Parents cite child care issues as a reason for leaving the workforce...

Parents cite child care issues as a reason for leaving the workforce...

Households with young children took a major hit during the global pandemic. School closures and virtual learning forced parents to make difficult decisions.

For many, the dilemma centered around balancing work with the need for child care.

In industries where workers were deemed essential, folks were forced to decide between keeping their jobs and caring for their children at home.

Not surprisingly, some workers needed to leave the labor force to care for their children, and working mothers account for most of the exodus.

In January 2021, there were 1.5 million fewer American mothers with children under age 13 in the workforce. That's an 8% drop when you compare it to the prior year.

The decline in mothers participating in the labor force may have long-lasting consequences, ranging from limited career progression to increased mental health issues.

But as restrictions subside and schools and offices reopen, the question of child care remains at the forefront for many American parents.

One company is offering a solution in the wake of the child care crisis...

One company is offering a solution in the wake of the child care crisis...

Employment figures are regaining lost ground as the number of COVID-19 infections in the U.S. continues to fall.

As schools reopen and in-person learning resumes, you might assume that parents of young children are anxious to return to the workforce...

However, even with a return to some normalcy – which may include a hybrid of remote and in-person work – child care remains a serious challenge for many parents.

Balancing a career with caring for others can increase stress and anxiety among parents, limiting their productivity and performance at work.

In fact, a pre-pandemic U.S. Chamber of Commerce study shows that child-care-related issues – such as employee absences from work – cost companies billions of dollars annually.

One solution is Bright Horizons Family Solutions (BFAM). Founded in 1986, the long-established service provider specializes in a slew of child care services across its 700-plus locations nationwide...

Given the current shortfall in child care, Bright Horizons' services may help companies balance work and family life in a way that ensures success for employees.

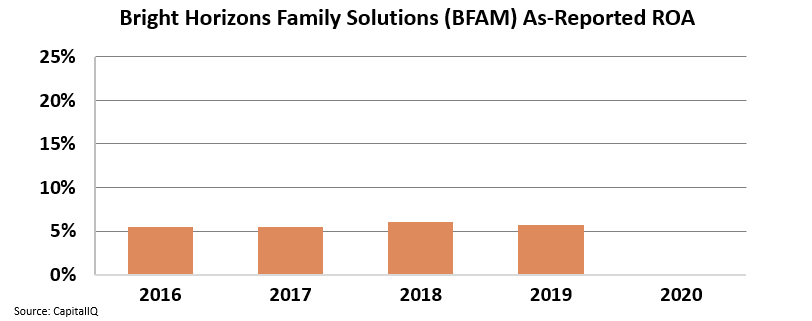

However, based on as-reported financial metrics such as return on assets ("ROA"), it appears that Bright Horizons is not a very profitable company.

For example, excluding the pandemic in 2020, the company has had unimpressive ROA figures between 5% and 6% over the past five years, collapsing to zero during the pandemic.

See for yourself below…

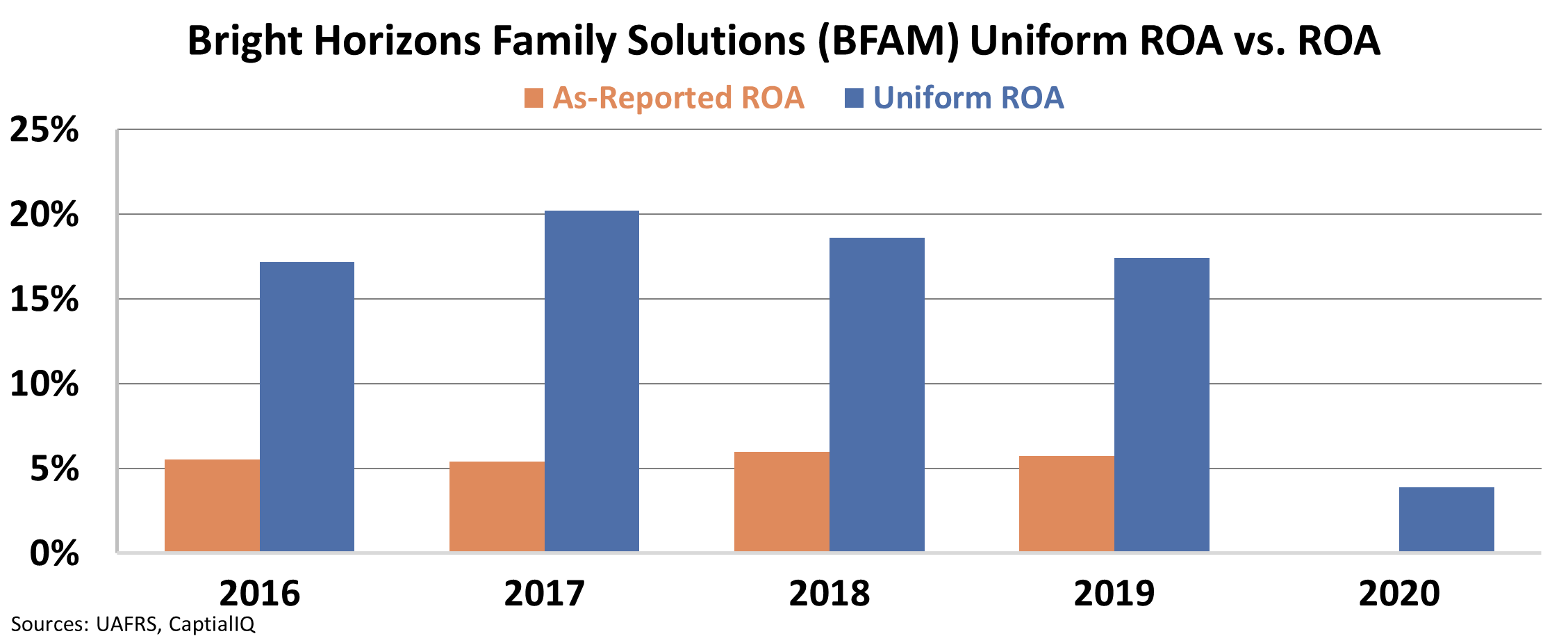

However, when we remove the accounting distortions inherent to GAAP, you can see that the true returns for Bright Horizons over the past five years have been more than 17%, higher than corporate averages of 12%.

Bright Horizons can build value for families during normal times. Now the question is whether Bright Horizons can carry this forward into the post-pandemic era.

Uniform Accounting shows Bright Horizons has impressive levels of profitability… But this alone can't tell investors whether the stock is a buy...

Uniform Accounting shows Bright Horizons has impressive levels of profitability… But this alone can't tell investors whether the stock is a buy...

To understand if the stock is a buy or not during reopening, we also need to look at what the market expects.

For that, we need to review our Embedded Analyst Expectations for the company. And tomorrow, we will show you where Bright Horizons stands in the current market.

Stay tuned to Altimetry Daily Authority to find out more...

Regards,

Rob Spivey

July 6, 2021

Parents cite child care issues as a reason for leaving the workforce...

Parents cite child care issues as a reason for leaving the workforce...