Saudi Aramco (2222.SR) had a down year... So it's giving away more money...

Saudi Aramco (2222.SR) had a down year... So it's giving away more money...

Even after a poor 2023, Saudi Arabia's national oil company remains one of the five largest companies by market cap.

Revenue fell 18% to $440 billion thanks to weak oil prices. Net profit dropped nearly 25%.

That didn't stop it from giving more cash away, though. Saudi Aramco raised its dividend by 30%.

Businesses this big rarely give away anywhere near this much cash. The rest of the top 15 companies by market cap have dividend yields at or below 2%. Saudi Aramco's yield is now about 5.5%.

Said another way, its annual dividend is just shy of $100 billion... on a down year for earnings.

For investors, the question is now about sustainability. Today, we'll take a closer look at whether Saudi Aramco is enticing investors to stay... or burning cash it can't afford to lose.

It all comes down to cash flows...

It all comes down to cash flows...

Saudi Aramco believes its cash position is robust enough that it can breathe... even when faced with upcoming obligations.

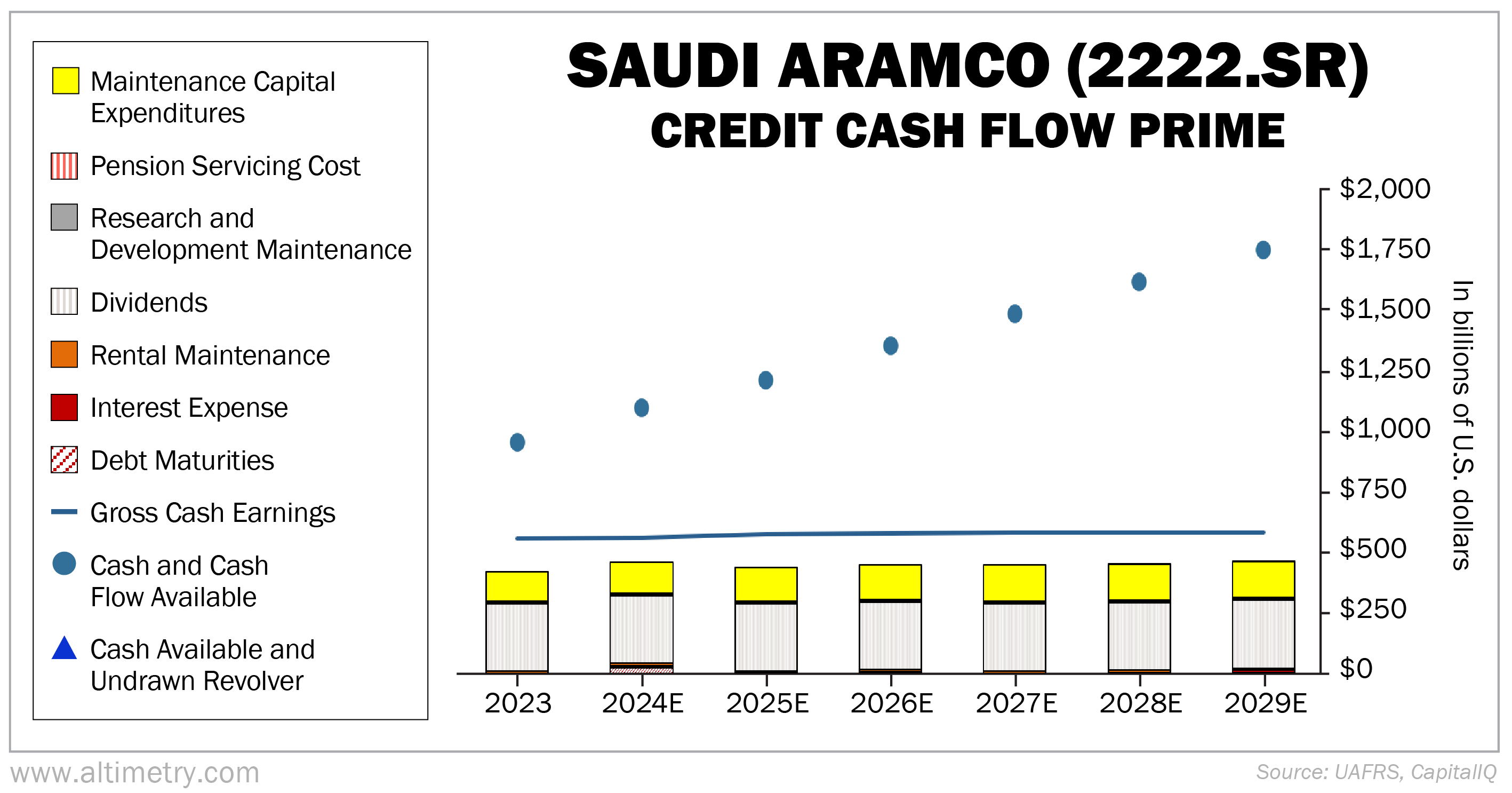

We can check its math using our Credit Cash Flow Prime ("CCFP") analysis.

The CCFP gives us a more accurate sense of a company's overall health. It compares financial obligations against cash position and expected cash earnings.

In the following chart, the stacked bars represent Saudi Aramco's obligations through 2029. This is what it needs to pay to keep the company from going under.

We compare these obligations with cash flow (the blue line) and cash on hand at the beginning of each period (the blue dots).

Through 2029, Saudi Aramco's cash flows alone exceed all of its obligations by an average of $119 billion.

Take a look...

As you can see, the dividend hike barely puts a dent in Saudi Aramco's balance sheet. The company can easily cover all its costs.

In fact, it may actually have room to raise its dividend further. And quite substantially, too... as much as another 50% to 75%.

This business is so profitable that even in a down year, it's accumulating a huge pile of cash...

This business is so profitable that even in a down year, it's accumulating a huge pile of cash...

Saudi Aramco has a humble $100 billion sitting on the balance sheet right now. It could support a full year of dividends, even if it didn't sell any oil.

The biggest issue with this company is that it's only listed on the Saudi stock exchange. That makes it harder for U.S. investors to get ahold of shares.

Saudi Aramco is a no-brainer investment in today's environment. It's using its cash to keep investors happy... even while oil prices aren't cooperating.

After all, it's not every day one of the world's biggest companies offers to pay you 5.5% for waiting through the bad times.

That's a great deal... if you can get it.

Regards,

Joel Litman

April 3, 2024

Saudi Aramco (2222.SR) had a down year... So it's giving away more money...

Saudi Aramco (2222.SR) had a down year... So it's giving away more money...