'Zombies' are taking over... but you might not even realize it.

'Zombies' are taking over... but you might not even realize it.

The $12 trillion private-equity ("PE") industry is full of dead money. These zombie PE firms can't afford the interest on their debt... making them the "walking dead" of the investment world.

Zombies had been popping up in PE long before interest rates started rising. Take Fenway Partners, for instance. The firm hasn't raised money since 2006. And its portfolio still looks the same as it did all those years ago.

In short, not every PE firm can be a giant like Blackstone or Carlyle. Ten of the biggest pension funds have nearly $7 billion stuck in firms that are at least 15 years old. They're tired of waiting around for a payout.

Many of these funds will have to cut their losses and pull their investments out. Even if they decide to wait a little longer, they'll likely think twice before putting even more money to work in PE.

And if you think this problem will be contained to the private market... think again.

Today, we'll explain why these zombies might not be around for much longer – and what it could mean for your stock investments.

PE firms can't keep feasting on cheap debt...

PE firms can't keep feasting on cheap debt...

If they want to stay afloat, they'll need to turn to fundraising. As we mentioned, there are tons of zombies that haven't raised money in 15-plus years.

Even worse, just as they want to raise money... nobody wants to invest. PE investments rely on debt to be profitable. And the more expensive that debt is, the harder it is to get the high returns people expect.

With today's high interest rates, it's a bad time to be a PE zombie looking for cash.

Management-consulting firm Bain & Company expects a 28% decline in industrywide fundraising this year. Said another way, investors are funneling nearly a third less money into PE than they did in 2022.

And that's leading to the worst-case scenario... bankruptcy.

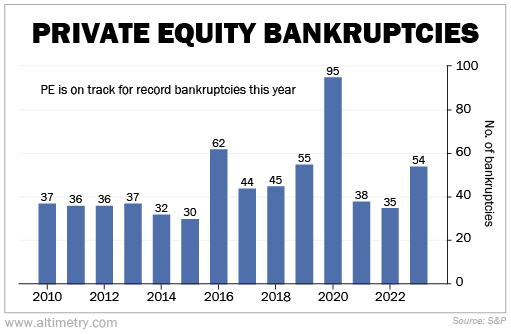

Through the first half of the year, the PE market reported 54 bankruptcies. That's more in six months than we'd see in most full years.

Take a look...

If this rate keeps up for the rest of the year, we'll see upwards of 108 bankruptcies. That's at least a 13-year record... even higher than at the height of the pandemic.

But while these bankruptcies are happening in private equity, it doesn't mean the public market is safe...

But while these bankruptcies are happening in private equity, it doesn't mean the public market is safe...

PE firms are customers and suppliers of publicly traded companies. These bankruptcies can't be neatly contained.

Plus, PE zombies might need to liquidate other assets to cover their losses...

Keep in mind that these private firms don't need to report losses unless they sell an asset. So when they're forced to sell, the sudden drop is jarring. It can look like asset prices are falling faster than they actually are. That can spook investors into selling stocks, too.

And it's yet another reason banks might keep tightening their lending standards.

At the end of the day, PE-backed companies are still a part of the same economic web as the rest of the economy. So even though bankruptcies are happening in private equity today, the trend is going to keep spreading.

We're already headed into a recession. The concerning PE landscape makes it even more clear that equity markets – both private and public – aren't the place to put all your money right now.

Regards,

Rob Spivey

October 4, 2023

P.S. Private equity is crumbling... and it's only a matter of time before the bleeding spreads to publicly traded stocks. If all your money is in equities today, your portfolio could be at serious risk.

That's why my team and I recently launched a brand-new research service – entirely focused on opportunities outside of the stock market.

This strategy offers the potential for double-digit income and triple-digit capital gains. And the best part? Our returns are legally promised in a binding contract... no matter what the stock market does from here.

For a short time, we're offering a special deal for 50% off a full year of this research. Plus, you'll receive $8,500 in free research and bonuses just for signing up. Get the details here.

'Zombies' are taking over... but you might not even realize it.

'Zombies' are taking over... but you might not even realize it.