One of Warren Buffett's Biggest Moves in Years Has Slipped Under the Radar

The legendary Warren Buffett has been a little frustrated with the U.S. stock market lately...

The legendary Warren Buffett has been a little frustrated with the U.S. stock market lately...

In late February, Buffett released the annual Berkshire Hathaway (BRK-B) shareholder letter, where he seemed mildly exasperated. He said that he believed there were very few opportunities happening in the U.S. stock market, thanks in part to the possibility of rising rates.

His frustration in February is part of the reason people were interested when Berkshire announced a few weeks ago that it was acquiring reinsurance company Alleghany (Y) for $11.6 billion.

The price tag caught investors by surprise, considering that this is one of Berkshire's biggest acquisitions in more than five years. But this move wasn't very surprising given Buffett's long-term affinity for the reinsurance sector.

However, in our view, another recent Berkshire move requires much more attention...

Berkshire revealed that it has invested an additional $1 billion in Occidental Petroleum (OXY), meaning that it's now one of the largest owners of the oil company. Berkshire has amassed more than 136 million shares of Occidental, with a 15% stake between common and preferred stock.

This acquisition is uncharacteristic for Buffett, as he rarely ventures into the oil and gas industry. It seems to have fallen under the radar, as everyone else seems to be focused on the even bigger Alleghany acquisition.

With the increased Occidental stake, it's clear that Buffett is making a bet on oil and commodity prices...

With the increased Occidental stake, it's clear that Buffett is making a bet on oil and commodity prices...

Berkshire has worked with Occidental before. In fact, Occidental's preferred equity comes from when Berkshire helped the firm fund the acquisition of Anadarko back in 2019.

Occidental has been printing money for Berkshire ever since. Its preferred equity paid $800 million in annual dividends, and last month the company announced it was boosting its dividend to common shareholders.

The dividends alone would be enough to make Buffett happy with this investment. But on top of that, the stock has significant upside potential if oil prices remain strong for longer.

So what is Occidental expected to do in the future?

So what is Occidental expected to do in the future?

Let's take a closer look at what investors expect the company to do, based on its current stock price...

Stock valuations are typically determined using a discounted cash flow ("DCF") model, which makes assumptions about the future and produces the "intrinsic value" of the stock.

Here at Altimetry, we know models with garbage-in assumptions based on distorted GAAP metrics only come out as garbage. Therefore, we use the current stock price with our Embedded Expectations Analysis ("EEA") to determine what returns the market expects.

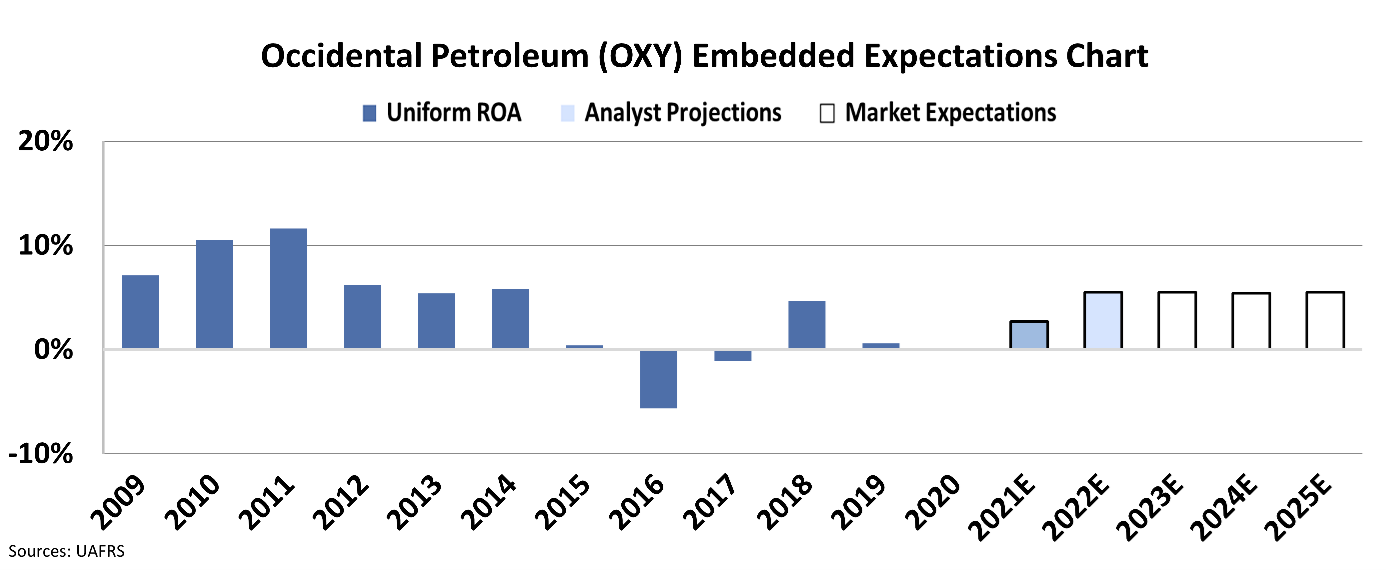

Occidental is currently trading at around $58 per share. Looking at the following chart, we see at that price, the market is expecting Occidental's Uniform return on assets ("ROA") to remain at just 5%...

Considering this Uniform ROA level is lower than it was at any point during the last time oil was above $100 per barrel, it doesn't seem the market is pricing in the potential for oil prices to continue to rise.

Our EEA framework allows us to see what Buffett sees, which is the possibility for upside in the future.

Buffett has already managed to return a ton of cash from Occidental's dividend payments in recent years by holding the stock. And if OXY shares move higher, this will be an added bonus for Berkshire.

Regards,

Rob Spivey

April 6, 2022

The legendary Warren Buffett has been a little frustrated with the U.S. stock market lately...

The legendary Warren Buffett has been a little frustrated with the U.S. stock market lately...