Attention to detail is important...

Attention to detail is important...

But so is seeing the big picture. This past week, my coaching comment to our global team was on the importance of understanding how smaller tasks fit into larger objectives.

This relates to the concept of "missing the forest for the trees"... which has been a common saying for centuries about someone who focuses too much on a simple detail, thereby missing the whole picture.

Attention to detail is vital in work and research, especially in the financial field. Too often though, we see how people miss the general purpose of a task or project by only caring about specific details. It's the equivalent of myopia, or nearsightedness.

So when assigning tasks, we ask our managers to always provide our teams with a big picture of the task to be done. One way of doing this is by explicitly stating the ultimate audience of a particular deliverable.

Providing this context helps our teams to understand the context of the content they create. That leads to many small changes that ultimately benefit our "audiences," whether they are institutional investors, families, or individuals.

Knowing the ultimate audience helps an employee to see the forest as well as the trees. It converts business near-sightedness into a view of the entirety of the research or project.

Managing the risk of employees missing the forest for the trees is different in a work-at-home environment...

Managing the risk of employees missing the forest for the trees is different in a work-at-home environment...

In particular, it's not always clear how to answer big-picture questions. Before the coronavirus pandemic, employees could easily walk into their boss' office and quickly ask for clarification.

It was easy to be aware of when supervisors were available when their offices were close by. However, the work-at-home environment isolates co-workers from each other... so employees don't always know when their colleagues are free.

E-mail, phone calls, and video calls are common ways to try and solve this problem. However, as the past six months have shown, co-workers end up worrying that phone calls are too invasive. You don't know if the person will pick up, or if you're interrupting them in the middle of a project (or another call). E-mail can be too formal if you only need to ask a simple question.

In many cases, employees might not want to bother co-workers or bosses... and so they choose to do nothing. This can hurt productivity and learning... and it can lead to project myopia – just doing what you think needs to be done as opposed to thinking about that bigger picture.

One way of creating more informal communication is using chat services such as Slack (WORK). This is a channel-based messaging platform, so it can have channels as large as the whole company and as small as specific teams. Additionally, any employee can send direct messages to any other co-worker. Slack also allows users to set a status so others know when their colleagues are busy or available.

Employees can easily communicate with any other user or team, thus making virtual work simpler for everyone.

Slack was founded in 2009, and just went public last year. As a young firm, it's still trying to become profitable... and it's facing competition from tech giants Microsoft (MSFT) and Alphabet (GOOGL). In particular, Microsoft is challenging Slack by pushing its Teams product and its easy integration across Microsoft Office products.

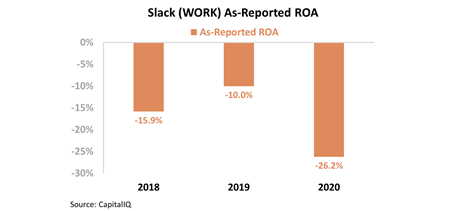

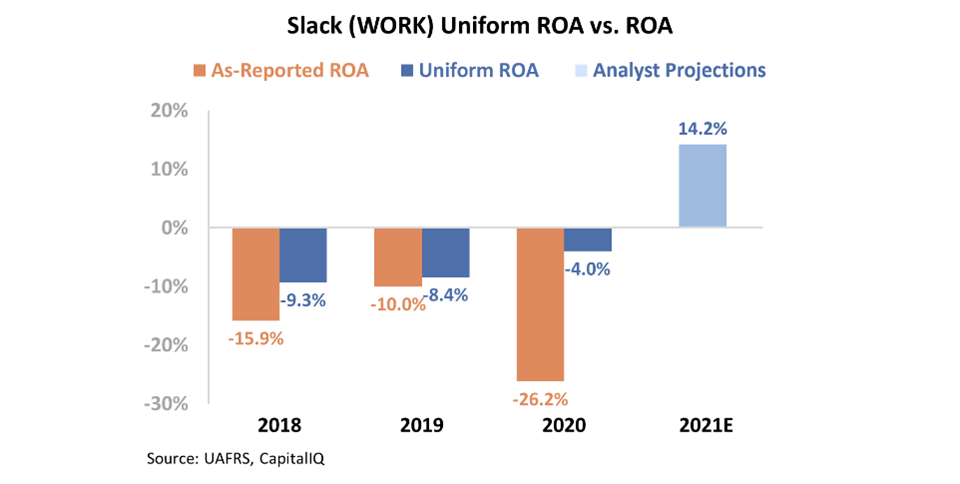

GAAP metrics appear to confirm Slack's profitability problem. The company's as-reported return on assets ("ROA") has been negative over the past three years and cratered to a low of negative 26% this year.

However, this isn't an accurate representation of Slack's ROA. Stock option expenses – among other distortions – are suppressing the firm's profitability metrics.

Uniform Accounting shows how necessary Slack's platform has become during the pandemic. Instead of falling, the company's Uniform ROA increased to negative 4% this year. While still negative, this is the highest ROA level for Slack in its history... and shows how close the company is to becoming profitable.

Negative returns are common for startups... Yet even as competition has increased in the space with Microsoft, Alphabet, and others, Slack's ROA for the next full fiscal year is forecasted to turn positive.

Based on the as-reported ROA trajectory, investors might think that Slack's returns would still be negative. However, Uniform Accounting shows this calendar year has been a positive one for the company. Slack's software is more vital than ever, and the company has been able to turn the increased demand into higher levels of profitability.

While the trees may be full of as-reported metrics, it's important to look at the forest and obtain the entire picture. For Slack, profitability isn't as negative as the market thinks.

Regards,

Joel Litman

November 6, 2020

P.S. What other company's products have you found yourself using more in the work-at-home world? Let us know in an e-mail to [email protected].

Attention to detail is important...

Attention to detail is important...