Due diligence is important when finding potential investments – especially with companies in an under-policed part of the market...

Due diligence is important when finding potential investments – especially with companies in an under-policed part of the market...

Microcaps are like the Wild West. There are a lot of bad actors out there. It also means that when a company starts to look questionable, people run for the hills.

These names typically fly under the radar of stock regulators like the U.S. Securities and Exchange Commission ("SEC") because they think these companies are too small to matter.

When choosing a microcap (or any stock), you need to do your due diligence. And doing it right is essential. Otherwise, you might walk into what looks like a compelling investment opportunity, only for it to blow up your portfolio instead.

You could also walk away from a stock pick that you're spooked by, only to find out it was caught up in trumped-up charges. And once those clouds were removed, the company skyrocketed.

One of our best ideas falls into this category. This almost 40-year-old vice-industry veteran lost its auditor, which sent investors running for the hills. But when we took a closer look at this stock in our Microcap Confidential service, we came away excited, not afraid. And today, readers who followed our advice are up more than 235%...

By taking a deeper look, we were able to get comfortable with an interesting idea...

By taking a deeper look, we were able to get comfortable with an interesting idea...

Strip-club operator RCI Hospitality's (RICK) accounting firm quit in July 2019. BDO, RCI's auditor for several years, was uncomfortable with anonymous accusations about related-party transactions brought to the SEC's attention.

Related-party transactions, or when management does business with friends instead of the conducting the best shareholder deal, are normally a massive red flag... especially for people like us, who care about management's alignment with shareholders. And on the news, the stock plummeted.

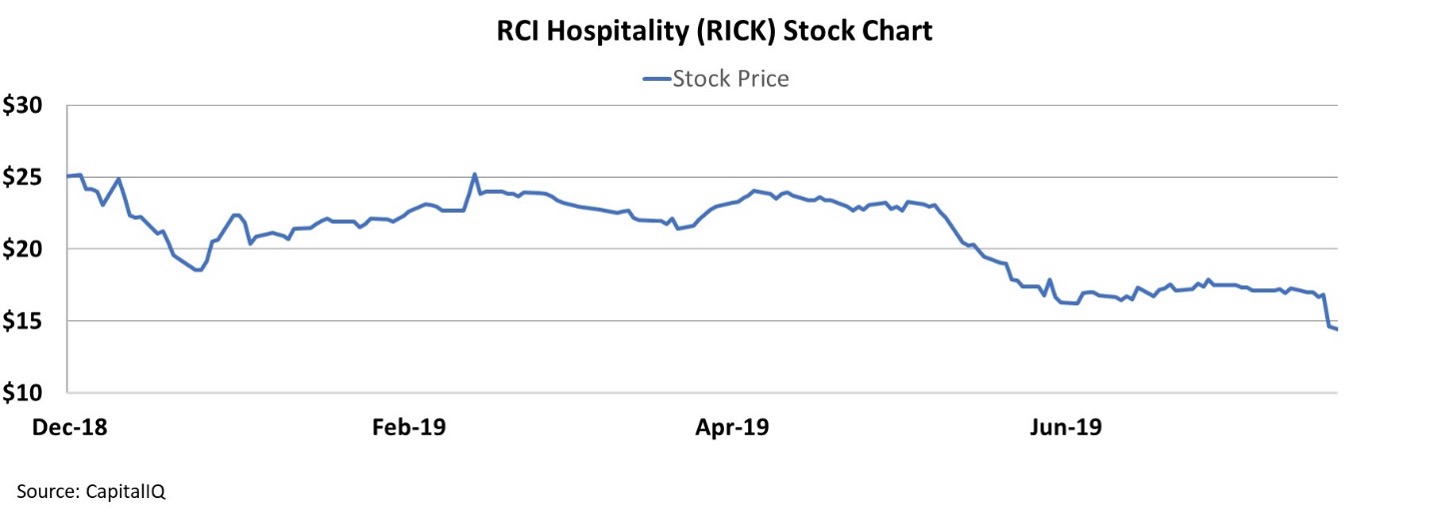

RICK shares were trading for more than $23 before the first accusations were leveled in late 2018. But when BDO resigned, the stock dropped below $15 per share...

But a deeper look at the accusations and the subsequent findings gave us a lot of confidence about RCI's operations.

The investigation eventually found the company needed to improve its internal controls. RCI settled with the SEC in September 2020 in a deal that included a civil penalty of $400,000. No other smoking guns were found.

So why did BDO quit? As we mentioned, RCI is an adult-entertainment operator. Its main business is to run strip clubs. It's an off-putting industry for a big accounting firm like BDO to be involved with, and so BDO was looking for an excuse to run.

RCI is the largest adult entertainment operator in the U.S. and the only publicly listed one. Over the past decade-plus, it had been "rolling up" the strip club market. RCI buys companies at cheap, private-company valuations, using the more affordable financing it can get as a public company and reaping the benefits.

Being a roll-up in a small, under-followed business can be highly profitable if done right. RCI was doing it right... And we had the potential to buy the stock at a discount.

The combination of overblown fraud accusations and the coronavirus pandemic created a massive opportunity...

The combination of overblown fraud accusations and the coronavirus pandemic created a massive opportunity...

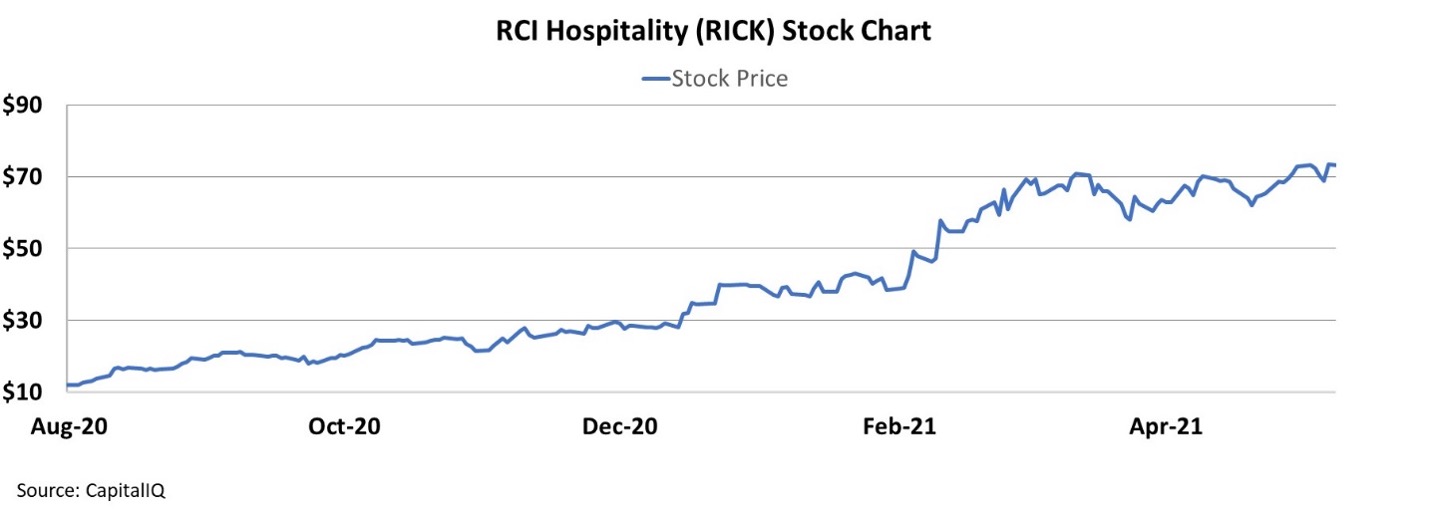

Due to all these issues, by the time we got comfortable with RCI in August 2020, the stock was sitting at $13.82 per share. And looking at the market's expectations, we saw that the company was priced like it was a worthless fraud, not a smart operator.

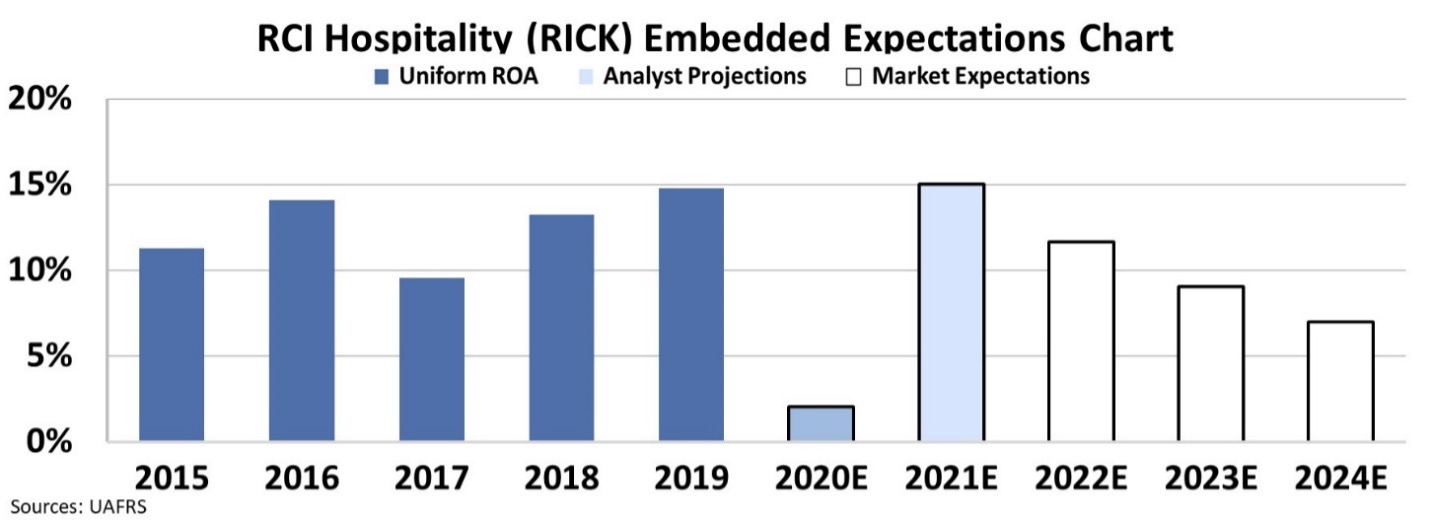

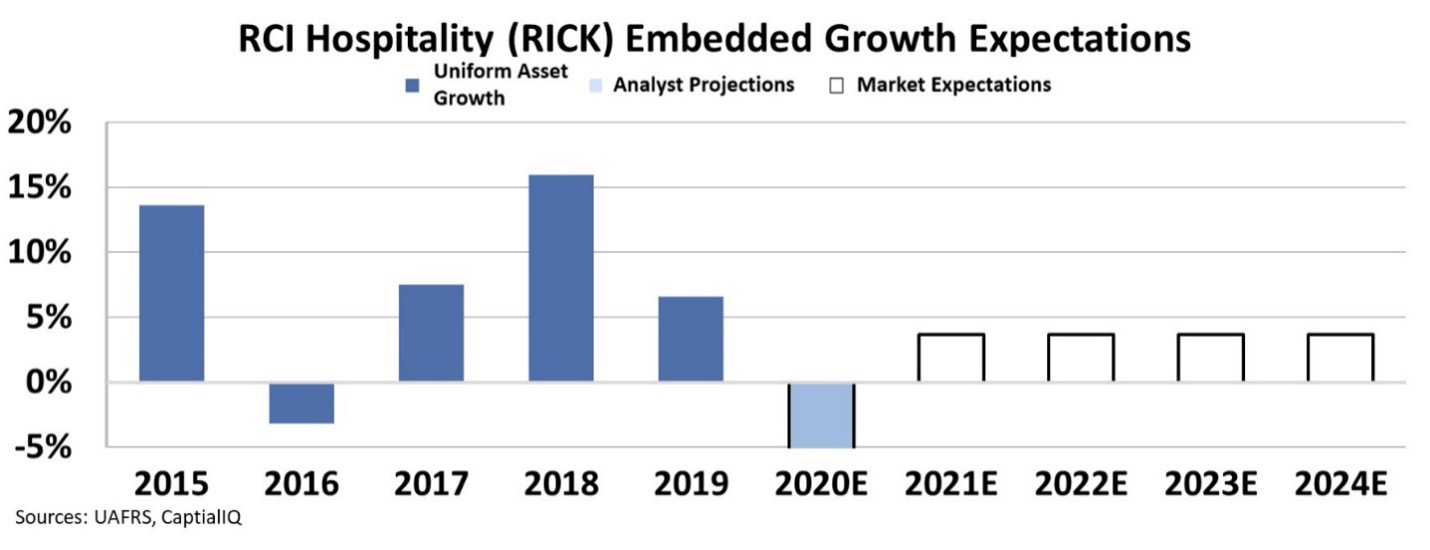

In the chart below, the dark blue bars represent RCI's historical corporate performance levels in terms of Uniform return on assets ("ROA") when we analyzed it in 2020. The light blue bars are Wall Street analysts' expectations for the next two years. And the white bars show the market's expectations for the company's ROA over the next five years.

In this case, the market expected that RCI would see returns collapse over the next few years. The market was betting that either RCI had serious fraud issues that would ruin it or that people would never want to go to a strip club again after the pandemic.

We knew that RCI didn't have fraud issues that would ruin it. And we also had high confidence that strip clubs weren't vanishing after the pandemic. That doesn't even get into the other fascinating growth opportunities we saw for the business at the time.

Our due diligence and understanding of the company's real profitability gave us the confidence to pound the table on the name. Since our recommendation in August 2020, our readers are up more than 235%.

The RCI story is a reminder that due diligence doesn't always just mean you walk away from companies... Sometimes, you find a gem.

The RCI story is a reminder that due diligence doesn't always just mean you walk away from companies... Sometimes, you find a gem.

But you need to do the deep work to do it – especially in the under-policed world of microcaps. That's exactly why we created Microcap Confidential.

It has been nearly a year since we launched this newsletter to identify tiny companies with massive upside.

Since July, we've recommended 18 microcap stock picks. Thirteen of those names are up double or triple digits. We've closed partial positions in five of those names for doubles. And one of those positions is currently up more than 400%!

To gain instant access to our favorite microcap stock picks right now – and to get a year of Microcap Confidential for 60% off its regular price – click here.

Regards,

Joel Litman

June 22, 2021

Due diligence is important when finding potential investments – especially with companies in an under-policed part of the market...

Due diligence is important when finding potential investments – especially with companies in an under-policed part of the market...