When interest rates are rising, most companies perform worse...

When interest rates are rising, most companies perform worse...

Many businesses could borrow money basically for free a few years ago. Now, they have to pay more to finance their operations. These companies have much higher interest payments on their debt today.

Not only does that mean they need to fork over more cash... they also can't spend that money investing in the business.

But some types of companies thrive when rates rise. Banks and insurance companies are two common examples...

Banks don't have normal products and services like other businesses. They make money on the cash folks deposit for a small interest rate ("interest owed")... which the banks then lend out for a higher rate ("interest received"). When rates rise, interest owed doesn't go up all that much. Interest received, on the other hand, tends to spike.

That usually offsets any slowdowns in borrowing or higher default rates that sometimes come with a higher-rate environment.

Insurance companies also thrive. They collect risk premiums ahead of time and only pay out when something goes wrong. Those premiums don't just sit in a vault or bank account... they get invested.

Insurers need to be careful with their investments – they can't risk blowing up their portfolios with speculations.

The vast majority of insurance "float" (money contributed to policies) is invested in bonds. With interest rates rising, insurers can start investing in higher-yielding bonds.

Insurers and banks aren't the only ones that benefit from higher interest rates. So today, we'll look at some less-obvious places where investors can benefit from high interest rates.

Any company with significant client assets or cash balances is likely to benefit from higher interest rates...

Any company with significant client assets or cash balances is likely to benefit from higher interest rates...

We looked for large-cap companies in our coverage universe that satisfied two key criteria...

- They have huge amounts of investable cash, which they could invest to make a good return in today's environment.

- Their Uniform return on assets ("ROA") is expected to fall over the next few years.

The second criterion should sound familiar to regular readers. It refers to our typical Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from the company's future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

The market believes these companies will suffer from high interest rates because they aren't banks or insurers. But they may actually be able to make money like banks and insurers.

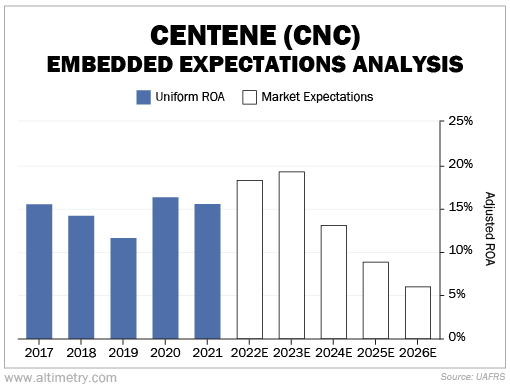

One of those companies is health care provider Centene (CNC). The company's Uniform ROA is forecast to be 18% when 2022 numbers are finalized.

However, the market thinks profitability will decline. As you can see in the following chart, it expects returns to fall as low as 6% by 2026...

Centene is sitting on loads of investable cash. It has about $29 billion in cash and investments today. Those assets should perform better than they did before interest rates started moving higher.

Said another way, Centene should be able to bolster its returns with smart investments. The market thinks Uniform ROA will fall off a cliff. Any surprises to the upside could be a boon for Centene stock.

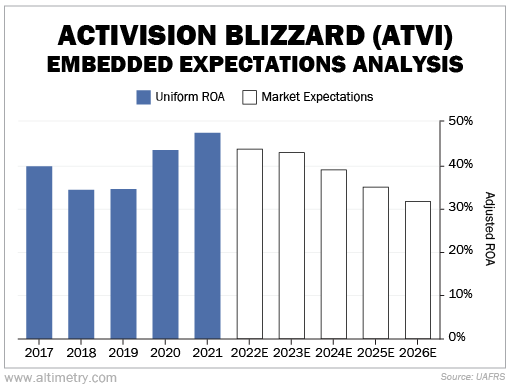

Video-game giant Activision Blizzard (ATVI) is also sitting on a mountain of cash...

Video-game giant Activision Blizzard (ATVI) is also sitting on a mountain of cash...

You may recall that software giant Microsoft (MSFT) is trying to buy the business for about $69 billion. The deal still looks like an uphill battle as it faces investigations from antitrust regulators.

But Activision investors shouldn't mind. The business has about $12 billion in investable assets, which is over 20% of its enterprise value ("EV").

(Enterprise value is the total stakeholder value, including market cap and net debt.)

The company's Uniform ROA has been around 35% or more for the past five years. The market thinks that number will fade to just 32% by 2026. Take a look...

Investors are already pessimistic about Activision Blizzard. Any good news could send shares higher. And it's sitting on a mountain of cash, which should provide a floor on valuations... even if the Microsoft deal falls through.

Centene and Activision Blizzard are only two examples...

Centene and Activision Blizzard are only two examples...

Other companies like managed-care business Molina Healthcare (MOH), mass-media giant Fox (FOXA), and homebuilder Lennar (LEN) also made our list.

Investors have a lot of preconceived notions about high interest rates. They think only banks and traditional insurers can benefit from this environment.

But if you look beyond the surface-level data, there are plenty of companies that can do well when interest rates are high. All it takes to find them is some out-of-the-box thinking.

Regards,

Rob Spivey

March 2, 2023

When interest rates are rising, most companies perform worse...

When interest rates are rising, most companies perform worse...