The record number of ships waiting to dock is just scratching the surface of supply chain woes...

The record number of ships waiting to dock is just scratching the surface of supply chain woes...

Struggling to find toilet paper and standing desks in the early days of the pandemic was only the beginning of the supply chain shortages we've experienced over the past two years.

Grocery store aisles continue to be sparse or even bare, and shipments are often delayed by weeks or months.

Combine this with continued lockdowns and a severe chip shortage that hampered electronics and hardware production... and things don't look much prettier.

The once seamless global supply chain is grinding to a halt.

Highly populated areas of China are back in lockdown thanks to rising case counts, and more than one-fifth of all the world's container ships are stuck off the coast of China waiting to dock. As of the end of April, there were more than 500 vessels waiting to load and unload, an increase of almost 200% from February.

Supplies already couldn't be any tighter, and demand is hitting three-year peaks as well. After having our lives shut down by the pandemic, folks were in quick flight to rebound to their normal lives.

Companies are hoping to capture this spike in demand and ramp up their production, but things just aren't that simple.

As White House economists have been quick to remind us, these supply chain issues didn't just start with the pandemic.

While the global supply chain went largely unnoticed before 2020, it had slowly been unraveling with the increased demand put on it by increased globalization.

That means the end of the pandemic won't simply put an end to supply chain issues.

Instead, these issues are systematic, as U.S. companies have historically underinvested in property, plant, and equipment (PP&E) to maximize cash flows and resulting returns for shareholders.

Skimping out on these investments helped companies boost their bottom lines for a few years, but the time to pay the piper has finally arrived.

Our supply chain is like a pair of creaky old knees. They'll let you keep walking, but they're going to have a hard time getting up after sitting for a while.

Just like knee replacements are inevitable for an aching knee, it's just as crucial to replace ailing supply chain infrastructure.

There's only one real fix for our supply chain issues...

There's only one real fix for our supply chain issues...

We have spoken extensively about what is going to be a major capital expenditure ("capex") supercycle in the coming months and years.

Our data also confirms what the White House has been saying about capex investments: Companies will need to invest in capex to replace aging assets to allow the supply chain to flow normally again.

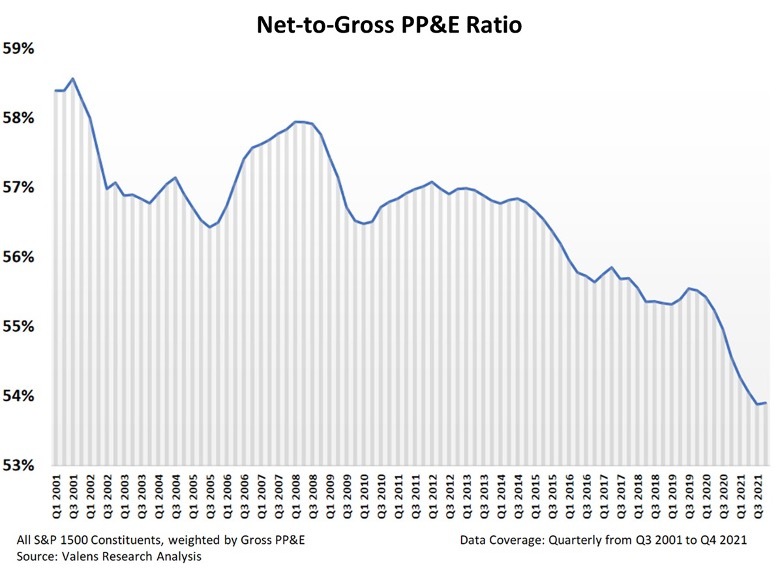

Looking at the following chart, we can see how old assets are in the U.S. A low net-to-gross PP&E ratio means that assets are more heavily depreciated on U.S. corporate balance sheets.

In other words, this chart is a measure of how old companies' physical stuff is. Based on the chart below, assets are at an all-time-high age. We can also see that in the fourth quarter of 2021, the trend finally started to reverse as companies realized the need to invest...

It's in corporate America's best interest to embrace investing in PP&E, as it will be the only way to capture all the market's pent-up demand.

Newer and therefore more dependable infrastructure will also provide the foundations for a more intertwined global economy, while maximizing the wealth of those living domestically as well.

That's why we're so bullish on the capex supercycle. It will be a boon for businesses and consumers alike.

In fact, we recently published some materials on what you should do before the Federal Reserve keeps raising interest rates, including information on how it might impact the capex cycle. If you're interested in learning more, you can click here.

Best,

Joel Litman

May 9, 2022

The record number of ships waiting to dock is just scratching the surface of supply chain woes...

The record number of ships waiting to dock is just scratching the surface of supply chain woes...