When John Moody created his eponymous credit-ratings agency in 1909, he had one major rule...

When John Moody created his eponymous credit-ratings agency in 1909, he had one major rule...

Moody's would never get paid by the entities it was rating.

For the first several decades of its existence, it upheld this principle. Then John Moody died in 1958. And a few years later, Moody's abandoned his mandate.

Since then, the agency and its peers have found themselves at the center of numerous financial disasters... all because they broke John Moody's most important rule.

Anyone who lived through the Great Recession likely remembers that lesson well. One of the biggest reasons for the calamity was that ratings agencies gave their stamp of approval to investments they didn't understand... or ones they knew were risky.

They were getting paid to do so, after all.

Now, it looks like they're at it again. A lot of public companies may be far riskier than you realize... especially in one particular corner of the market.

Credit-ratings agencies have incorrectly rated more than $100 billion in commercial real estate ('CRE') debt...

Credit-ratings agencies have incorrectly rated more than $100 billion in commercial real estate ('CRE') debt...

That's according to a recent article in the Financial Times.

For instance, 1407 Broadway in New York City is prime real estate... in theory. It's a few blocks south of Times Square. But the building is on the brink of foreclosure. Its owner hasn't made payments in a year.

And yet, ratings agency Fitch still rates $187 million in bonds tied to the building as "AA"... one step below the top tier.

Said another way, Fitch's rating suggests there's only a 0.5% chance of the owner defaulting on these bonds. We're not sure how that could be right for a property that's flirting with foreclosure.

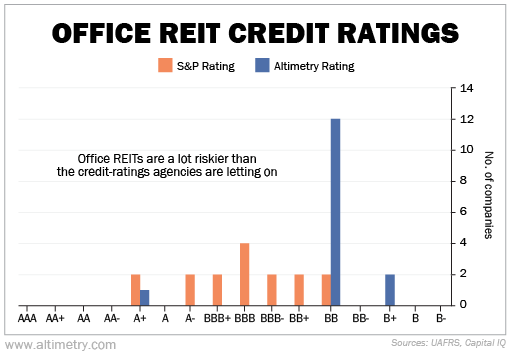

You can see how off-base these ratings agencies are by looking at public office real estate investment trusts ("REITs")...

There are 67 public office REITs with market caps above $10 million. Sixteen are rated by S&P. And only four have a high-yield credit rating ("BB+" or lower). The other 12 are supposedly investment grade.

But when we assessed these companies using our proprietary Altimetry Credit-Rating system... we found that only one of those 16 companies is investment grade.

Take a look...

The ratings agencies are being far too generous with these risky companies. That's jarring enough on its own. But the issues don't stop there...

If you expand this analysis to all 67 REITs, nothing changes. Only one deserves to be investment grade.

Credit-ratings agencies were supposed to function as unbiased judges of credit risk...

Credit-ratings agencies were supposed to function as unbiased judges of credit risk...

Now, they get paid by the very companies they rate.

In CRE, the rating involves assessing the properties backing the debt. Ratings agencies are supposed to consider factors like occupancy rates, rental income, and market conditions.

But they sure seem to be overlooking or underestimating risks. That could very well be due to pressure from clients... or simply a lack of thorough analysis.

This sort of mispricing tends to fly under the radar until we get a situation like 2008. Then it leads to severe – and sometimes, borderline catastrophic – consequences for the economy and investors.

We often say that credit is the lifeblood of the economy. It doesn't matter if you're investing in the bond market... or you're only interested in equities.

To understand what's going on in the markets, you have to understand credit.

But that doesn't mean you should rely solely on traditional credit ratings. The agencies are often slow to respond to what's actually happening... partly because those same companies pay the bills.

Listen to your gut. A property that's about to be foreclosed upon has no business being "investment grade." And remember that you are the best person to look out for your own financial interests.

Don't trust the ratings agencies just because they're supposed to be experts. You owe it to yourself to dig deeper.

Regards,

Rob Spivey

August 14, 2024

When John Moody created his eponymous credit-ratings agency in 1909, he had one major rule...

When John Moody created his eponymous credit-ratings agency in 1909, he had one major rule...