Banks are at their limit...

Banks are at their limit...

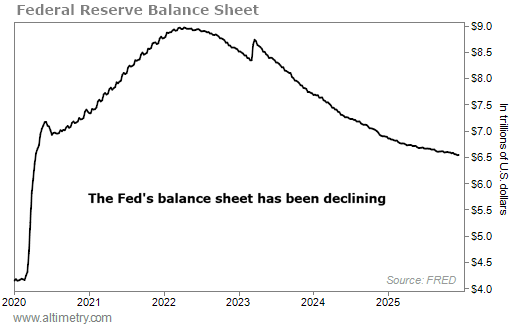

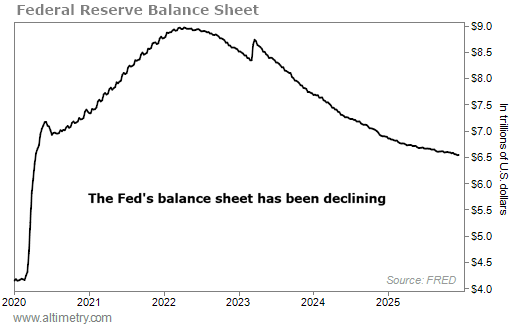

For most of the past two years, the Federal Reserve has been quietly draining liquidity from the financial system.

Interest-rate hikes grabbed most of the headlines. But the central bank was also applying a more subtle force... through quantitative tightening ("QT").

QT is a way for the Fed to influence the money supply. It can cool down the economy by selling investments like U.S. Treasurys or mortgage-backed securities.

Or it can choose not to reinvest the proceeds from maturing Treasurys... essentially sitting on cash instead of injecting it back into the economy.

When the Fed is growing its balance sheet, we call that quantitative easing ("QE") – the opposite of QT. QE means the Fed is buying assets, usually from banks.

QT has been the name of the game for some time now. But as we'll show, recent Fed moves signal the central bank is moving back toward QE... whether it wants to admit it or not.

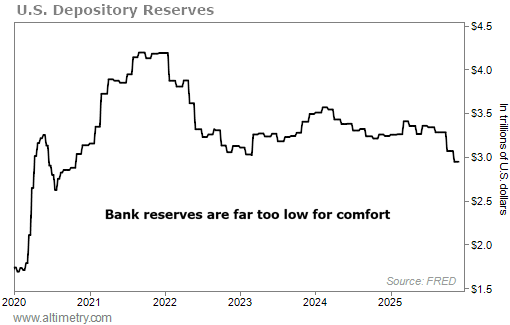

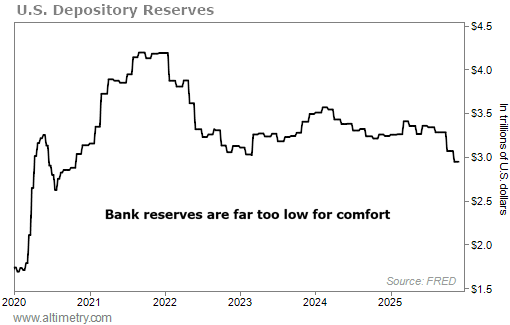

Because of the dynamic between liquidity, assets, and banks, the Fed's balance sheet is a good proxy for bank reserves...

Because of the dynamic between liquidity, assets, and banks, the Fed's balance sheet is a good proxy for bank reserves...

By reserves, we mean the cash banks have parked with the Fed. And as you can see, that balance sheet has been sliding for years...

The Fed has been buying from banks less and less. It effectively refused to let banks lend to it.

And that brings us to a problem. If QT goes on for too long... banks run out of places to lend their money.

Bank reserves have fallen off a cliff in recent months. They're now below $3 trillion for the first time since late 2020.

Check it out...

This represents the lower bounds of what banks consider comfortable for day‑to‑day operations. Reserves give them liquidity in an emergency. So the lower that buffer is, the more careful they have to be with lending.

Put simply, when reserves dip too far, banks will pull back from lending.

The Fed seems to realize what's going on...

The Fed seems to realize what's going on...

It announced in late October that it would end QT as of December 1.

Officially, the move was described as a "technical adjustment." In reality, it's a clear sign...

The Fed wants to stimulate the economy.

The central bank spent last month reinvesting its maturing investments and buying $40 billion in short‑term Treasurys. Officials have been careful to avoid calling it QE. But the effect is the same.

Liquidity is easing. The Fed's balance sheet is no longer shrinking. Soon enough, banks will be more comfortable lending again.

These changes won't happen overnight. We'll need to be patient. But it's another positive sign for credit. We might even see bank lending standards loosen up within the first two quarters of 2026.

The broader backdrop remains supportive. Earnings growth is solid. Valuations are reasonable. Investor sentiment has cooled from earlier extremes.

And now, liquidity is no longer shrinking beneath the surface. This is just what the economy needs to keep powering forward.

The Fed isn't ready to start throwing around the term "QE." But its actions speak clearly. There's a floor under liquidity... and we've reached it. The system has to stop tightening.

We can't guarantee smooth sailing ahead. But things look a lot better as we move into the next phase of the economic cycle.

Regards,

Rob Spivey

January 5, 2026

Banks are at their limit...

Banks are at their limit...