Dear reader,

Last night, I shared some of the most exciting news of my career...

By launching Altimetry – and our new Altimetry's High Alpha newsletter – my team and I are bringing institutional-level research to the consumer, without the institutional-level fog that makes the information impossible to digest.

With Uniform Accounting, we've been able to regularly identify names with 100%-plus upside, and we're seeing many stocks with the same distorted GAAP accounting setups that have yielded those types of returns in the past.

I spent last night taking my friend Porter Stansberry and Stansberry Research Managing Director Jared Kelly through the financial distortions that we've seen previously with companies like Facebook, Broadcom, Planet Fitness, and Regions Financial... all before their stocks rose 150%-plus.

And I even named one specific investment that is primed for a big move higher right now.

I also took them through just why GAAP accounting is so distorted...

One of the things I've spent most of my career focusing on is understanding GAAP accounting, to better understand where the distortions come from. Based on our conversation last night, I think even Porter and Jared were surprised and concerned about how problematic the as-reported accounting statements are.

Using my "Truth Detector" system, we looked at several real-life examples that reveal companies' true performances... showing the real potential for those businesses and their stocks.

I think Porter and Jared were as excited as I am by how putting Uniform Accounting in the hands of individuals will level the playing field with Wall Street.

If you couldn't join us, don't worry...

We've heard from several folks who weren't able to attend.

So for the next few days, you can still hear all the details for yourself...

You can even still get my favorite High Alpha recommendation right now, absolutely free...

And you can take advantage of an exciting discount I've decided to offer for early subscribers.

Get all the details – and watch the full replay – right here.

Is this the right time to be recommending a long portfolio?

Throughout the financial media and investing landscape, many people are afraid of a recession and slowing global growth. Even many of my institutional clients – from hedge-fund founders to folks at major mutual-fund complexes – are asking about the risks ahead.

One thing we focused on during last night's event was how a lot of those concerns are based on bad accounting data. And we all know that incorrect data lead to incorrect insights.

Once Uniform Accounting adjustments are applied to U.S. corporations, something interesting comes out. I covered it during last night's event, but I'll tell you here, because it's important for every investor to know...

Real corporate profitability and credit signals don't point towards the imminent risk of a market or economic collapse. Uniform Accounting points to quite the opposite.

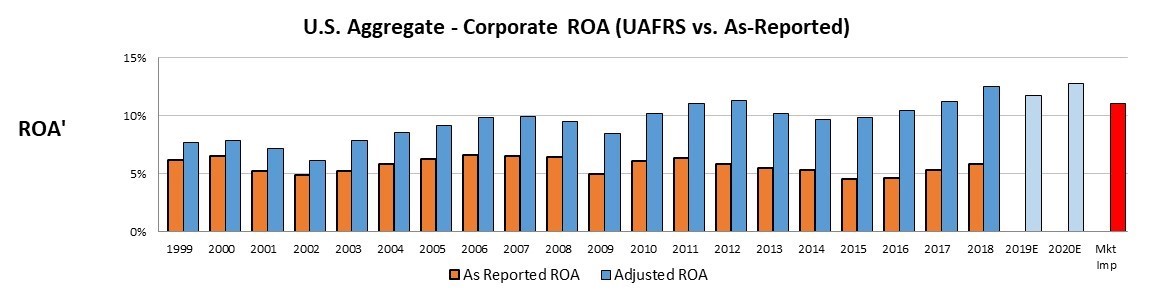

U.S. corporate profitability on a uniform basis is currently at all-time highs. And it's trending higher. Take a look at the chart below comparing the as-reported corporate return on assets ("ROA") versus the Uniform Accounting ROA...

On top of that, U.S. corporate price-to-earnings ("P/E") ratios are not at historically high levels right now... They're actually below levels we've seen over the past several years. Market expectations are not elevated... They are relatively neutral.

Also, the credit signals we see once we make Uniform Accounting adjustments are flashing an "all clear" sign today. U.S. corporations don't have any imminent debt maturity headwinds that could create the type of credit destruction that leads to a market collapse.

Giving a more accurate macro perspective is another thing we're going to be focusing on from time to time at Altimetry. Uniform Accounting doesn't just give us the ability to better identify real corporate profitability and upside – it also helps us better understand how we should be positioned in the market as a whole.

This is a market ripe for finding outperforming companies...

Based on the current market environment, stock pickers are going to do well.

While we're not anywhere near a market collapse, the next few months might be a sideways market.

There are specific companies that can break from that trend, and that's where we're focused. These are businesses that have a combination of company-specific or industry-specific tailwinds that can break away from the market, have intrinsic undervalued characteristics caused by distorted accounting, and are set up for the market to realize it.

And around the corner, as earnings growth picks up into 2020 and potentially beyond, Uniform Accounting will let us identify the type of companies that can grow better than the market realizes, and dodge the bad ones with fake earnings growth and false potential.

So again, if you haven't yet seen last night's presentation, you can still watch the full replay right here.

Regards,

Joel Litman

September 26, 2019