It has investors concerned about the next tech bubble...

It has investors concerned about the next tech bubble...

Last week, a new piece of analysis fanned the flames of the investing world. It restarted an ongoing debate about whether the market is currently in a massive bubble.

No, we're not talking about the army of individual investors on the WallStreetBets forum on discussion site Reddit going to war with hedge funds over GameStop (GME), AMC Entertainment (AMC), and other stocks – although this certainly has many investors spooked.

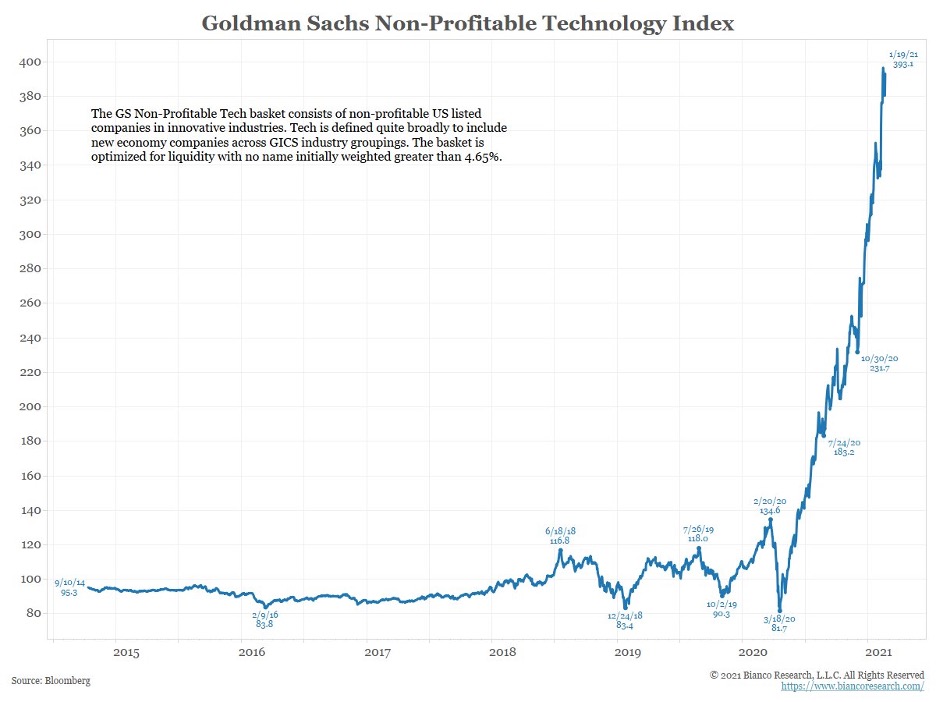

It was this chart from Jim Bianco of Bianco Research, which shows Goldman Sachs' (GS) Non-Profitable Technology Index. This index is an equally weighted basket of technology companies that haven't yet turned a profit.

As you can see, after years of relative stability, the index saw a massive spike in 2020 as these stocks took off after their March lows...

This growth of more than 400% beats out the S&P 500 Index and the Dow Jones Industrial Average over the same period... and this is all from companies with no GAAP profitability.

Many investors point to this as a reason to think that the market is in a bubble... and is heading for collapse. Pundits are claiming fundamentals and stock prices have become completely divorced from one another.

However, from years of study, we have a different view here at Altimetry...

Rather than a bubble, this shocking result may come from using the wrong data...

Rather than a bubble, this shocking result may come from using the wrong data...

While the chart is initially alarming, there's more to "non-profitable" companies than meets the eye. When the accounting distortions around stock option expense, research and development (R&D), and others are removed, a different picture emerges.

Uniform Accounting makes it clear that many of these firms are throwing off large amounts of cash year after year.

After making the right accounting adjustments, we can see that Tesla (TSLA), Shopify (SHOP), Spotify (SPOT), Workday (WDAY), Roku (ROKU), Peloton (PTON), Pinterest (PINS), Teladoc Health (TDOC), and other poster children of the "non-profitable tech" run have positive earnings.

That said, the real factors behind the rally come down to something bigger. This goes beyond the fact that as-reported metrics aren't showing the real data.

This rally gets to the heart of the idea that there's a difference between a great company and a great stock.

This rally gets to the heart of the idea that there's a difference between a great company and a great stock.

Great companies have high returns, impressive business models, and efficient operations. Their owners know cash can be generated from a minimal investment.

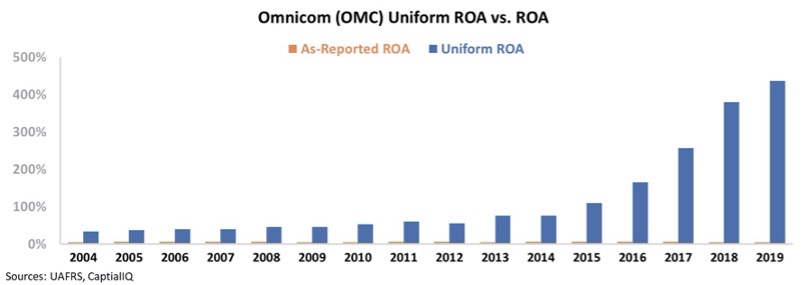

This is why companies like Omnicom (OMC) – the advertising conglomerate with an impressive 437% Uniform return on assets ("ROA") in 2019 – are truly extraordinary... as businesses. An extremely high ROA doesn't necessarily translate to that company's stock rocketing higher.

In Omnicom's case, that 437% Uniform ROA is nearly 90 times higher than the as-reported 5% figure for 2019. Furthermore, GAAP accounting fails to show the company's steady improvement in profitability. Take a look...

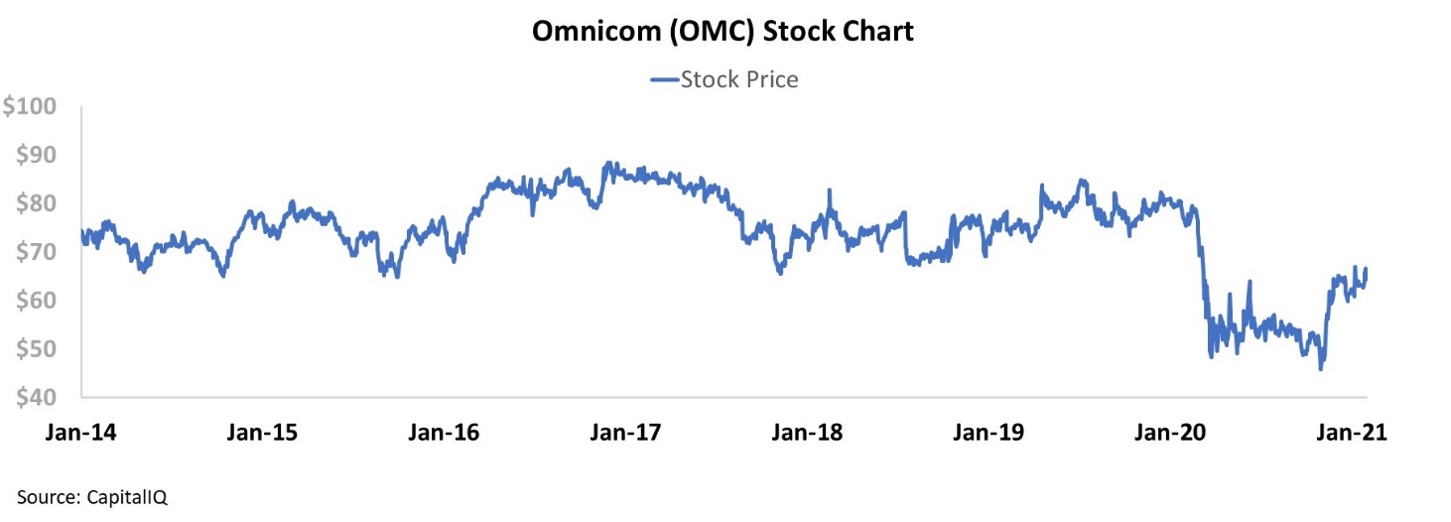

This doesn't mean we believe Omnicom's stock will take off... It means that if investors are looking at the company based on as-reported metrics, they'll misunderstand how good the business actually is.

Since 2014, Omnicom has seen its real returns soar from 75% to an expected 285% for 2020. And yet, the stock has fallen from $74 to less than $65 over this same period.

What actually makes a stock go up or down isn't just how good the company is...

What actually makes a stock go up or down isn't just how good the company is...

It's how the company performs relative to expectations... And how that causes market expectations to change.

Great companies have high returns. Extraordinary companies have high returns while being able to grow at the same time.

Great stocks are companies that are able to generate earnings power at levels higher than what the market is pricing in for them to do. That's a different question entirely.

For Omnicom, the market already expected the company's returns to skyrocket before they did so. That's why OMC shares didn't take off when the company's profitability did.

Here at Altimetry Daily Authority, we always emphasize just how wrong the as-reported metrics are...

Here at Altimetry Daily Authority, we always emphasize just how wrong the as-reported metrics are...

We want to make sure readers realize that you can't use those metrics to value companies. They're just directionally wrong more often than not.

But just knowing that Uniform profitability is better than what the as-reported metrics show isn't enough. You also need to take the next step – understanding what the market expects the company to do going forward – in order to figure out if the stock is undervalued or overvalued.

A stock may climb if the market expects ROA to collapse, but returns end up only staying flat. It might also occur if the market expects a company to grow modestly, and the company actually sees fundamentals accelerate even faster than the market anticipated.

Many of the "non-profitable" tech firms have taken off because of the "At-Home Revolution." This massive societal shift has meant these companies' business models are now more viable and relevant than they were before.

That meant people were suddenly in need of these firms' products and services, and were willing to pay top dollar for them. The market didn't expect these companies to hit a critical mass as fast as they did... so those stocks rose until markets were pricing in this new reality.

And as these companies continue to take more share of the economy, the market will have to continue to adjust its expectations – pushing the stocks higher.

This can only be understood by looking at the context of what makes a great stock as opposed to a great company.

Regards,

Joel Litman

February 2, 2021

It has investors concerned about the next tech bubble...

It has investors concerned about the next tech bubble...