AI is eating Omnicom's (OMC) lunch...

AI is eating Omnicom's (OMC) lunch...

With $15 billion in 2023 revenue, the company is the fourth-biggest name in advertising. But in the past five years, AI has taken a big bite out of Omnicom's value as a business.

In addition to competing with other ad agencies, Omnicom now has to compete against low-cost, AI-generated ads. And the market is well aware of this existential threat to legacy ad agencies. Omnicom's stock has barely moved in the past five years... up just 5%.

The S&P 500 has climbed 80% over the same period.

The company has tried to adapt. But being another big player in advertising just isn't good enough anymore. To survive in this new landscape, Omnicom needs to be the biggest.

And now, it's preparing to make that happen...

The advertising industry has been consolidating for years...

The advertising industry has been consolidating for years...

But Omnicom is taking things to a new level. The company announced in December that it's spending $14 billion to buy Interpublic (IPG).

Like Omnicom, Interpublic is an advertising giant. It's sitting on $11 billion in revenue, making it the sixth-biggest in the industry today.

Both businesses have spent decades expanding their reach by acquiring smaller firms. Their merger will form the single biggest advertising powerhouse in the world.

This could be exactly the boost Omnicom needs to stay relevant against the threat of AI.

The post-merger company will have more resources to develop its own AI capabilities... before it gets left behind entirely.

Better yet, Omnicom got an incredible deal – and the market hasn't noticed yet.

For Omnicom investors, the best part of this merger is simple...

For Omnicom investors, the best part of this merger is simple...

It got Interpublic at a steal.

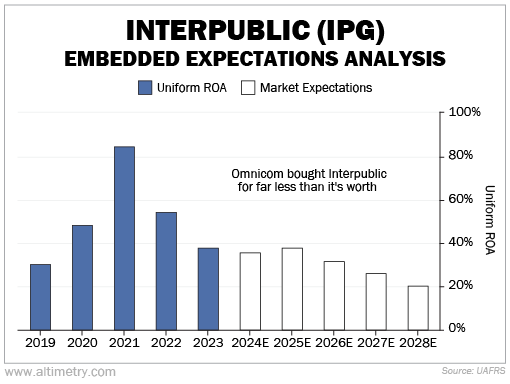

We can see this through our Embedded Expectations Analysis ("EEA") framework...

We start by looking at what Omnicom paid for Interpublic. From there, we can calculate what that price assumes about Interpublic's future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well Interpublic has to perform in the future to be worth what Omnicom for the acquisition.

Interpublic's Uniform return on assets ("ROA") has comfortably cleared 30% every year since 2019. That's more than twice the 12% corporate average.

But for the business to add value at the price Omnicom paid, Interpublic only needs to return above 20%.

Take a look...

The combined company will generate more revenue than any other legacy ad agency. Dominance is no longer a question.

The real test will be whether the post-merger Omnicom can innovate fast enough to make this deal more than just a short-term Band-Aid. But as long as Omnicom doesn't fumble the integration, it stands to extract huge value from this acquisition.

One thing is certain... AI is redefining the advertising industry.

One thing is certain... AI is redefining the advertising industry.

And being the biggest might be Omnicom's only way to survive.

If it can successfully integrate Interpublic and build its own AI solutions, Omnicom could close the gap with digital advertising giants.

If it fails, this deal will go down as Omnicom's desperate move to stay afloat in an industry that's moving on without it.

Investors still see this business as a traditional ad agency that's struggling to keep up. But if the company can follow through, folks who recognize its hidden value today could be in for major upside.

Regards,

Joel Litman

February 25, 2025

AI is eating Omnicom's (OMC) lunch...

AI is eating Omnicom's (OMC) lunch...