After a multimonth bidding war, the North American train landscape is about to look different...

After a multimonth bidding war, the North American train landscape is about to look different...

Canadian Pacific Railway (CP) and Canadian National Railway (CNR.TO), two of the largest railway operators in North America, have been fiercely battling over acquiring smaller rival Kansas City Southern (KSU), a short-rail operator south of the border.

The drama began in late March when Canadian Pacific started a bidding war with its $25 billion takeover offer, which at first appeared to be enough to close the deal.

In May, Canadian National countered with a $33.6 billion offer, leading Kansas City Southern to back away from the initial deal with Canadian Pacific.

Canadian National's deal offers to buy more stock at a higher price and cover a $700 million breakup fee Kansas City Southern would need to pay for backing out of the deal with Canadian Pacific.

As of now, Kansas City Southern's shareholders still need to vote on the deal. The takeover bid is awaiting a regulatory announcement due later this month that will determine whether or not the U.S. Surface Transportation Board ("STB") approves Canadian National's use of a voting trust to acquire the shares.

If regulators decide against the deal, Canadian Pacific, with less direct overlap with Kansas City Southern and therefore less regulatory concern, will be waiting with a newly revamped offer of its own.

All of this fighting raises the question… is Kansas City Southern that valuable?

All of this fighting raises the question… is Kansas City Southern that valuable?

The main value proposition for both acquirers is that Kansas City Southern, while the smallest major American freight operator, plays a massive role in trade between the U.S. and Mexico.

It ferries up auto parts from factories in Mexico to the U.S. and carries down agricultural produce from the plains to across the border.

By creating the first railroad network to connect all of North America, from the Gulf through the American Midwest and into Canada, the winner of the bidding war would be able to cover many of the most vital regions for rail transport across the continent.

While this business strategy makes sense, as with any other big acquisition, the equally important question is: How much did you have to pay to get it?

Fortunately, by utilizing our Embedded Expectations Analysis framework, we can get a good sense of exactly what Kansas City Southern will need to do for Canadian National's shareholders to be happy with the purchase price.

Stock valuations are typically determined using a discounted cash flow ("DCF") model, which makes assumptions about the future and produces the "intrinsic value" of the stock.

Here at Altimetry, we know models with garbage-in assumptions based on distorted GAAP metrics only come out as garbage. Therefore, with our Embedded Expectations Framework, we use the current stock price to determine what returns the market forecasts.

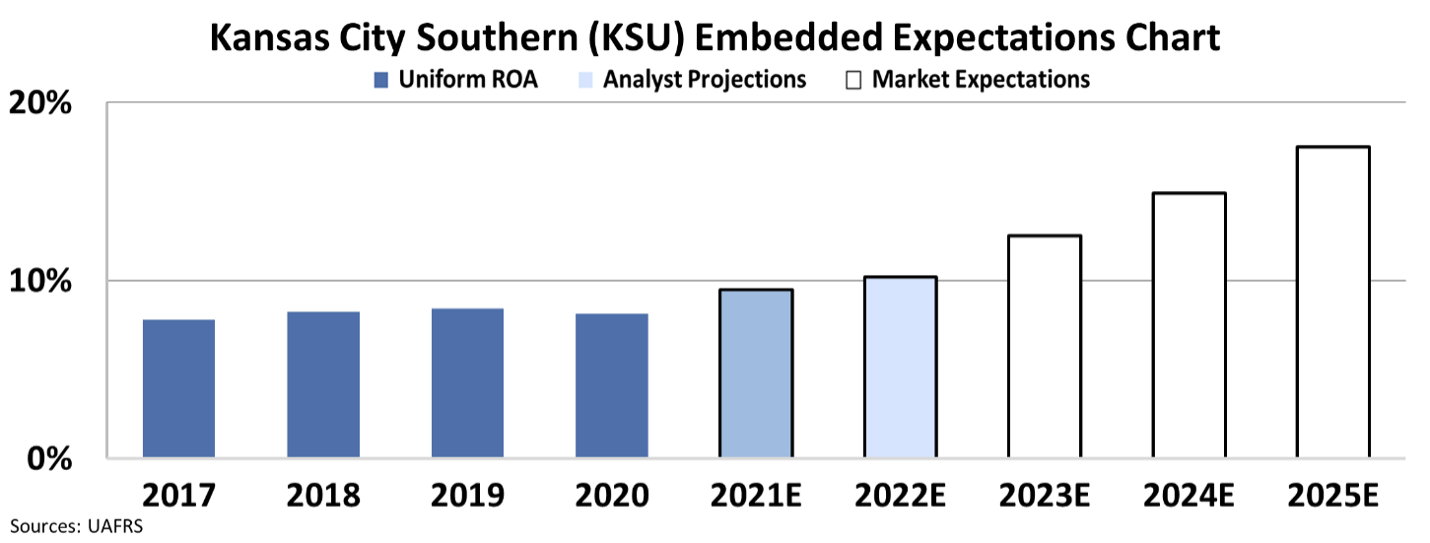

In the chart below, the dark blue bars represent Kansas City Southern's historical corporate performance levels in terms of return on assets ("ROA"). The light blue bars are Wall Street analysts' expectations for the next two years. Finally, the white bars are the market's expectations for how the company's ROA will shift over the next five years.

As the deal stands currently, Kansas City Southern shareholders are getting $200 in cash and roughly 1.06 shares of Canadian National stock, which translates to about $319 per share.

At this price, Canadian National is going to have to realize synergies to justify its decision. That's because Kansas City Southern would need to see Uniform ROA reach 18% by 2025 for the deal to pay off. It is an unlikely scenario, given the company would need to reach record-high returns.

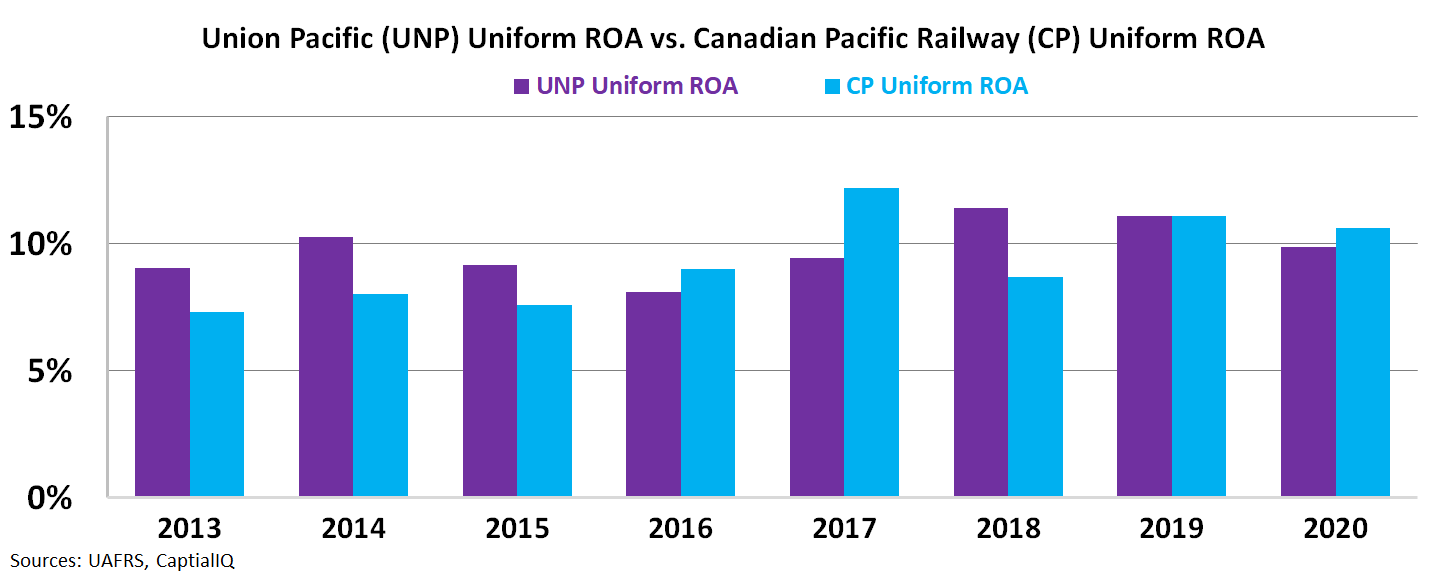

Canadian National's Uniform ROA has hovered around 10% over the past seven years. Even its biggest competitors – Canadian Pacific, Kansas City Southern's other bidder, and Union Pacific (UNP), a railroad titan of the American West – have historically never seen Uniform ROA crest above 13%.

Forecasts for 2021 and 2022 ROA should only rise to 12%, less than the 17% to 18% levels needed for Kansas City Southern's acquisition price to be reasonable. It looks like Canadian National may be suffering from the winner's curse a few years from now when it looks back on the price tag of this transaction.

Thanks to Uniform Accounting, we can see the feasibility of this transaction immediately, a takeaway usually clouded by as-reported metrics.

It goes to show using the right numbers is crucial for investors and management teams alike.

Expectations are what markets are all about... so remember to keep an eye out for mispricings...

Expectations are what markets are all about... so remember to keep an eye out for mispricings...

In our Altimetry's Hidden Alpha newsletter, we use our Uniform Accounting analysis to identify companies that are primed for big upside because of market mispricings.

Readers who followed our advice have doubled their money with four different recommendations... and are currently sitting on double-digit gains with 15 open positions.

Learn more about Hidden Alpha – and find out how to gain instant access to the full portfolio of open stock recommendations – by clicking here.

Regards,

Rob Spivey

August 31, 2021

After a multimonth bidding war, the North American train landscape is about to look different...

After a multimonth bidding war, the North American train landscape is about to look different...