Very few products anticipate consumer needs before they exist...

Very few products anticipate consumer needs before they exist...

In the early 2000s, the mobile phone industry was dominated by the European telecom giant Nokia (NOK).

Nokia's market share was as high as 49% in 2007, selling a record 437 million handsets that year.

Its cellphones did everything you'd expect – they were durable, had long battery life, and you could make calls from anywhere.

The natural path was for cellphones to act like traditional phones but with more mobility, which consumers wanted.

But with the Internet and computers clearly on the rise, a few visionaries took the cellphone concept a step further.

BlackBerry (BB) was an early innovator in business-focused smartphones...

BlackBerry (BB) was an early innovator in business-focused smartphones...

BlackBerry phones had a full keyboard, making it easier to send text messages and e-mails, and extra security features, making it like a work computer, only smaller.

The late Steve Jobs, CEO of Apple (AAPL) from 1997 to 2011, saw what BlackBerry was doing as a first step toward the bigger trend of mobile computing... only BlackBerry's phones mostly utilized existing concepts and only appealed to a single niche of the market.

Coming off the success of the 2001 launch of the iPod, Jobs saw that a mobile phone could be so much more than a phone. Subsequently, following the success of this multipurpose mobile device, Apple began a two-year research and development (R&D) process before releasing its first iPhone in early 2007.

At the time, consumers were confused. It looked more like an iPod than a phone, didn't have a physical keypad, and had so many features bundled into one device that it felt overwhelming.

For the next three years, iPhones slowly gained market share while BlackBerry's phones started to decline as the best-selling phone.

As the Internet became universal, BlackBerry simply couldn't keep up with smartphone advances. Its small screen and clunky keyboard were OK for simple tasks like e-mailing, but the iPhone was designed for the future.

As-reported metrics miss this seismic market shift...

As-reported metrics miss this seismic market shift...

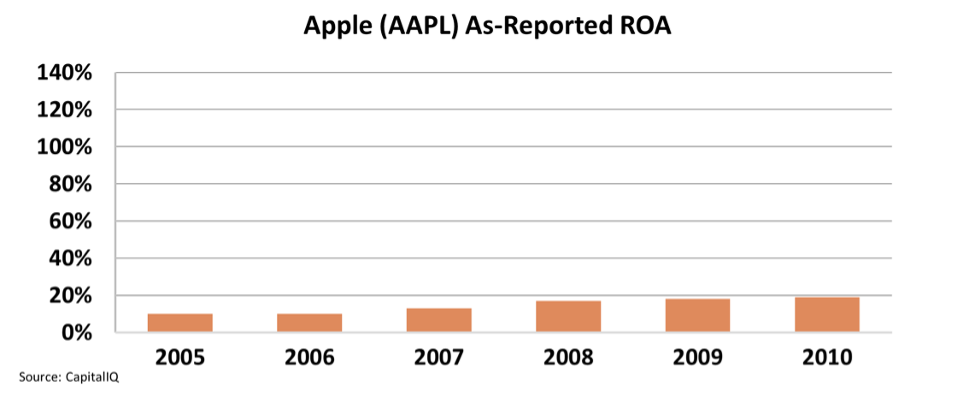

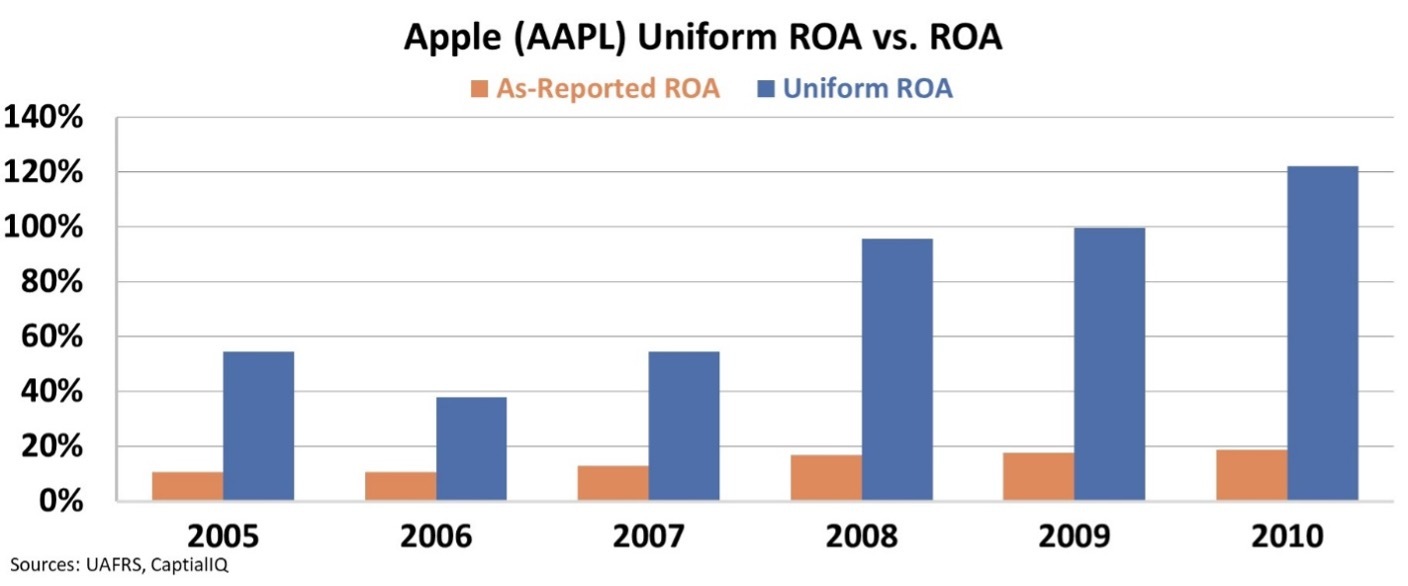

Between 2005 and 2010, Apple's as-reported return on assets ("ROA") barely moved.

ROA was around 10%, while the company invested heavily in R&D for the iPhone. Apple's ROA only marginally improved to 19% by 2010. For such an innovative, transformational product, it looked like a flop...

But when looking at the Uniform metrics, we can see how the iPhone became the dominant player just a few years later. Uniform ROA skyrocketed from robust 40% levels in 2006, well past 120% in 2010.

By predicting the future of mobile phones before it had arrived, Jobs put Apple in a position to ride the wave for years to come.

Last year, BlackBerry finally threw in the towel and stopped producing mobile handsets. Meanwhile, the iPhone continues to be a leading player. The App Store alone generated $61 billion in revenue for Apple, with mobile games and in-game transactions accounting for 59%, or $40 billion in revenue.

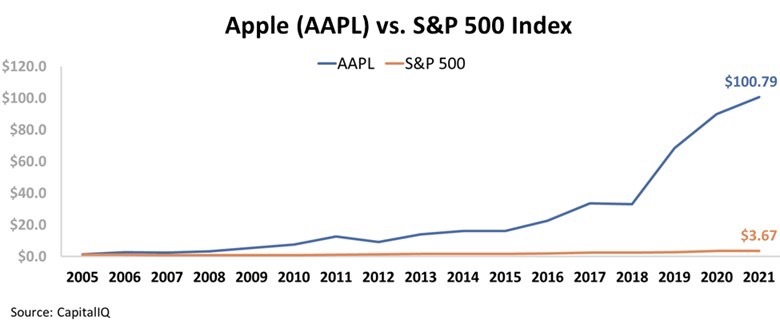

Apple's stock rose from around $1.50 per share in 2005 to around $168 per share today, making it a more than 100-bagger within 17 years – this shows how the iPhone helped transform Apple's returns.

Apple has also outperformed the S&P 500 Index by more than 25 times in that period of 2005 to date. While every dollar invested in the S&P 500 has more than tripled, every dollar invested in Apple is now worth more than $100.

Today, the last visionary prediction Steve Jobs made before his passing in 2011 is finally starting to play out...

Today, the last visionary prediction Steve Jobs made before his passing in 2011 is finally starting to play out...

At the time, much like his original vision for PCs, Jobs' prediction didn't get much attention... In fact, few people understood what he meant.

But today, his final prophecy is coming to life right now.

In my brand-new presentation, I reveal how Jobs' final prediction will transform the economy and your investments. I also give away the name and ticker symbol of my favorite way to play Job's final prophecy – totally free of charge.

Get all of the details right here.

Regards,

Joel Litman

March 23, 2022

Very few products anticipate consumer needs before they exist...

Very few products anticipate consumer needs before they exist...