People like to pay for an experience...

People like to pay for an experience...

Even as prices soar to record highs, many experts say the industry is "doomed."

While office spaces in large metropolitan centers remain empty due to employee and employer reservations, many people who fled cities early during the pandemic are rethinking their decision.

Although the question remains whether office life will ever return to what it once was, there's another side of city life that is burgeoning with activity.

In-person activities left for dead early in the pandemic have made a startling recovery.

And now, many former city dwellers who thought they would make a home in a warmer climate or the suburbs are starting to trickle back to cities, as they realize they miss the city life and the experiences it offers.

According to the New York Times' article, "In 2021, New York's Housing Market Made a Stunning Comeback," the Big Apple's apartment and home sales began to rebound in the second half of last year...

New York's sudden turnaround was spurred by the same group that left the city at the start of the pandemic: affluent renters and buyers with the means to move.

From March 2020 to June 2021, 254,500 households left the city, a 106% increase from the pre-pandemic baseline. But since July, encouraged by the city's gradual reopening, net migration has begun to improve in many of the wealthy neighborhoods that led the departures, according to a November Comptroller report.

The data shows that people are ending their suburban sabbaticals, as the fourth quarter of 2021 saw the all-time highest volume of closed sales for New York City apartments.

To top it off, inventory of apartments on the market fell dramatically from highs not seen since the fourth quarter of 2008 during the height of the Great Recession to average levels seen during a tight market...

It isn't just social lives poised to thrive...

It isn't just social lives poised to thrive...

While this influx of people back to cities is great for the cities themselves, it's also good news for one occupation.

Real estate agents are well-positioned for some good years ahead on the renewed transactions.

As folks come back to cities, they are looking for a real estate agent that can find them the space and amenities needed to work in a hybrid or fully remote environment.

These broker-client relationships have become more important than ever.

This benefits the large players like ReMax (RMAX), with its brokers spread around the country, including in major cities where it's seeing outsized boomerangs in demand.

Are investors missing a chance to purchase at foreclosure prices?

Are investors missing a chance to purchase at foreclosure prices?

Many might think of ReMax and other brokers as low-return businesses.

They assume the broker pockets most of the big checks, and real estate has become a highly competitive field, forcing down commissions.

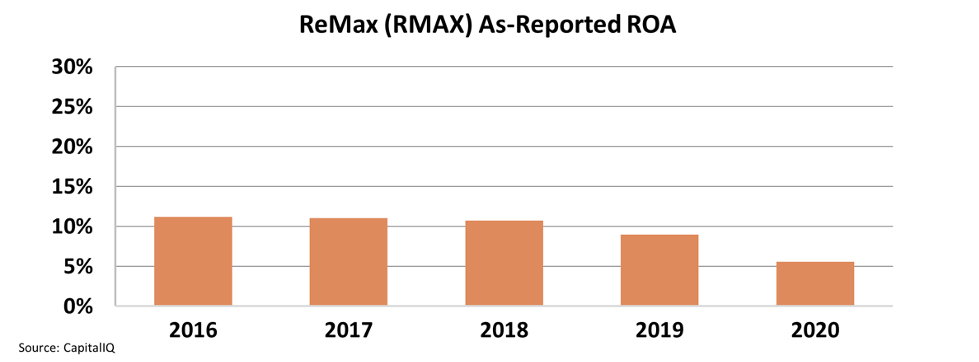

As-reported metrics appear to reflect this, with as-reported return on assets ("ROA") of 5% to 10% over the past five years, which had been fading even before the pandemic.

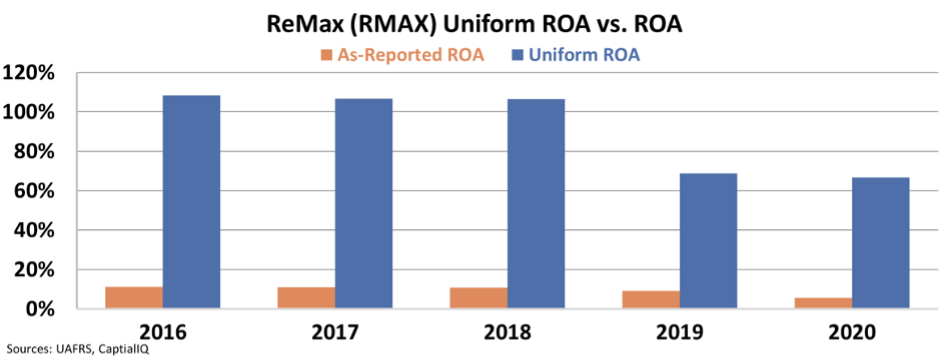

Here at Altimetry, however, we use our Uniform Accounting framework to account for GAAP-based distortions in financials.

The Uniform Accounting data shows a company that's successfully selling homes at a high level of efficiency. In fact, Uniform ROA reached more than 105% from 2016 to 2018 and was still above 60% in 2020 during the height of the pandemic.

When we look at the Uniform numbers, the story makes more sense.

As ReMax aims to be the go-to real estate broker during this influx of city demand, the company is well-poised to unlock real value for buyers with a strong network of brokers.

But it looks like the as-reported metrics are blinding the market. In fact, the market is pricing in ReMax to see returns fall to just 10% over the next five years. If ReMax outperforms this meager expectation, the stock could surprise investors on the upswing.

Thanks to Altimetry's Uniform Accounting, we can see the value unlocked in the move back to cities this year.

So, what will be the most profitable business in 2022?

So, what will be the most profitable business in 2022?

To start, let's take a step back and look at some of the most profitable business strategies that I've ever come across. Businesses like Amazon (AMZN), Alphabet (GOOGL), and Microsoft (MSFT) all use a "hack" to rake in billions of dollars in under-the-radar revenue.

And here at Altimetry, we've identified a new group of small companies tapping into a similar "hack." If history repeats itself, these stocks are poised to take off.

I demonstrate the success of this business strategy in my recent presentation and cover why I think this group of stocks could see triple-digit gains.

Click here to view my presentation.

Regards,

Joel Litman

February 2, 2022

People like to pay for an experience...

People like to pay for an experience...