The U.S. has long been home to the world's most powerful companies...

The U.S. has long been home to the world's most powerful companies...

By any metric – revenue, profitability, or return on assets ("ROA") – America leads the way.

So it's no surprise to us that the U.S. topped last year's Fortune Global 500 rankings... regaining the top spot with 139 firms on the list, compared with China's 128. The two have been battling it out for years.

It's not just that the U.S. has the most companies. Those companies are also the best on the list. U.S. firms consistently outperform their global peers...

A recent report from the Center for Strategic and International Studies, a bipartisan nonprofit policy research organization, highlighted that the average ROA for American companies is the highest in the world.

Switzerland, the next-closest contender, lags by about one percentage point.

And that dominance of U.S. corporations is creating an even bigger divide in the corporate world. The largest players are thriving and setting the pace. But the rest of the field is struggling to keep up...

The big players are pulling away...

The big players are pulling away...

The S&P 500, dominated by America's biggest corporations, has been on a remarkable run.

Because they're so big, S&P constituents can pour money into innovation, become more efficient operators, and dominate their industries in ways that smaller players can't match.

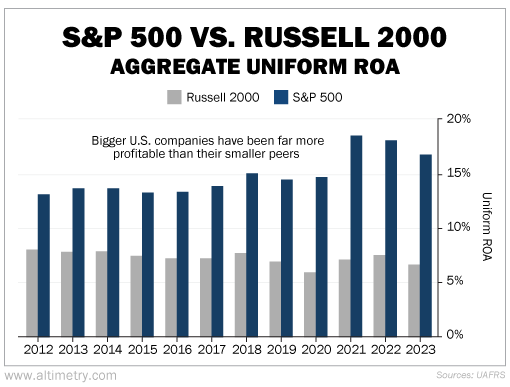

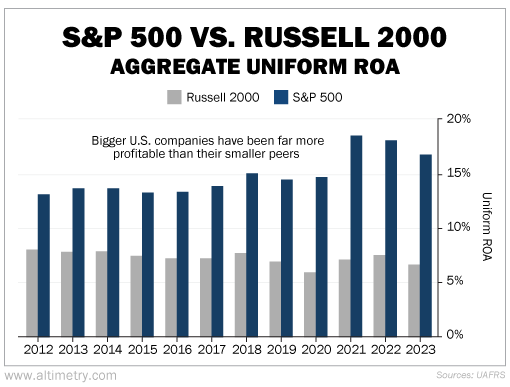

We can see this through the aggregate Uniform ROA of the S&P 500. Over the past two decades, profitability for S&P 500 companies improved from 12% – around the U.S. corporate average – to as high as 19% in 2021 and 17% in 2023.

It's a different story when we shift our focus to the Russell 2000... a benchmark for small- and mid-cap companies.

The Russell's constituents often don't have the same access to resources or the size to cut down on costs like their very biggest competitors. They're fighting an uphill battle to gain market share and improve profitability.

That's why the Russell 2000's aggregate Uniform ROA lags the S&P 500 by a wide margin. It peaked at 8% almost 20 years ago, in 2006. Since then, it has fallen to just 7%...

Not only are the biggest companies thriving... they're pulling further away from the rest of the market. It's hard for smaller businesses to compete. Many are struggling to stay afloat in today's environment.

That said, these smaller companies are not without potential. Some of them are positioned to break out and become leaders in their own right.

That's a big part of President-elect Donald Trump's plans for the future. He wants to help keep American companies competitive on the global stage through tariffs on Chinese goods that currently undercut American companies.

And for investors, it's an opportunity to buy into companies at the tipping point of significant growth.

As with so much of investing, the key is finding the right opportunities...

As with so much of investing, the key is finding the right opportunities...

Not every U.S. company will benefit evenly. Some compete with Chinese companies more than others... and have more to gain in the coming years.

Benefiting from this trend isn't as simple as investing in the Russell 2000. There are plenty of small companies on the verge of outsized gains. And there are plenty more that will continue to struggle.

If you want to learn more about the U.S.-China dynamic, we're hosting a brand-new Master Class series on January 22 and 23.

We'll uncover the truth behind GDP numbers... how to invest in the right indexes... and what Bruce Lee's martial arts approach can teach us about investing success.

(Yes, that Bruce Lee... His philosophy is more relevant to the markets than you might think.)

More than 700 Altimeter Pro subscribers tuned in during our last Master Class series... and we received some outstanding feedback. If you're already subscribed, you should have received your latest invitation on January 9.

For everyone else, if you're interested in signing up, click here to claim a special discounted rate.

We'd love for you to join us – and we're confident you'll find these lessons incredibly valuable.

Regardless, if you've never considered investing outside the S&P 500, now is a great time to do so. It may soon be time for smaller companies to really shine.

Regards,

Joel Litman

January 14, 2025

The U.S. has long been home to the world's most powerful companies...

The U.S. has long been home to the world's most powerful companies...