Sometimes, truth is stranger than fiction...

Sometimes, truth is stranger than fiction...

Out of all the crazy events that happened at the onset of the coronavirus pandemic last year, nobody could have predicted what happened in the oil market.

With economic activity around the globe basically put on hold to fight the pandemic, no one needed oil. But oil was still coming out of the ground... And it needed to go somewhere.

Planes were grounded, cruise ships were sitting at the dock, and fewer cars were on the road.

With less industrial production and limited travel, the world needed less oil.

The mismatch of supply and demand got so bad that when May crude future contracts were settling, the price of oil briefly went negative.

Essentially, people weren't paying to buy oil from producers and companies that had oil in storage. The producers were paying people to take oil from them.

The logical places to park oil – storage tanks and other infrastructure across the globe – were maxed out. Producers were desperate to sell, but people didn't want to buy.

Popular storage areas in South Africa were full. Oil tankers were being used to store oil out at sea. Even the big oil storage tanks at the hub in Cushing, Oklahoma, were topped up.

It was so bad the U.S. had to let producers store reserves in its strategic oil reserve, just to give them somewhere to store it.

It has taken almost a year for the glut to work down, as demand recovered and supply moderated. But the backlog still isn't totally clear... As Bloomberg recently explained, about one-fifth of that initial April 2020 surplus remains.

But even that is a dramatic improvement over where the oil market was a year ago.

This has translated into positive trends in oil prices... which have been great for much of the oil patch.

However, not everyone will be a winner from the big recovery in oil prices...

However, not everyone will be a winner from the big recovery in oil prices...

Oil prices have been in recovery since last April and are now around $65 per barrel as countries begin their return to normalcy.

While this has made headlines due to concerns about inflation for consumers at the pump, the gas station isn't the only place likely to affect the economy and investors...

One big set of losers from the recovery has been the companies that were printing money by storing oil.

Consider NuStar Energy (NS)... The company transports and stores petroleum and other fossil fuel products. It makes almost all of its profits from its oil, refined products, and chemical storage facilities.

NuStar is a decent business overall, even though as-reported metrics suggest otherwise...

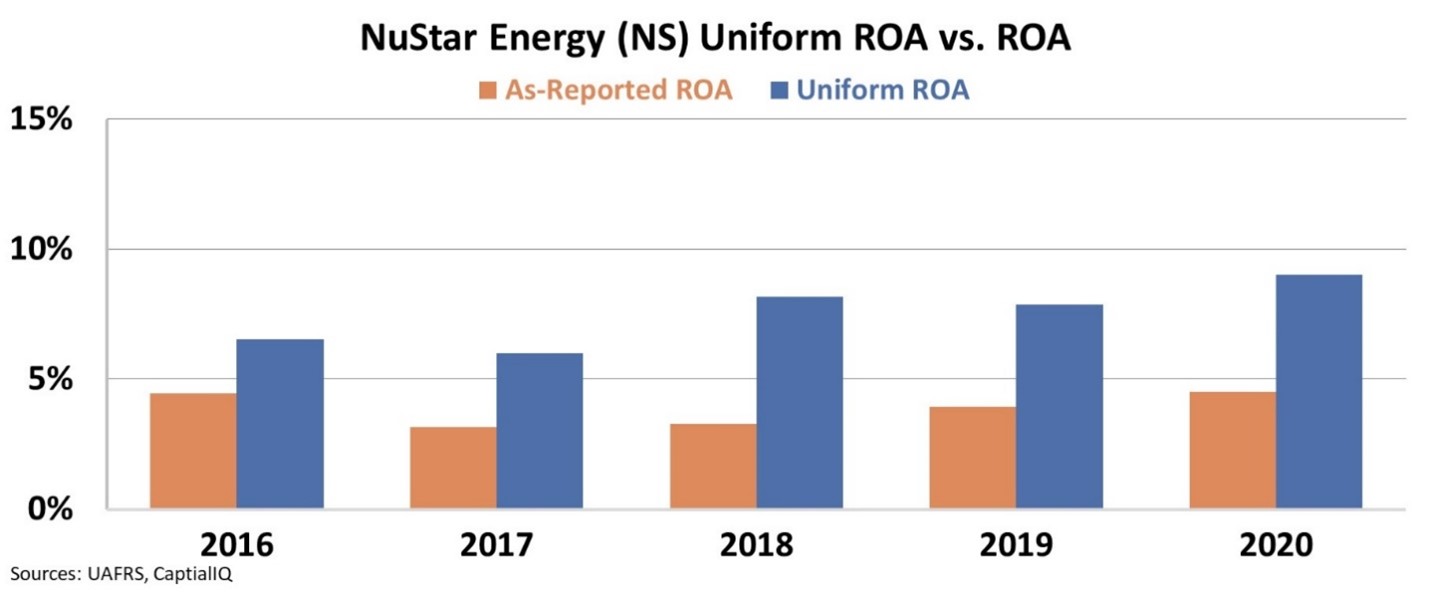

The company's as-reported return-on-asset ("ROA") levels have been weak over the past few years – in a stagnant range between 3% and 5%. But when we clean up the numbers with Uniform Accounting, we can see that NuStar's real profitability has been trending higher. The company's Uniform ROA has increased from 7% in 2016 to 9% last year.

NuStar has been an improving and decently profitable business. And the tight market of 2020 allowed the company to charge a premium for its services – thus helping ROA rise higher.

Investors are pricing this rise to continue... But NuStar may struggle to meet those expectations.

Investors are pricing this rise to continue... But NuStar may struggle to meet those expectations.

In a less tight oil market, NuStar isn't going to be able to charge the high prices it did in 2020. It also won't have as high of capacity.

So, to gain a greater understanding about what the market is pricing in, we can use our Embedded Expectations Framework.

Most investors determine stock valuations using a discounted cash flow ("DCF") model, which takes assumptions about the future and produces the "intrinsic value" of a stock.

However, as regular Altimetry Daily Authority readers know, models with garbage-in assumptions based on distorted financial metrics only come out as garbage. Therefore, we've turned the DCF model on its head with our Embedded Expectations Framework. We use the current stock price to determine what returns the market expects.

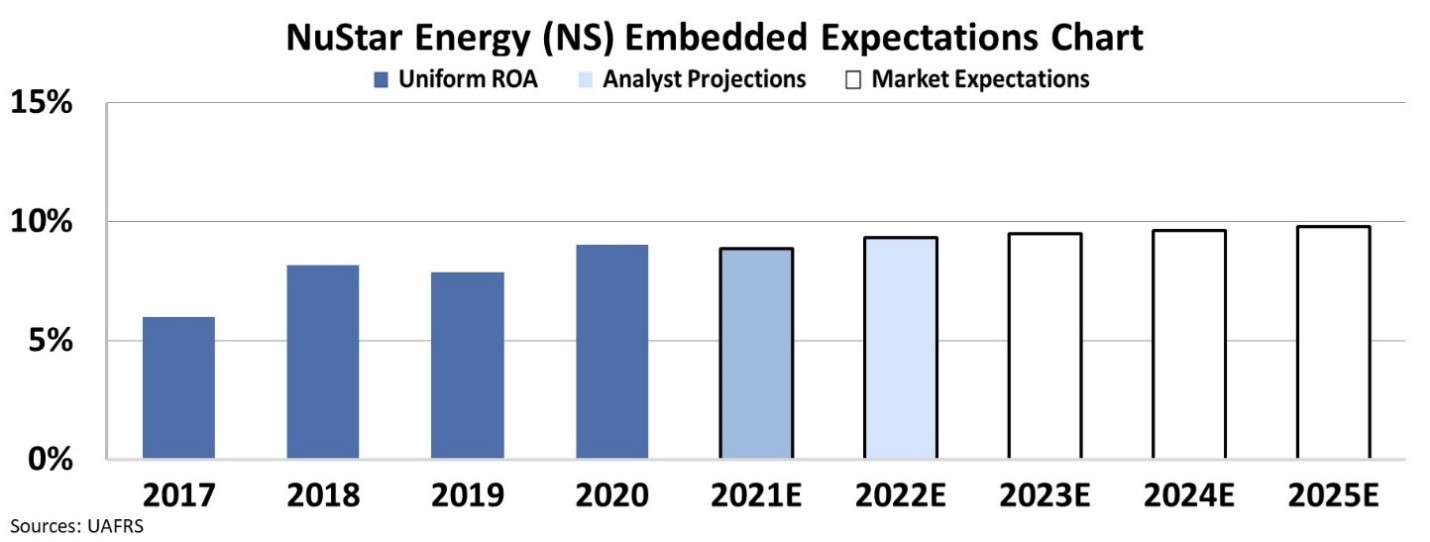

In the chart below, the dark blue bars represent NuStar's historical corporate performance levels in terms of ROA, as we already discussed.

The light blue bars are Wall Street analysts' expectations for the next two years. Finally, the white bars are the market's expectations for how NuStar's ROA will shift over the next five years.

Even though the storage glut has receded, Wall Street analysts are expecting NuStar's Uniform ROA to remain at 9% levels through 2022. But the market is pricing in Uniform ROA to not just stay strong... but to expand to 10% by 2025.

Considering how oil is now flowing again as the world emerges from the pandemic, these expectations look overly optimistic.

With more oil ending up in planes, ships, and cars – as well as in the production of more goods – it doesn't need to be sitting in storage as much. As a result, NuStar's profitability is likely to suffer... So investors might want to temper their expectations.

Regards,

Joel Litman

May 4, 2021

Sometimes, truth is stranger than fiction...

Sometimes, truth is stranger than fiction...