President Donald Trump has two goals leading up to the midterm elections...

President Donald Trump has two goals leading up to the midterm elections...

He wants Republicans to retain control of Congress... and lower credit-card interest rates.

Trump touted his strategy during a recent trip to Michigan – a strong political bellwether. And simply put, voter frustration is building...

According to a Detroit News survey, nearly two-thirds of potential Michigan voters said their household costs rose over the past year. More than 80% of them pointed to groceries as the leading cause.

To cover these costs, many are turning to credit cards. And now, Trump wants to cap those interest rates at 10% – well below the national average of about 20%.

So far, none of the major credit-card companies have followed through.

And they ultimately might refuse to cap interest rates. But, as we'll explain, they can certainly afford to lower them... up to a certain point.

One industry bigwig thinks interest-rate caps could be disastrous...

One industry bigwig thinks interest-rate caps could be disastrous...

According to JPMorgan Chase (JPM) CEO Jamie Dimon, these limits would force one of two outcomes...

Companies would stop offering credit cards to high-risk borrowers. Or they'd lose money to people who can't settle their debts.

Card issuers would also lower credit limits and reduce their rewards. (Cardholders often redeem those rewards to pay off credit-card balances.)

With a 10% cap, companies would close up to 85% of credit-card accounts or drastically cut their credit lines. Up to 159 million people wouldn't be able to use their cards anymore.

The question is: How much cushion do these companies have before they bleed profits? We can look to Capital One Financial (COF) and American Express (AXP) for some answers...

They're two of the largest, and most profitable, credit-card issuers...

They're two of the largest, and most profitable, credit-card issuers...

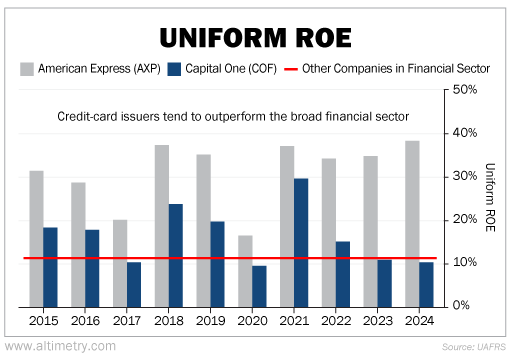

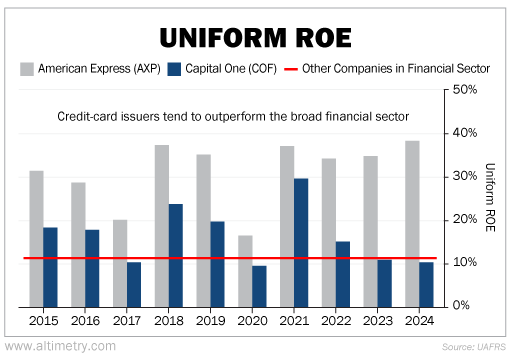

Over the past decade, Capital One and American Express have averaged 17% and more than 30% in Uniform return on equity ("ROE"), respectively.

Other companies in the financial sector typically generate a Uniform ROE of just about 11%.

Take a look...

Capital One's ROE was even higher (closer to 20%) before it acquired Discover Financial Services in May 2025.

The bottom line is, the largest credit-card issuers are far more profitable than the average financial company.

That means they have "wiggle room." These companies can charge consumers less interest and still churn out plenty of cash.

Yet their stocks could still take a beating...

Yet their stocks could still take a beating...

Sky-high interest rates virtually guarantee big profits for credit-card companies... and big returns for investors. They won't be happy if those gains tumble.

Yet that's exactly what could happen if Trump implements a 10% cap.

Companies like American Express and Capital One would still be profitable. But a lower interest-rate cap would chip away at future earnings. And Mr. Market wouldn't be happy.

So they have every reason to put up a fight.

For now, we're being cautious with major credit-card companies. They have a lot to lose from Trump's latest agenda... and very little to gain.

Regards,

Joel Litman

January 23, 2026

President Donald Trump has two goals leading up to the midterm elections...

President Donald Trump has two goals leading up to the midterm elections...