AI stocks have dominated the market for the past two years...

AI stocks have dominated the market for the past two years...

And early leaders, like Nvidia (NVDA), Microsoft (MSFT), and Apple (AAPL), have reaped huge benefits.

In the past year, Apple is up 29% and Microsoft is up 31%. Nvidia has soared more than 150%.

These companies have provided a much-needed boost to the stock market... Back in 2022, the tech-heavy Nasdaq 100 Index dropped by about one-third. The index is up 18% so far this year.

It's not all sunshine and roses though. AI companies have masked the underperformance of the broader tech industry...

The Technology Select Sector SPDR Fund (XLK), which tracks a range of tech stocks, is up only 20% year to date.

That may seem OK for a 10-month period. But it doesn't stack up to the fund's strong performance in recent years... Between 2019 and 2021, XLK had an average return of 41%.

AI tech stocks Nvidia, Microsoft, and Apple make up more than 40% of XLK and have largely carried the index this year. The other, non-AI stocks have struggled to keep pace.

While AI continues to surge, tech, as a whole, remains an alluring space for investors.

That doesn't mean you should blindly buy everything you can get your hands on, though. Investors still need to be cautious when putting money into tech today...

Once upon a time, companies like PayPal (PYPL), Snap (SNAP), and Zoom Video Communications (ZM) ruled the tech sector...

Once upon a time, companies like PayPal (PYPL), Snap (SNAP), and Zoom Video Communications (ZM) ruled the tech sector...

They led the market at the height of the COVID-19 pandemic... when FinTech, visual messaging, and video technology were in high demand.

In 2020, these companies took advantage of near-zero interest rates and bought cheap debt.

This helped them invest in their businesses and grow at breakneck speeds. And the market rewarded them for it.

But then they hit a wall... The Federal Reserve started hiking rates in 2022, causing many venture-capital investors and banks to turn off their money taps.

Today, these same companies are struggling to stay afloat... PayPal, Snap, and Zoom are more than 70% off their 2021 highs.

Without significant AI exposure, these stocks won't return to their highs any time soon. We're seeing this trend among many other tech companies as well...

According to Bloomberg, revenue growth for companies in the S&P Information Technology subindex fell below 7% in the past 12 months. The five-year average was 10%.

Overall, 75% of companies in this index are growing more slowly than their historical averages.

The message is clear... Very few non-AI companies are seeing the same success as their AI counterparts.

AI is the reason some tech companies are prospering while others are struggling...

AI is the reason some tech companies are prospering while others are struggling...

AI is a critical part of today's tech revolution. And as history has shown, companies that jump on the opportunity to innovate tend to profit. Those that don't inevitably miss out on big upside.

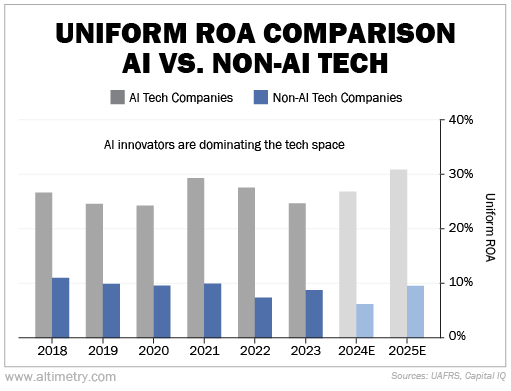

Take a look at the following chart. It shows the average Uniform return on assets ("ROA") for the biggest AI and non-AI tech firms...

AI tech firms averaged a Uniform ROA of around 25% over the past five years... more than twice the 12% corporate average. They pushed 30% levels in 2021 due to solid market performance.

On the flip side, returns for non-AI tech companies have hovered around an unimpressive 9% in the same period.

Thanks to the AI boom, Wall Street analysts forecast that AI companies' returns will reach new peaks in 2025 and beyond.

Meanwhile, non-AI businesses will likely miss out on this opportunity. Analysts expect Uniform returns to stay below 10% going forward.

AI companies are already more profitable than their non-AI counterparts. And the gap will only widen in the coming years, which means…

Investors need to be selective when entering the tech space...

Investors need to be selective when entering the tech space...

It's not enough to just "buy tech." You need to know which companies are focusing on the right technology.

And these days, AI is the ticket to explosive gains. That's why Nvidia, Apple, and Microsoft are leading the market.

If you're looking to profit from the AI boom, you shouldn't immediately jump into a tech stock just because it did well in 2020, or a tech fund like XLK.

You're better off picking companies that are truly capitalizing on the AI megatrend... the ones bringing revolutionary new products to market.

Regards,

Joel Litman

October 7, 2024

AI stocks have dominated the market for the past two years...

AI stocks have dominated the market for the past two years...