No matter where I (Joel) go, everyone is talking about one thing...

No matter where I (Joel) go, everyone is talking about one thing...

Inflation.

I've been on the move a lot recently. At one point, I visited five different cities on three different continents in six days.

And I can't help but notice that inflation is on everyone's minds. Everyone, everywhere.

The global media can't help but talk about rising prices – how they'll destroy the economy, and unemployment will run rampant.

That may actually be true in many emerging markets, where the cost of food and power takes up almost all of a person's wages.

However, I believe the idea that the U.S. is headed for a repeat of 1970s-era "stagflation" is just ridiculous. True, inflation was an accelerant of the economic crisis back then. But it wasn't the main cause.

Inflation alone doesn't cause bear markets...

Inflation alone doesn't cause bear markets...

In the 1970s, the U.S. market went through a period called the "lost decade." Inflation was notching above 10%. It coincided with terrible stagflation – a period of huge unemployment and flat (if not negative) economic growth.

During that time, the U.S went from making up 40% of the world's economy to making up just 28%. It was one of the worst bear markets in U.S. history.

But inflation wasn't at the heart of the lost decade. Corporate credit was. While interest rates soared, lenders stopped lending because they feared mass defaults. The same pattern played out during the Great Depression... the Great Recession... and all over the world for the past 150-plus years.

Corporate credit fell apart. Bankruptcies ran rampant.

The point is, inflation alone doesn't drive horrible economies and equity bear markets... regardless of what the mainstream media tells you.

Without these other factors, markets may be volatile. But economies and valuations can still prevail.

Not only that, but in the 1970s, tax rates were skyrocketing...

Not only that, but in the 1970s, tax rates were skyrocketing...

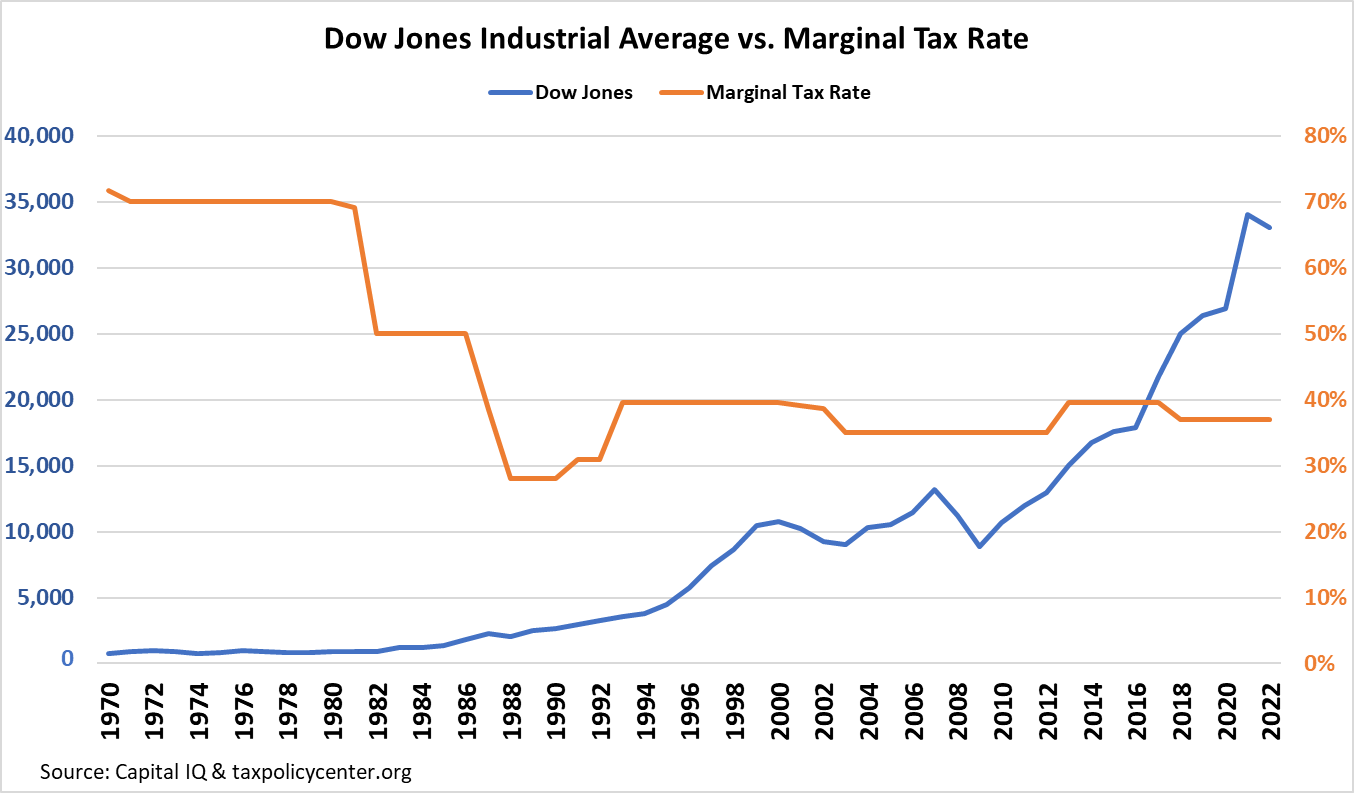

Marginal tax rates (the highest real tax bracket for earners) were well above 70%. However, high inflation made that number even higher – it soared above 85%. That created the perfect storm for the lost decade.

If you look at tax rates around the world, you'll notice a trend. Higher inflation in low-tax environments can still lead to good economies. But high tax rates in lower-inflation environments often result in stagnant economies.

This is what we're seeing in China today. The country's economic slowdown, which began long before the pandemic, is only now being reported.

The key ingredient is an effective marginal tax rate above 85%. That kicks in at a salary of $140,000. Said another way, if a company in China wants to pay an employee an additional $10,000 ($150,000 total), the company will spend about $140,000 to do it. Yes, tax rates in China are that high.

When people are taxed at almost all of their incremental salary, they just stop working.

The same thing happened in the U.S. in the 1930s and the 1970s. Former President Ronald Reagan recognized this phenomenon when he was still an actor. He said once people reached their marginal tax level, they'd just go to the country, so to speak, until January 1 – when it made sense to begin working again at that lower tax rate.

This is what the mainstream media can't seem to grasp. In a normal inflationary environment, low tax rates remain low. But in higher-inflation environments, high taxes hit the taxpayer even harder... because taxes are based on nominal (face value) gains, not "real" ones.

If you buy a stock for $100 and sell at the end of the year for $120, you have a gain of $20. At a tax rate of 50%, you'd be forced to pay $10 in taxes. That's bad enough without adding inflation into the mix.

However, with 10% inflation, your "real" gain is going to be even smaller. That $120 stock is now worth only $110 in today's money... So your $20 profit is now a $10 profit. That means your tax of $10 reflects 100% of your gain.

It's important to understand that when you're investing during an inflationary period, you pay taxes on gains you essentially never made.

(If you want to hear more about this concept, be sure to check out my recent interview with our corporate affiliate Stansberry Research. You can listen to the full discussion right here.)

At that effective tax rate, you might as well not have bought the stock at all. That's exactly what led to the lost decade in the 1970s. People realized that if the government takes all of their gains, there's no point in investing.

That realization is why Reagan sought to lower tax rates during his presidency. Had it not been for those tax cuts, it's possible the U.S. wouldn't have recovered in the 1980s and 1990s and retained its economic dominance.

Take a look at the following chart. It compares the Dow Jones Industrial Average at different marginal tax rates. You can see that lowering taxes kick-started a huge boom for U.S. stocks...

As I already explained, this phenomenon occurs all around the world.

You may recall a massive improvement in the Japanese economy and stock market just as the U.S. was engulfed in 1970s stagflation.

Part of Japan's strategy for improving production and encouraging people to work more was – you guessed it – lowering taxes. The country reduced individual taxes, which had been as high as 85% pretty much every year from the 1950s to the 1970s. The Japanese economy boomed, becoming the second-largest in the world.

Here in the U.S., taxes are relatively low (for now, at least). So we're unlikely to experience a period of 1970s-style stagflation anytime soon. Stagflation requires super high tax rates that we simply don't have.

This is why in the end, the U.S. will come out on top of today's tough economic environment...

This is why in the end, the U.S. will come out on top of today's tough economic environment...

Yes, we're in a time of relatively high inflation. But taxes aren't high. The economy will settle back down. It will just take a little time.

Countries like China, however, are in deep trouble. Its marginal tax rate is well over 85%. High inflation and high taxes will spell disaster for its economy. Not only will it tank the market, but it will stall productivity.

But here's the key thing to remember... Inflation alone isn't enough to derail the world's No. 1 economic machine.

So please remain calm about inflation. Ignore the mainstream media "noise." Today's economic situation is not the same as what happened in the 1970s... no matter what the headlines say.

Wishing you love, joy, and peace.

Joel

September 30, 2022

P.S. If you missed my "Financial Lifeline" event last week, there's still time to listen to my urgent warning. In short, I believe a massive shift in the coming weeks will trigger huge gains and losses by the end of the year... and the actions you take now could determine your wealth for the next decade. It has to do with a critical strategy that could help you profit no matter where stocks go next. For a limited time only, check out the free replay right here.

No matter where I (Joel) go, everyone is talking about one thing...

No matter where I (Joel) go, everyone is talking about one thing...