It's a revolutionary innovation in the world of working from home ('WFH')... the lunch break!

It's a revolutionary innovation in the world of working from home ('WFH')... the lunch break!

This story came out in the middle of April, but I suppose we're slow on the uptake from social media...

Senior management at British food-delivery service Just Eat recently came up with a novel solution to a problem employees were raising.

Staff had been complaining that one of the issues with the lockdown is (since they can't see visually when their peers aren't busy) that they were constantly scheduled on rampant, back-to-back calls all day.

Here at Altimetry, we're obsessed with the question of "could it just be an e-mail?" – a rule Joel and I have lived by since we founded Valens Research back in 2009. If it doesn't have to be a meeting, we try to avoid them. This certainly doesn't mean we don't believe in meetings... Collaboration is essential to any successful business. But we also understand that meetings can sometimes be less of a benefit and more of a hassle.

But my wife's company doesn't have quite the same mantra. Every day, I can hear her from my home office... She's at her desk on meeting after meeting throughout the day, with little time for the actual work she needs to get done.

So what was management's solution at Just Eat? It was to introduce the "Power Hour," an hour around lunch when "Just Eaters" would have time to have lunch or do other projects.

As management said, it's just another way the company continues to "brilliantly enhance the lives of Just Eaters everywhere!"

As many people observed, though, all Just Eat was doing was re-introducing a not terribly novel innovation – a lunch break during the day...

While we mock Just Eat, it's relevant to note that the issue of how to adjust to WFH is a real one. The coronavirus pandemic and the "stay at home" shift across the globe has accelerated trends that were already building scale, and these are unlikely to fully reverse once the world exits the broader disruptions.

The shift to working more at home is likely to continue, even if not at the current rate where office buildings everywhere are barren. And as people spend more time at home, they're going to be spending more time investing in their home... especially during their "Power Hour" over lunch.

In our next monthly issue of Altimetry's Hidden Alpha – publishing on Monday – we'll be covering that trend of "Your Home, Your Castle"... And better yet, we've identified the companies that are likely to be big winners because of it.

If you want to see the businesses we've found that are going to be riding the wave of working from home, playing at home, and the other things we're going to be doing more of at home, make sure to subscribe to Hidden Alpha today. You can sign up here.

As a society, we're obsessed with 'the next big thing'...

As a society, we're obsessed with 'the next big thing'...

It's fun to think about the future, but that sometimes comes at the expense of thinking about the present or even the near future.

When looking at what types of technologies are receiving the most investment, we often see perfectly viable options falling behind because they aren't as exciting or "sexy" as trying to discover the next big thing.

You can look at what types of companies are popular investments for angel investors and venture-capital firms to get an idea of what we mean...

While incredibly sophisticated logistics software options are ready for the market today, many startups have focused on using blockchain for logistics and are being fully funded.

At risk of sounding like luddites, it doesn't quite make sense to us to leave perfectly good technology on the table just to hold out hope for something better in the distant future.

Another example is the massive amount of investment we've seen from the private sector in renewable energy sources like solar and wind power. We're all for adopting more zero-carbon energy sources, but wind and solar aren't ready for the big stage yet: baseload power.

Wind and solar have become the poster child of renewable energy sources because they seemingly create energy out of nothing, and it's easy to visualize how "clean" they are.

That said, there's a number of drawbacks that we're still years from resolving to make these sources commercially viable at a large scale.

Currently, we don't have infrastructure to viably store and transport solar and wind energy at a fully widespread scale. The venture-capital-funded startups are researching more efficient batteries and energy transmission methods, but again, we're years away from breakthrough.

Additionally, wind and solar are volatile energy sources. We have no control over when it's going to be windy, and we aren't even good at predicting clouds. Solar panels will go unused every single night, so it's tough to say we'll always have sufficient energy on hand.

That means these power sources can't be relied on to consistently deliver the power that the economy needs – the baseload power we mentioned before.

Despite these drawbacks, most people still associate renewable energy with wind and solar...

However, one of the cleanest and cheapest energy sources is already commercially viable, and nobody seems to be paying attention.

Nuclear energy of course has its risks and drawbacks... But just like solar is overly glorified, nuclear is overly vilified.

First, the actual health risk from nuclear power is next to zero if safety measures are followed. It's also a much better form of baseload power – it's a constant, 24-hour energy source.

Additionally, as most people don't seem to know, nuclear emits no carbon once it's up and running. The last concerns people throw around are about the expensive setup and decommissioning costs, which are also largely misunderstood.

If all of the commonly cited concerns were true, nuclear would be a bad energy source... and a bad business.

We can test this by looking at one of the companies most involved with nuclear energy – Exelon (EXC). It operates the largest fleet of nuclear plants in the U.S., so it's our best proxy for investor perception and the profitability of nuclear energy.

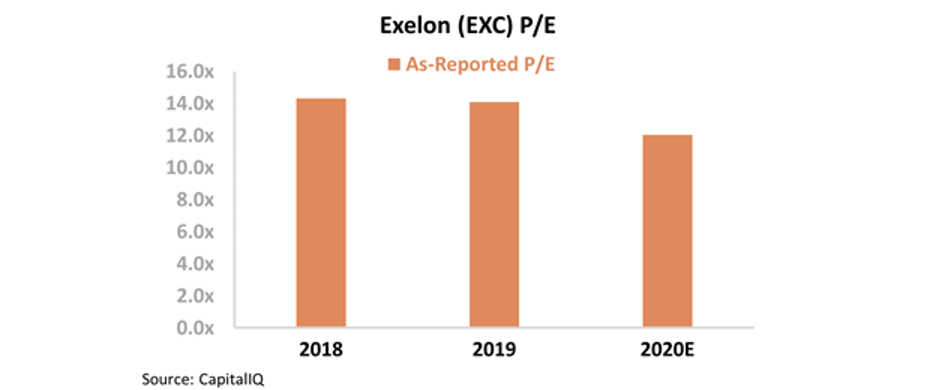

Beginning with investor perception, it's as expected. Exelon trades at a significant discount to the market... It has a price-to-earnings (P/E) ratio of just 12, compared to market averages around 20.

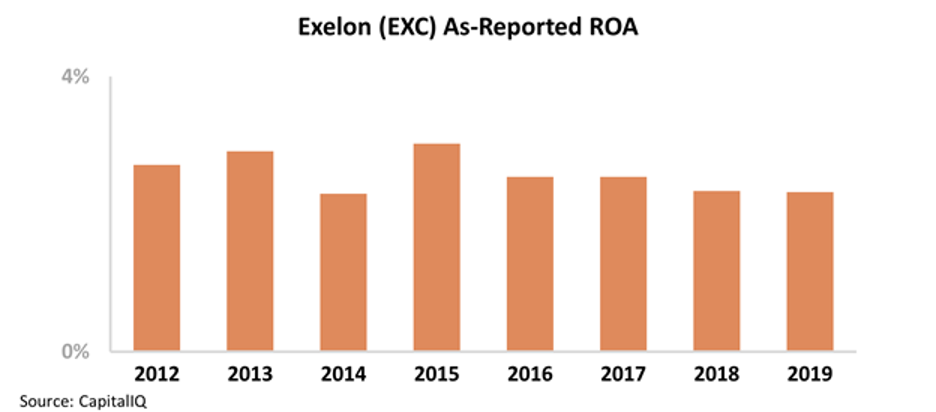

Furthermore, Exelon's profitability is in line with its valuations. As an energy utility, we normally expect returns to be around 4%. That said, given the high startup costs for nuclear, Exelon's return on assets ("ROA") has remained at 2% to 3% levels since 2012.

These numbers help confirm the common perception around nuclear energy. It's expensive to produce, and investors price it for its risks.

However, the as-reported metrics may be helping to mislead the public...

You see, nuclear energy is actually one of the cheapest energy sources all-in – the costs are just concentrated towards the beginning of its lifecycle.

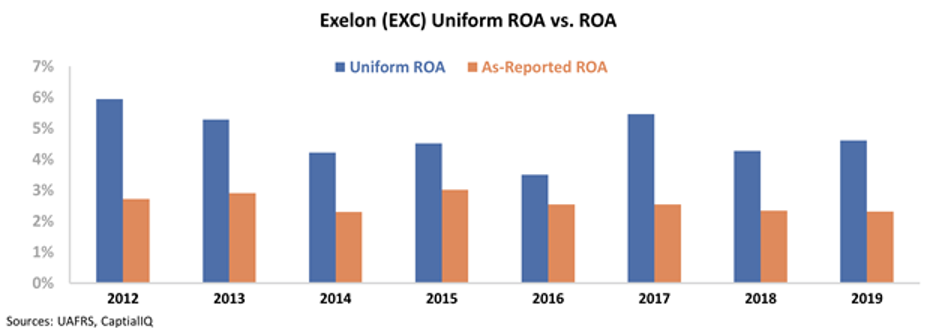

When we look at Exelon using Uniform Accounting metrics, we can see the firm's true profitability.

In reality, Exelon's Uniform ROA has remained at or above average 4% levels... most recently improving back to 5% last year.

This may not seem like much, but the difference between 4% and 5% ROA is massive for asset-heavy utilities. Exelon's 22 nuclear sites are driving above-average returns.

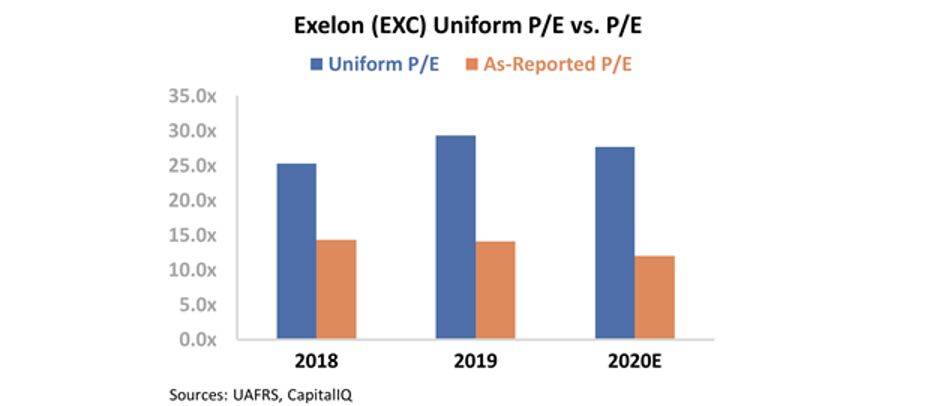

While this may seem like a case where the market doesn't realize the true value of nuclear energy, the truth is that investors have already caught on. Exelon's Uniform P/E ratio is actually 28 times – expensive relative to the market.

Investors are already treating nuclear energy like it's the profitable, sustainable energy source that it really is when the plants are up and running. Maybe they should start treating building new nuclear power plants the same way.

Regards,

Rob Spivey

May 1, 2020

It's a revolutionary innovation in the world of working from home ('WFH')... the lunch break!

It's a revolutionary innovation in the world of working from home ('WFH')... the lunch break!