Once Again, This Chipmaker's Credit Risk Is Being Overblown

In this changing market, the investors who stay ahead of the herd will profit...

In this changing market, the investors who stay ahead of the herd will profit...

Over the past few months here at Altimetry Daily Authority, we've regularly discussed the "At-Home Revolution." It's the massive societal shift that's unfolding in the wake of the coronavirus pandemic as consumers have moved their spending to the home. This means certain businesses and industries have been and will continue to be winners... and that means big upside for investors.

However, this isn't the only big trend we're seeing emerge from the pandemic that investors should be monitoring...

Last Wednesday, we talked about the strength of Delta Air Lines' (DAL) market position, despite all appearances to the contrary. Airlines are struggling in the current environment. And yet, due to Delta's strong historical returns and solid cash position, the company is likely to survive and take market share when things return to normal... and it stands ready to "roll up" any competitors who will fail.

When the pandemic is over, the companies like Delta that survive in struggling fields will be in an even stronger competitive position... which will lead to superior returns. We call this phenomenon "survive and thrive."

And we're not the only ones noticing this trend. Just last week, asset-management giant BlackRock (BLK) released a report recommending the "energy, aviation, and lodging companies hammered by the pandemic." According to the firm, the market hasn't yet realized the potential for gains by select companies in a market shake-up in these industries.

We've already started to see the market catch on to our first big theme that was accelerated by the pandemic: the At-Home Revolution. As the market is changing so quickly, it's important for investors to watch for new themes... and the "survive and thrive" theme has emerged repeatedly after historical instances of similar economic turmoil.

In our Altimetry's High Alpha newsletter, we've found one company that's primed to take advantage of the disruption in one of the industries hit hardest by the pandemic. You can gain instant access to this recommendation with a High Alpha subscription... Learn more here.

In early 2015, Robin Blumenthal at Barron's relied on our insights to write about a beaten-down chipmaker...

In early 2015, Robin Blumenthal at Barron's relied on our insights to write about a beaten-down chipmaker...

She was looking at Advanced Micro Devices (AMD) as a turnaround idea.

Blumenthal approached Valens Research – the firm that powers the research at Altimetry – for help due to the credit tilt of the article. At Valens, we also make sure to analyze both stocks and bonds together, as neither can be analyzed in a vacuum. As such, Blumenthal needed to see if AMD was a compelling idea... or if a credit overhang could hurt the stock.

Overall, Blumenthal believed the company was in a good place. With new CEO Lisa Su at the helm, AMD was cutting costs and moving into new businesses that had the potential to create significant revenue and improve profits. However, Blumenthal wanted to make sure that the other side of the company's capital structure wouldn't "torpedo" the stock...

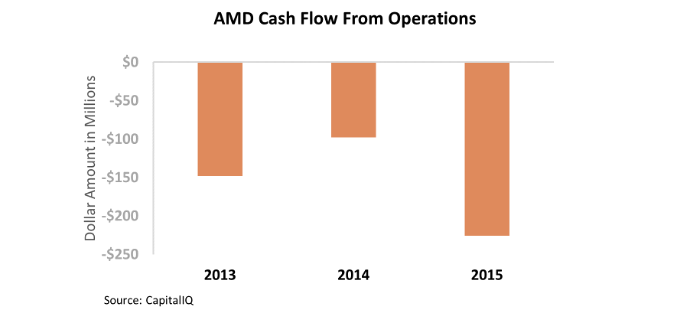

At the time, AMD's as-reported cash flows from operations were negative for each of the past three years, which rightfully scared investors. On top of that, credit-ratings firm Moody's (MCO) ranked the company as "B2." This rating is in the deep "junk" bond space, meaning AMD had a relatively high probability of default.

Another factor that spooked investors was AMD's credit default swaps ("CDSs"). A CDS is like an insurance contract to help hedge the risk of a bankruptcy. Similar to a higher insurance premium, a higher CDS level signals greater risk.

At the time, a CDS for AMD was trading at 600 basis points. This was an elevated level that indicated real risk of distress for the company's credit.

If a business doesn't generate positive cash flow from operations, it's extremely difficult to pay off debt. And a company that defaults on debt will see its share price rapidly decline.

Regardless of the future opportunities for AMD's new businesses, if it never gets to invest in them because it's in bankruptcy and management is ousted, that potential doesn't mean anything. As you can see below, the as-reported numbers painted a bleak picture of AMD's cash flow from operations...

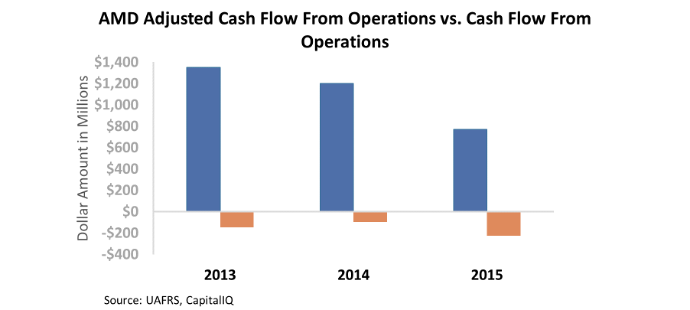

However, GAAP accounting completely misrepresented AMD's real performance in both earnings and cash flows.

Non-cash stock option expenses, research and development (R&D) investment, and other expenses were misrepresenting the company's cash flows. These distortions caused AMD's cash flows to appear negative.

In reality, AMD had positive cash flows from operations of nearly $1.2 billion in 2014. Take a look...

With so much cash generated, AMD's risk of defaulting on its bonds was way lower than both equity and credit markets were thinking.

The company's bonds were trading at yields of 8%, and risk of bankruptcy was priced in for AMD shares. This large discrepancy between what Uniform Accounting and the as-reported numbers showed created an opportunity.

Since then, the market caught on. Thanks to AMD's strong cash flows and Su's leadership, the company was able to manage its debt load – eventually seeing profitability expand massively.

AMD's CDS has dropped to only 56 basis points. The market correctly recognizes that the company isn't a default risk.

Yet, Moody's has only raised AMD's credit rating from a high-risk, high-yield "B2" rating to a slightly less high-risk, but still high-yield "Ba2." Although three notches higher, this is still a junk bond rating.

This tells us that Moody's is once again missing the mark on AMD... and this is deceiving investors.

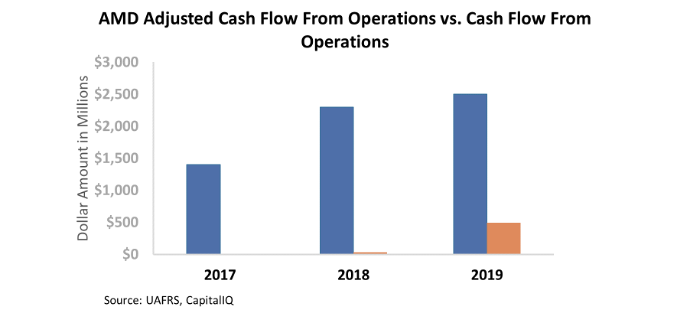

The chart below shows AMD's current cash flows from operations. As-reported cash flow from operations sat near zero as recently as 2018, and only improved modestly to around $500 million in 2019. On the other hand, adjusted free cash flow has been robust and growing – it was more than $2.5 billion last year.

Using as-reported metrics, Moody's still thinks AMD is in trouble... But Uniform Accounting proves that the company isn't.

Since early 2015 and the Barron's article, AMD shares have risen from $2.50 to more than $80. This rise stems from greatly reduced credit risk, and then the artificial intelligence ("AI") boom.

The equity and credit markets have woken up. And yet Moody's remains asleep at the wheel... because the firm is looking at the wrong data.

Many institutional investors simply aren't allowed to buy any bonds the big credit rating agencies rate as junk, regardless of the quality of the agencies' analyses. Fortunately, with Uniform Accounting we can be aware of this opportunity... even if the credit-ratings firms aren't.

Regards,

Rob Spivey

August 26, 2020

In this changing market, the investors who stay ahead of the herd will profit...

In this changing market, the investors who stay ahead of the herd will profit...