The tech takeover is leaving commodities in the shadows...

The tech takeover is leaving commodities in the shadows...

Investors have spent the past year captivated by the "Magnificent Seven" tech stocks. These industry giants now account for 30% of the S&P 500's market capitalization... despite only bringing in an estimated 20% of earnings.

And tech itself has a disproportionate influence on the market. The sector's weight is roughly eight times that of the energy sector, which accounts for 4% of the S&P 500's market cap.

Most of the past year's economic growth has been digital. Tech companies like Microsoft (MSFT) and Nvidia (NVDA) dominated the market thanks to their AI investments.

But for an economy to grow – even a digital economy – we need physical goods.

AI relies on lots of data centers, wires, computing power, and power plants to fuel all that demand. And all of that physical infrastructure relies on real materials like metal, electricity, and plastic.

As we'll explain, the optimism for technology is getting ahead of economic reality. And as euphoria reaches these irrational highs, the market might be in for a correction soon...

It has been decades since investors lost sight of reality to this extent...

It has been decades since investors lost sight of reality to this extent...

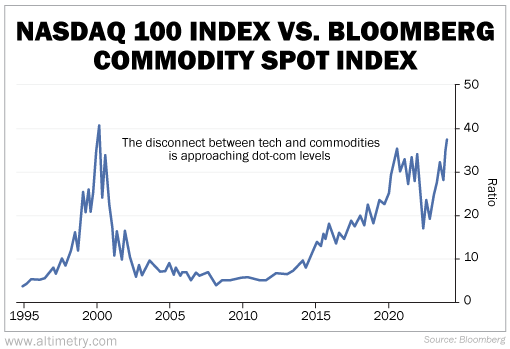

Take a look at this chart from Bloomberg. It shows how much tech investors are getting ahead of themselves... by comparing the price of the Nasdaq 100 Index with the Bloomberg Commodity Spot Index, which reflects the price action of commodity futures.

The higher the ratio, the more investors are betting on tech... while leaving the commodities that empower tech behind. It's a sign that tech investors have gotten too bullish, too fast.

The ratio has been on the rise for several years now. And as of late January, it was fast approaching 40 times. The only other time it surpassed that level was at the peak of the dot-com bubble...

Commodities fluctuate based on supply and demand. So it's unlikely that they're trading for cheaper than they should be.

Big AI companies like Nvidia had record years last year. But this chart shows massive stock gains in the tech sector are being driven by hope more than actual investment.

And based on the big dislocation between tech stocks and commodity prices, tech isn't growing quite as fast as investors were banking on.

The market is approaching a crossroads...

The market is approaching a crossroads...

Either commodities will start to catch up, or the tech sector will have to pull back.

A sudden commodity rally seems unlikely. Several world economies are officially in recessions, including giants like Japan and the U.K. It's no secret we think the U.S. is close behind.

Global economic growth is going to keep suffering. That's a perfect recipe for tech valuations to start falling.

So while the tech sector's growth has been phenomenal, this imbalance suggests a correction could be ahead.

Be careful where you tread in this AI mania...

Regards,

Joel Litman

February 28, 2024

The tech takeover is leaving commodities in the shadows...

The tech takeover is leaving commodities in the shadows...