As earnings season approaches, let's step back and look at the market as a whole...

As earnings season approaches, let's step back and look at the market as a whole...

Earnings season starts next week. It kicks off with banks and other early reporting companies, so now is a good time to wonder how the season will look.

Zacks published an interesting overview as part of its earnings trends report series.

It shows that while the earnings picture remains strong, growth is forecasted to decelerate. It also shows that estimates for the third quarter have not been raised throughout the quarter.

Stocks often pop upwards when companies surpass analyst estimates. It is one of the most exciting ideas behind investing. It is why we give so much credence to our Embedded Expectations Analysis that quantifies the exact degree to which growth is already priced.

With earnings expected to rise about 26% from the prior year, accompanied by 14% revenue growth, it seems that analysts are already pricing in a healthy recovery from the pandemic-pressured third quarter of 2020.

But will companies be able to meet these expectations, let alone exceed them, as 86% of companies did in the second quarter of 2021?

That marked the best ratio of companies that beat earnings estimates in the past eight years. The market is coming off a hot streak, and many are concerned it can't heat up much more.

This quarter has brought numerous pandemic headwinds, which have been glossed over in prior quarters. Over the past several months, the built-up gunk in the global supply chain has been particularly top of mind for consumers, investors, and governments.

Similarly, new concerns about the prevalence of the delta variant of the coronavirus have put greater-than-anticipated pressure on several industries, such as automotive manufacturing, hospitality, and travel.

It is, therefore, no surprise that many investors and pundits think this coming earnings season will disappoint.

This powerful indicator is flashing red...

This powerful indicator is flashing red...

Just as we can quantify the degree to which growth is already priced into companies' valuations, we can also quantify aggregate management confidence levels.

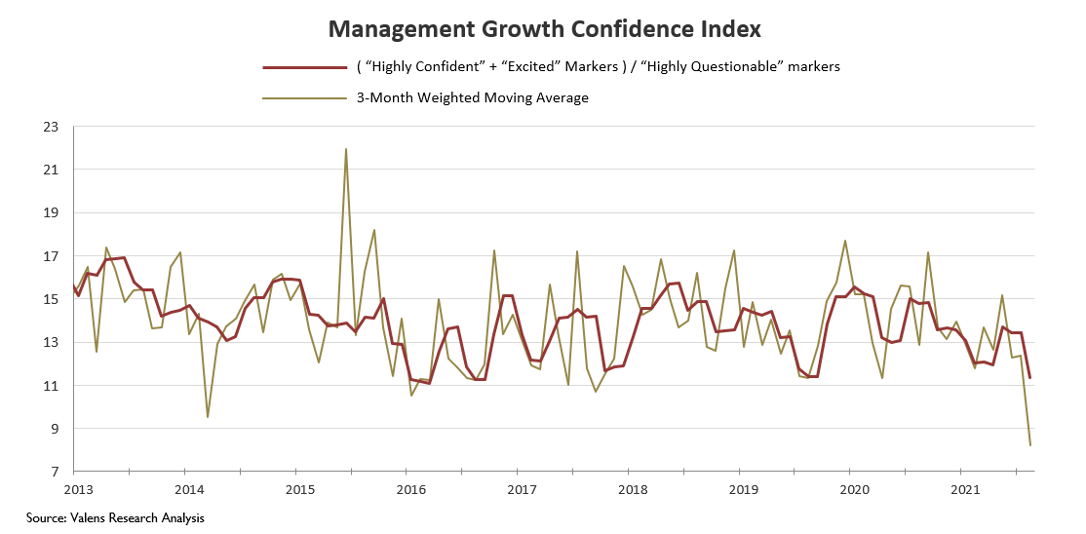

Our Management Growth Confidence Index is based on our Earning Call Forensics ("ECF") work. ECF is our proprietary auditory analysis tool that uses changes of cadence, pitch, and other vocal qualities during earnings calls to identify when management is excited, highly confident, or highly questionable about a topic.

We can sense management teams' confidence levels by looking at the ratio of excitement and confidence markers to questionable markers.

While we typically use this as an additional signal in our stock picking process, we can also use it as a macro signal by aggregating recent calls across the entire market.

When the Management Growth Confidence Index is high, it generally means that management teams are more bullish on their short- and medium-term outlooks, as they were in late 2020. Leadership teams saw many opportunities to invest as society emerged from the pandemic. Unsurprisingly, the market proceeded to do very well.

But this time, it doesn't paint a particularly rosy picture.

In August, the index fell to some of the lowest levels we've seen. Even the three-month average dropped to the low end of the historical range.

Remember, investors should never take a single indicator as gospel.

Other indicators, chiefly those on the credit side, still point bullish. But investors should pay attention when management teams display overall concern over short-term headwinds and risks, especially when headed into earnings season.

The data point to a possible slowdown in growth and rise in near-term fear, so investors should brace themselves for continued market choppiness...

The data point to a possible slowdown in growth and rise in near-term fear, so investors should brace themselves for continued market choppiness...

It does not mean we are headed into a bear market. Instead, this is a trend to monitor, as we have been since we highlighted it two weeks ago to our Timetable Investor readers in The Altimeter Weekly.

Timetable Investor readers get first access to our macro thoughts, insights, and data, along with other market ideas you won't hear anywhere else.

You can get access to it by subscribing to our Altimetry's Hidden Alpha newsletter. Each month you'll receive a monthly large-cap stock pick that is the culmination of our proven research process alongside The Timetable Investor.

To learn more about Hidden Alpha – and how to save 75% off the first year of a subscription – click here.

Regards,

Joel Litman

October 4, 2021