The WFH 'outside' revolution?

The WFH 'outside' revolution?

As the fall season finally settled in last week in Maine, a thought occurred to me as I was looking out the window of my home office.

I had a long call booked on my calendar, the sort that would require screen sharing and focused collaboration and thought... with the cool New England weather so beautiful, why don't I enjoy being outside?

So I happily moved my computer setup out to my deck overlooking the water, with the idea that the fresh air and pleasant view would get the creative juices flowing to brainstorm company ideas.

Surprisingly, this was the first time I had ever worked outside during the pandemic. Given how lovely it was, I'm quite disappointed that the idea didn't come to me sooner.

Notwithstanding my late arrival at the party, as the idea of working outdoors has begun to gain traction.

A New York Times Wirecutter blog post on "How to Move Your Home Office Outside" points out that as more and more people have adapted to working from home over the past year and a half, many have begun to think about new places around the home to work.

For many, as the fair fall weather still allows it, this has meant going outside. The reasoning is that a change in scenery can keep the mind fresh and boost productivity, contributing to a healthier work environment.

But as the Wirecutter post mentions, it's not always as easy as it seems to push the office outdoors.

Workers need to consider whether their Wi-Fi coverage will be sufficient – if they can find a spot without glare – and whether they have a comfortable place to sit that can foster productivity...

All of this means shopping for new outdoor furniture...

All of this means shopping for new outdoor furniture...

For the many people who've embraced the idea of enjoying the outdoors during work hours, investing in new outdoor furniture has been a must... if you can find any without a long wait time for delivery.

The disruptions facing the industry are common across the market. Surging demand means home furnishing retailers like Williams-Sonoma (WSM) have been riding this tailwind over the past year and a half. The company owns several retail brands, including Pottery Barn, West Elm, and Rejuvenation, to name a few.

Considering how folks are still moving or renovating through the At-Home Revolution, they continue to buy furniture for their homes. This means strong demand is unlikely to abate any time soon.

Williams-Sonoma's Uniform return on assets ("ROA") spiked to 16% in 2021 and is forecast to remain above historical averages over the next two years as the new orders keep rolling in.

Is Williams-Sonoma a good stock to buy?

Is Williams-Sonoma a good stock to buy?

A spike in earnings alone isn't reason enough to rush out and buy the stock.

What matters is what the market is pricing the company to do in the future. If it is already pricing in the strong furniture demand tailwinds, buying the stock at current prices is akin to putting your money into something with little if any upside.

Fortunately, by utilizing our Embedded Expectations Analysis framework, we can get a good sense of exactly what the market is anticipating for Williams-Sonoma over the next few years.

Stock valuations are typically determined using a discounted cash flow ("DCF") model, which makes assumptions about the future and produces the "intrinsic value" of the stock.

But here at Altimetry, we know models with garbage-in assumptions based on distorted GAAP metrics only come out as garbage. Therefore, with our Embedded Expectations Framework, we use the current stock price to determine what returns the market expects.

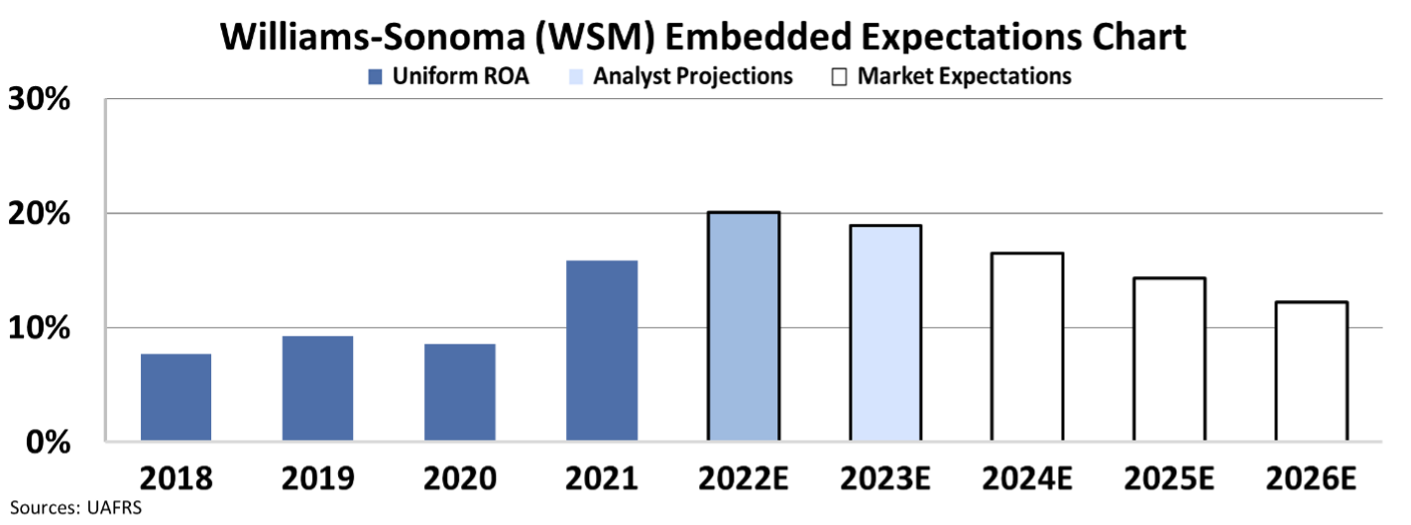

In the chart below, the dark blue bars represent William-Sonoma's historical corporate performance levels in terms of return on assets ("ROA"). The light blue bars are Wall Street analysts' expectations for the next two years. Finally, the white bars are the market's expectations for how the company's ROA will shift over the next five years.

The analysis highlights that the market isn't expecting ROA to stay this high forever, pricing in returns to fade to an average of 12% over the next five years. However, at these levels, the market is still pricing ROA to remain above 2010 to 2020 peaks of 11%, suggesting the boost from the pandemic will last indefinitely.

Whether or not the demand for home furniture and related accessories continues to surge, it may be hard to justify buying Williams-Sonoma at these levels.

Without the help of our Embedded Expectations Analysis, investors would have no context to see whether Williams-Sonoma is a screaming buy...

Without the help of our Embedded Expectations Analysis, investors would have no context to see whether Williams-Sonoma is a screaming buy...

We use this same process to find our best stock picks and understanding whether the names we identify are old news or overlooked.

Each month, in our Altimetry's Hidden Alpha service, we share our favorite large-cap stock pick that still has the opportunity for big gains.

In the most recent issue of Hidden Alpha, we analyzed several massive multibillion-dollar companies. Our recommendation this month is a large corporation pivoting for an enormous turnaround, and once it completes its pivot, the market is in for a huge surprise...

To learn more about this recommendation and gain instant access to Hidden Alpha and the full portfolio of open recommendations, click here.

Regards,

Rob Spivey

October 5, 2021

The WFH 'outside' revolution?

The WFH 'outside' revolution?