One unexpected partnership is taking shape in the U.S. government...

One unexpected partnership is taking shape in the U.S. government...

And it involves a massive IRS "hackathon."

Essentially, the Department of Government Efficiency ("DOGE") wants to build an AI-powered "bridge" that allows IRS software systems to talk to each other.

The ideal platform would optimize the review, analysis, and management of taxpayer data. Ultimately, this could revamp the agency's tax processes.

At the center of this project is DOGE's potential collaboration with Palantir Technologies (PLTR) – a proven leader in government AI solutions...

Palantir has already won high-profile contracts across defense, health care, and law enforcement. And it's ready to do more.

Today, we'll explore how the latest DOGE initiative could cement Palantir's status as the go-to provider for AI innovations in the public sector... and why investors should also keep an eye on other, "smaller" opportunities.

Palantir is the leading expert in AI-powered analytics...

Palantir is the leading expert in AI-powered analytics...

It uses this technology to consistently support high-stakes government projects... on everything from intelligence operations to medical research.

Last year, Palantir won a $480 million contract to improve battlefield intelligence for the U.S. Army. It also secured a $443 million deal with the Centers for Disease Control and Prevention to track outbreaks and public health trends.

This is an impressive track record. And it makes Palantir the ideal partner for big government jobs.

The planned IRS hackathon signals a pivotal moment in AI adoption within the public sector. A DOGE-Palantir partnership would surely expand the company's foothold into taxation – a sector ripe for modernization.

It could even spark broader government adoption, translating into more contracts for Palantir... as well as smaller industry players.

Investors are already well aware of Palantir's huge potential...

Investors are already well aware of Palantir's huge potential...

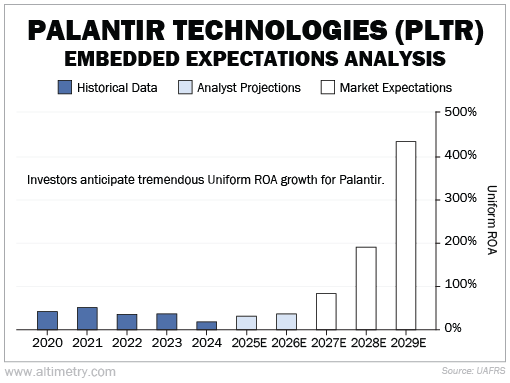

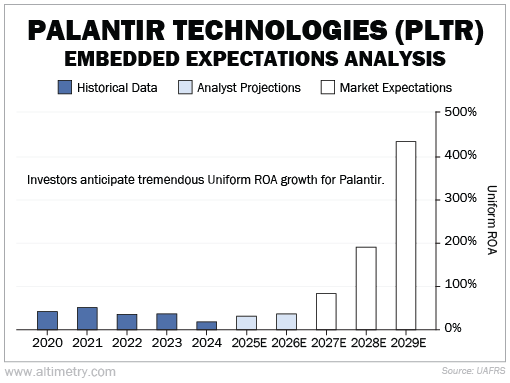

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from the company's future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

Since going public in 2020, Palantir's Uniform return on assets ("ROA") has ranged from 20% to 52%. And analysts are projecting similar profitability over the next two years.

However, investors are extremely bullish... They think Palantir's Uniform ROA will skyrocket to more than 430% by 2029. This would mark a 20-fold-plus increase in the next five years. Take a look...

The market already anticipates substantial growth for Palantir due to its government AI contracts. But investors see Palantir as the dominant player in this space.

Still, it's not the only company that can leverage AI across government agencies...

Still, it's not the only company that can leverage AI across government agencies...

The public sector is increasingly reliant on this technology. And it's creating ripple effects across the market... beyond Palantir.

That's pushing smaller firms – with niche AI expertise and scalable platforms – to the forefront.

Despite flying under the radar, they're critical to the AI ecosystem... They help larger organizations, like Palantir, deliver on ambitious government contracts.

But unlike Palantir, many of them have attractive valuations. This offers savvy investors a slew of untapped opportunities.

We cover some of these overlooked stocks in our latest report. One of our recommendations jumped almost 30% overnight last week.

And it's still trading far below our recommended buy-up-to price... for now. Investors are almost out of time to buy in before a critical May 1 deadline.

We're staring down a rare opportunity in the market right now. And those seeking the next AI leader would do well to cast a wide net.

Regards,

Joel Litman

April 30, 2025

One unexpected partnership is taking shape in the U.S. government...

One unexpected partnership is taking shape in the U.S. government...