that's not entirely unfounded.

The chip giant's market cap exceeded the combined total of Italy, Spain, and Portugal in May 2023. By this past January, it had surpassed the market sizes of Australia, Germany, and the Nordics.

It didn't end there. During the first half of 2024, Nvidia grew bigger than the markets of France, Canada, and Switzerland.

And by June, it even overtook the United Kingdom... one of the largest developed markets in the world.

German equity strategist Jonathan Stubbs joked that Nvidia might as well buy Germany.

The comparison is astounding. And Nvidia is undeniably one of the most prominent companies in the world today.

However, it also points to a potential imbalance.

Either Nvidia's valuation is excessively high... or its popularity is causing folks to underestimate major markets.

One of the best ways to evaluate valuation is by looking at earnings...

One of the best ways to evaluate valuation is by looking at earnings...

We can compare Nvidia's earnings with those of entire stock markets to see where they stand.

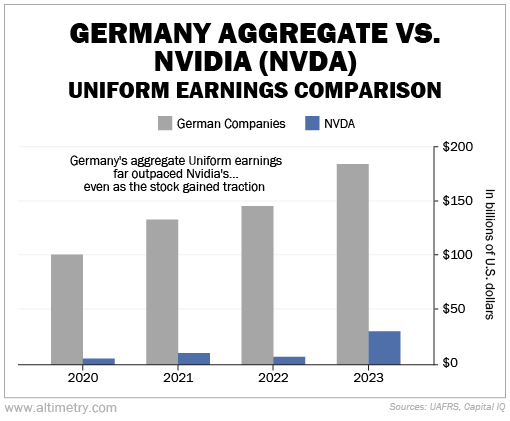

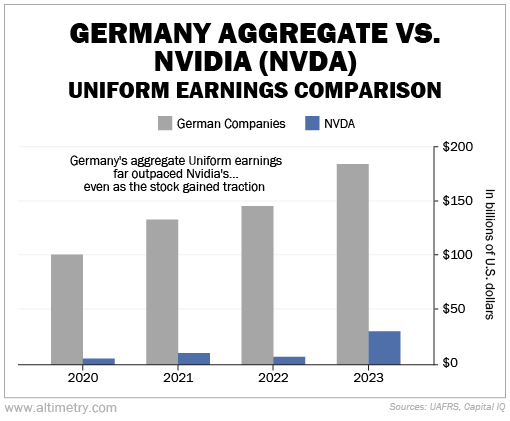

As the world's third-largest economy, Germany is a worthy opponent to the world's most (or second-most) valuable company. We can compare the aggregate Uniform earnings for all German-listed companies against Nvidia's Uniform earnings to get a better idea.

Germany's Uniform earnings have been far above Nvidia's for most of history. Aggregate German earnings came in at more than $100 billion in 2020, over 17 times Nvidia's numbers.

They were slightly below $150 billion in 2022, more than 19 times what Nvidia recorded.

And German earnings have been increasing at a healthy annual growth rate of 21% since 2020.

The chip giant's market cap surpassed Germany's in January 2024. Both Germany and Nvidia minted record earnings... about $184 billion for the nation and $31 billion for the chipmaker...

Let that sink in... German companies as a group earn about 6 times more than Nvidia. And yet, investors think Nvidia should be worth more.

Despite Nvidia's sky-high valuation, investors aren't betting on a slowdown...

Despite Nvidia's sky-high valuation, investors aren't betting on a slowdown...

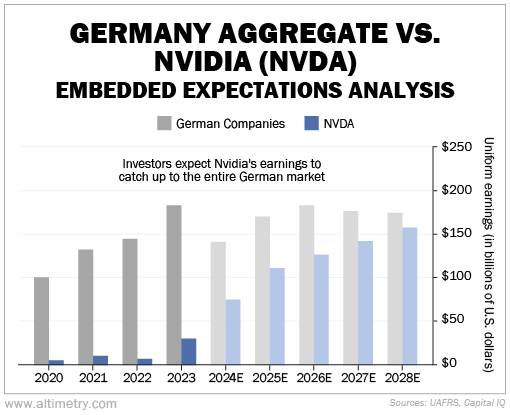

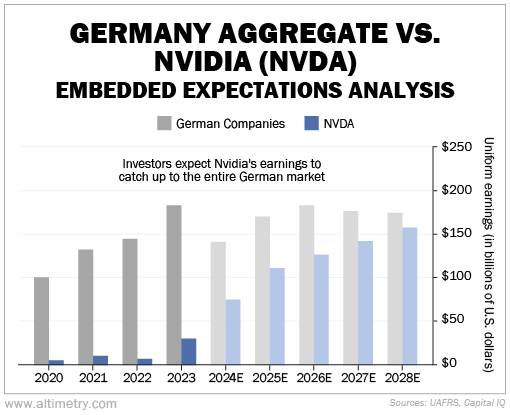

We can see this through our Embedded Expectations Analysis ("EEA") framework...

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company (or a country) has to perform in the future to be worth what the market is paying for it today.

Right now, investors expect Germany's economy to stabilize around $175 billion in Uniform earnings per year. They expect Nvidia to keep growing... and growing... and growing.

Specifically, investors think Nvidia's Uniform earnings will reach $158 billion by 2028... almost matching the entire German market.

Take a look...

To satisfy investor expectations, Nvidia will need to earn as much as the entire third-largest economy within the next five years.

To satisfy investor expectations, Nvidia will need to earn as much as the entire third-largest economy within the next five years.

There's no doubt that a mature economy will grow slower than the center of the AI universe... but this may be a bit extreme.

Investors often forget that growth eventually slows down...

Investors often forget that growth eventually slows down...

And that's how you end up with extremely overvalued stocks.

There's no doubt Nvidia is the most important stock on the planet today. However, think for a second what it would mean for one company to earn as much as the third-largest economy.

That would be an unprecedented level of dominance in the modern world.

Folks, as great of a company as Nvidia is, there's a clear mismatch in its valuation today. It has had a strong uncontested run in the chip industry.

But investors shouldn't assume it can keep this up for another five years. Growing earnings by 6 times like it's nothing is a high hurdle to cross... even for the biggest company on the planet.

Regards,

Joel Litman

December 12, 2024

Nvidia (NVDA) has been the stock market star of the past two years...

Nvidia (NVDA) has been the stock market star of the past two years...