While some industries remain untouched by AI, others are knee-deep in disruption...

While some industries remain untouched by AI, others are knee-deep in disruption...

It's no secret that AI is transforming the economy. But it's not doing so evenly. A report from the Brookings Institution highlights just how unbalanced the rollout really is...

Sectors like engineering, information technology ("IT"), and finance are at the top of the list. According to Brookings, they face some of the highest exposure to generative AI, thanks to the repetitive and technical nature of their workflows.

That makes them prime candidates for automation – but also ripe for reinvention.

And that's where the divergence begins. Some companies in these industries are leaning into the shift... while others are trying to wait it out.

Brookings says jobs that include engineering, coding, and writing are among the most likely to be impacted by generative AI...

Brookings says jobs that include engineering, coding, and writing are among the most likely to be impacted by generative AI...

These roles often rely on rule-based systems, digital tools, and large data sets. Those are the perfect ingredients for automation.

In theory, these industries should be early beneficiaries. But it only works if companies act quickly.

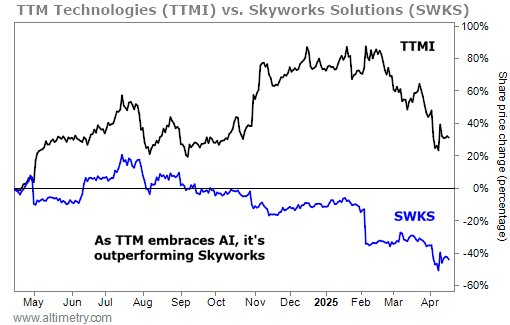

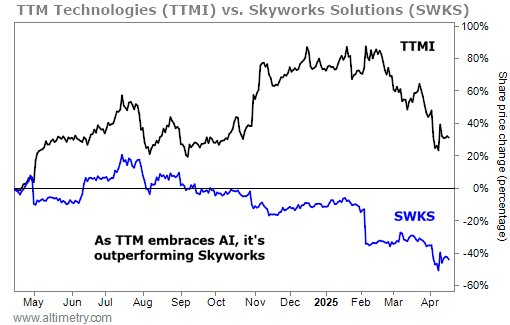

We can see the difference by looking at two IT-related companies... TTM Technologies (TTMI) and Skyworks Solutions (SWKS).

TTM Technologies makes advanced printed circuit boards for sectors like aerospace and defense (A&D) and automotive. Management has been vocal about leveraging AI to improve its design processes and production efficiency on recent earnings calls.

Investors have taken notice. Shares are up more than 30% over the past year.

Skyworks represents the other side of that coin. As a major player in radio frequency chips and wireless communication, it's operating in the hardware part of the IT industry.

But despite opportunities to integrate AI in areas like signal optimization and smart connectivity, its public commentary has been relatively quiet.

Recent filings and earnings calls haven't emphasized AI as a strategic focus. The latest company presentation only referenced AI once.

Investors are left wondering whether Skyworks is moving fast enough to seize this trend. No wonder shares are down almost 45% in the past 12 months.

Take a look...

Both businesses are exposed to the same forces. But one is moving to adopt AI fast – and being rewarded for it. The other is lagging.

That pattern is repeating across industries with high automation exposure. The biggest winners won't necessarily be AI creators. They'll be the companies that adopt early and execute fast.

The winners are using AI to enhance productivity – not just cut costs...

The winners are using AI to enhance productivity – not just cut costs...

Brookings pointed out that early adoption of generative AI doesn't just lead to cost savings. It can also accelerate product cycles, reduce design errors, and free up teams to tackle more complex work.

In fields like IT, competition is often won on speed and precision. So those benefits matter... a lot.

Companies like TTM are leaning into that opportunity. They're using AI not to replace workers, but to extend what those workers can do.

That's a crucial distinction. And it's one investors should watch for.

Not every business will be disrupted by AI at the same time. But the transformation is well underway in high-risk sectors. And silence is a major red flag.

Make sure you know where your investments stand on AI. It could mean the difference between double-digit gains and double-digit losses from here on out.

Regards,

Joel Litman

April 21, 2025

Editor's note: The AI revolution isn't limited to individual companies or sectors. The entire U.S. government is diving headfirst into this new tech...

And it's about to have serious consequences for the stock market.

In short, a crucial government deadline is fast approaching. And the fallout will create plenty of winners and losers.

Joel says if you aren't ready by May 1, you could be playing catch-up for the rest of the year. He'll reveal everything in an urgent briefing on Thursday, April 24 at 8 p.m. Eastern time.

You don't want to miss this... Save your spot for free right here.

While some industries remain untouched by AI, others are knee-deep in disruption...

While some industries remain untouched by AI, others are knee-deep in disruption...