The past two years have been the most turbulent for the banking industry since the Great Recession...

The past two years have been the most turbulent for the banking industry since the Great Recession...

The struggles came to a head in spring 2023, when First Republic Bank and Silicon Valley Bank ("SVB") both collapsed... resulting in two of the three largest commercial bank failures in U.S. history.

But to understand why these two banks went under – and why investors were worried about widespread collapses across the industry – we have to start further back.

The global pandemic sent the world into shutdown in 2020. Companies feared the worst as global supply chains came to a halt. And they opted to play it safe, putting their money in the banks until the storm cleared and they could spend again.

Consumers stopped spending as lockdown made travel and other experiences impossible. They, too, put money in the banks to spend at a future date.

As all that was happening, the U.S. government distributed more than $400 billion in stimulus checks to individuals in 2020.

In short, there was plenty of cash flooding the banks.

This surge in deposits caused a whiplash effect in the banking industry. And we're still dealing with it.

Yesterday, we looked back at the Texas savings and loan crisis of the 1980s... and how one man profited during the economic chaos.

Today, we'll examine the recent, similar banking crisis... how we got here... and what recovery efforts are underway.

Commercial bank deposits grew like crazy in recent years...

Commercial bank deposits grew like crazy in recent years...

Deposits rose from $10.5 trillion in 2015 to $13 trillion in 2019. In 2020 alone, they grew from $13 trillion to $16 trillion.

Read that again. Deposits grew more in 2020 than they did over the previous five years combined...

Now, when you give money to a bank, it doesn't just sit inside a vault until you come back to withdraw it.

Banks make their money by investing your deposits into assets like corporate and government bonds, mortgages, and auto loans. Except companies stopped spending money and issuing corporate bonds at the onset of the pandemic.

There weren't enough places for banks to move their money to. So they couldn't keep up with the influx of deposits.

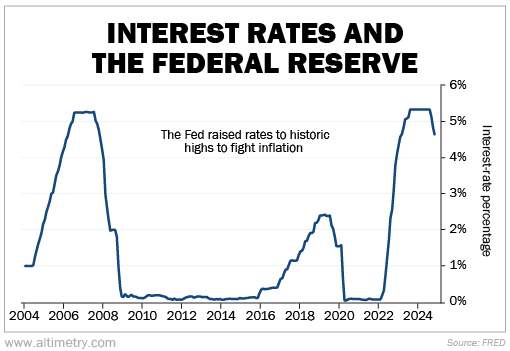

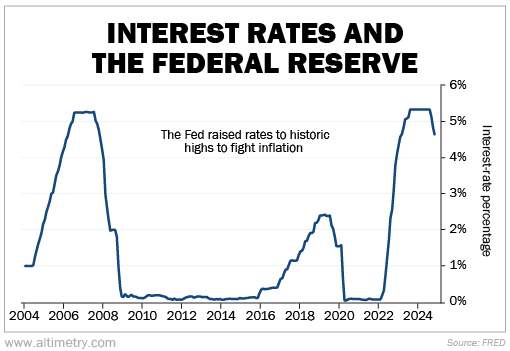

In order to fix the frozen economy, the Federal Reserve lowered the benchmark interest rate to near-zero levels. And the move worked... at first.

Investment picked up and commercial bank deposits leveled out around $18 trillion by the end of 2021. Companies began spending once again because it was virtually free to take on debt.

The Fed got the U.S. economy out of the rut caused by the pandemic. Money was flowing again... companies were issuing bonds... and things were looking up for banks.

But this new wave of spending led to another problem – inflation...

But this new wave of spending led to another problem – inflation...

Between 2015 and 2020, the consumer price index ("CPI") – one of the most common inflation measures – hovered between 0.1% and 2.4%. Inflation was just 1.2% in 2020 when spending slowed down.

That figure rose to 4.7% in 2021... and peaked at 8% in 2022. The Fed had a new problem on its hands.

And just as it used interest rates to give the economy a jump start in 2020, it used interest rates to battle inflation.

Starting in March 2022, the Fed raised rates 11 times... from near-zero levels to around 5.3%. This historic hike brought rates to a two-decade high...

This rate-hike cycle caused a new wave of issues for banks. And it eventually led to the collapse of SVB and First Republic.

In short, the Fed's overcorrection hurt the banking industry.

Anyone with money in the markets likely remembers the historic bank run of 2023...

Anyone with money in the markets likely remembers the historic bank run of 2023...

Venture-capital investors and other depositors wanted to withdraw funds after struggling in a high-interest-rate environment. Banks like SVB and First Republic had to sell investments like mortgage-backed securities ("MBS") and Treasurys to raise cash.

The problem was that they made those investments in 2020, when yields were low. New securities had higher yields and were far more valuable. So the banks were forced to sell their low-rate investments at a loss in order to recoup cash for withdrawals.

Depositors soon realized there might not be enough cash for everyone. You know what happened next...

SVB collapsed in March 2023 as the bank runs took hold. First Republic followed suit a few months later. Within a year of the Fed's interest-rate hikes, five U.S. banks went under... including two of the biggest bank failures in U.S. history.

The surviving banks still faced their fair share of struggles, even after regulators stepped in to prevent any additional bank runs...

The surviving banks still faced their fair share of struggles, even after regulators stepped in to prevent any additional bank runs...

Higher interest rates also pushed the cost of borrowing higher, which can lead to higher default rates. This made it riskier for banks to issue loans than it was in 2020.

Banks increased their reserves in 2023 to counteract the higher default risk. This is cash set aside to be used on a rainy day in case a borrower defaults.

In other words, it isn't money the bank can use to invest or generate profits.

And banks couldn't sell existing low-yield loans to put their money to work at higher interest rates... even if they wanted to. If they did, they'd take a loss on those loans, eating into their capital buffers.

Their ability to invest was further limited last year, when regulators looked to implement a set of standards known as Basel III. These regulations would have required "systemically important" banks to increase their capital buffers by 19%, and 10% for regional banks.

After benefiting from the Fed's efforts to stimulate the economy in 2020, some banks got crushed in 2022 and 2023.

And some are only alive today because regulators won't let them die...

This environment won't last forever, though. Tomorrow, we'll dive deeper into what might become the biggest wave of bank deregulation in decades.

Regards,

Joel Litman

January 8, 2025

The past two years have been the most turbulent for the banking industry since the Great Recession...

The past two years have been the most turbulent for the banking industry since the Great Recession...