A good friend of mine is an asset manager whose investments have also stemmed into venture capital...

A good friend of mine is an asset manager whose investments have also stemmed into venture capital...

He has focused a majority of his investments on the biotech industry. And one of the reasons that my friend is a strategic investor is because he can help the companies he invests in improve their communications with investors.

Many management teams remain naively focused on as-reported earnings. My friend can help them avoid the pitfalls of antiquated accounting rules, particularly in the area of research and development (R&D) expenditures.

He and I have spoken many times about how as-reported earnings are no longer a good indicator of how a stock will perform... And this is especially true with biotech firms.

One of the companies my friend is investing in is set to go public this year...

One of the companies my friend is investing in is set to go public this year...

A major focus area for the business is Alzheimer's disease research. Interestingly, being a board member, my friend has learned a lot about the science of Alzheimer's, along with the treatments.

He was telling me recently over dinner that from his research thanks to investing in this company, he has concluded that sleep is incredibly important in reducing the risk of Alzheimer's later in life.

Sustaining the rapid eye movement ("REM") cycles and maintaining deep sleep are especially critical. In fact, during deep sleep, generally after your sixth hour of sleep, your body goes through physical and mental recovery... and your brain organizes memories.

One silver lining of the ongoing travel and commuting restrictions is the opportunity for folks to get some extra sleep...

One silver lining of the ongoing travel and commuting restrictions is the opportunity for folks to get some extra sleep...

Getting enough deep sleep is incredibly important for a healthy mind.

During that dinner, another one of my friends asked, "What if I just don't sleep well?" Our successful biotech investor friend replied, "One of the best ways to optimize your sleep schedule is to reduce stress during the day."

It's no surprise that a great way to reduce stress is by meditating. And so our conversation turned to the benefits of that, yet again.

We've talked a lot about meditating here at Altimetry Daily Authority. Getting a better night's sleep is just one more benefit of the practice... so once again, I encourage you to give it a try if you haven't already.

Meditating isn't the only way to get a better night's sleep...

Meditating isn't the only way to get a better night's sleep...

One idea I love to bring up in my MBA classes is why students should spend more money on their bedding and bedroom – and less on their cars and other more frivolous expenses.

It makes sense... People spend more time in their beds than in their cars on any given day. Investing in your bedroom will have a greater effect on your health than spending more money on your car.

Following this logic, investors might expect a firm like Tempur Sealy International (TPX) – which offers high-end bedding – to earn premium returns, given the importance of its products for people's health.

However, this isn't the case... at least on an as-reported basis.

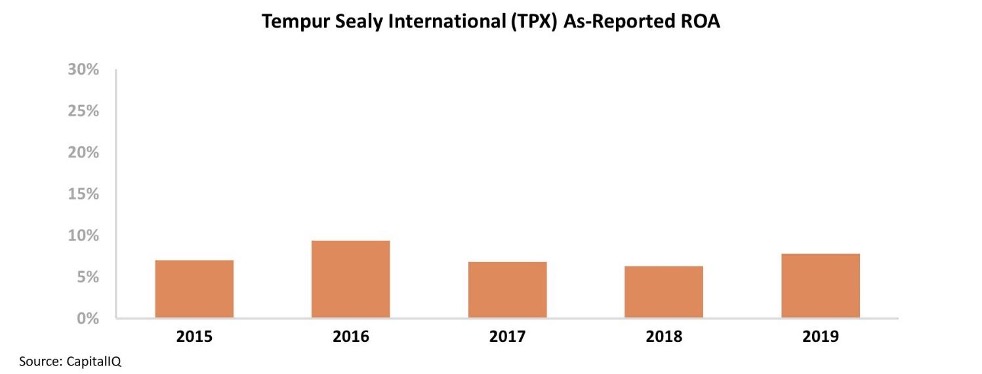

Looking at its GAAP returns on assets ("ROAs"), Tempur Sealy hasn't generated profitability greater than 10% in more than five years.

In fact, with returns below the corporate average, it would seem folks have deprioritized investing in their sleep... and that the company is paying the price.

But in reality, this below-average ROA is just 'noise' from bad accounting...

But in reality, this below-average ROA is just 'noise' from bad accounting...

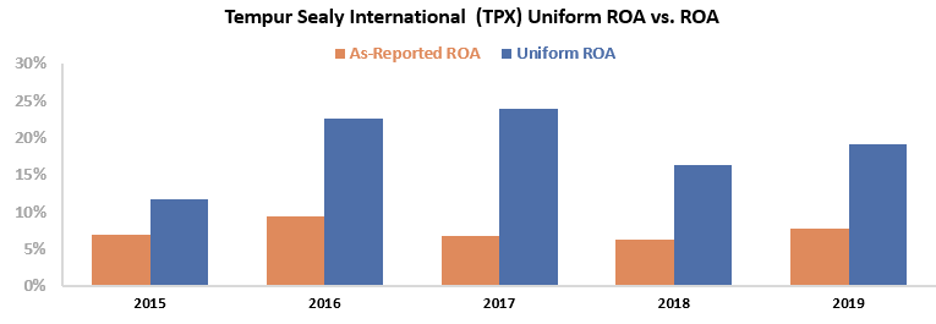

Once we adjust for distortions in line items such as goodwill and interest expense, we can see Tempur Sealy's real profitability.

These Uniform Accounting adjustments show that the company's actual returns have been consistently greater than 12% in recent years.

As you can see in the chart below, since 2016, Tempur Sealy's Uniform ROA has ranged from 16% to 24%. Take a look...

When using Uniform data, investors can see how Tempur Sealy is benefiting as people pay up to invest in a good night's sleep.

With these strong fundamentals, Tempur Sealy is positioned for its performance to improve, especially as folks increasingly shift spending to their homes as part of the "At-Home Revolution."

However, without Uniform Accounting, investors would completely miss this above-average performance... and might think Tempur Sealy is weaker than it actually is.

Regards,

Joel Litman

February 5, 2021

A good friend of mine is an asset manager whose investments have also stemmed into venture capital...

A good friend of mine is an asset manager whose investments have also stemmed into venture capital...