The size of the target market is one of the most important aspects of proper analysis on a particular company...

The size of the target market is one of the most important aspects of proper analysis on a particular company...

This simple metric helps investors understand how big a business could become, as well as the company's long-term potential. It's commonly called "total addressable market," or "TAM."

Companies with larger TAMs inherently have more potential upside. If they gain a big part of that market, lots of revenue and earnings should be heading their way.

For instance, Roku's (ROKU) market opportunity is anyone who wants to stream TV shows and other content using a TV. So anyone who wants to watch TV without using traditional cable is Roku's TAM. Apple's (AAPL) market opportunity is anyone who wants to have a smartphone or premium computer – as well as stream content – among many other markets.

Apple's massively larger TAM is why Roku, at a more than $45 billion market cap, is never going to get as big as Apple, with its more than $2 trillion market cap.

Here at Altimetry, we have a running joke about how e-commerce giant Amazon (AMZN) has the largest TAM of all...

Here at Altimetry, we have a running joke about how e-commerce giant Amazon (AMZN) has the largest TAM of all...

The joke is that Amazon's TAM is essentially the world's gross domestic product ("GDP"). Based on how the company is constantly launching new products in new industries to meet new customer needs, there doesn't seem to be a business Amazon won't enter.

And this idea recently became more apparent with Amazon's expansion into an entirely new market – hair salons.

If that doesn't prove Amazon's insatiable hunger for TAM, we're not sure what does.

The company decided to enter the space because it sees an opportunity to use salons to prove the power of augmented reality.

Amazon wants customers to see how their hair might look before taking any drastic steps for a haircut. It essentially plays out a simulation for the customer before stylists open their scissors.

It's just another example of how Amazon is leveraging its power and TAM to move into more industries.

With each move into a new market, Amazon creates big disruptions... and sends a shiver of fear through the current players.

With each move into a new market, Amazon creates big disruptions... and sends a shiver of fear through the current players.

First, it caused book stores to vanish across the U.S. and the globe. Then it was one of the big contributors to the emergence of e-commerce and the death of the mall.

And if Amazon has success and follows through with its prototype hair salons, Regis (RGS) should be worried about the move.

Regis owns, franchises, or holds ownership interests in nearly 7,000 hair salons across the U.S., including through chains such as Supercuts, SmartStyle, and Roosters.

While Regis is a market leader in the space, as we mentioned, no incumbent is ever safe when Amazon comes calling.

And it appears the market doesn't recognize Regis' potential risks.

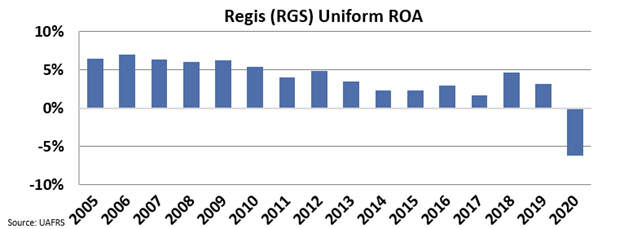

Historically, the company has steadily seen Uniform return-on-asset ("ROA") levels fall from around 7% in the mid-2000s to around 3% in the mid-to-late 2010s, aside from 2020's pandemic-induced negative 6%. Take a look...

And yet, the market is pricing in Regis' ROA to reach new peaks...

And yet, the market is pricing in Regis' ROA to reach new peaks...

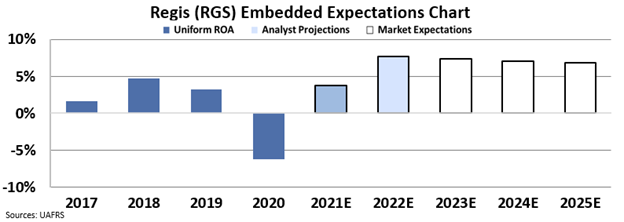

We can see this through our Embedded Expectations Framework. Here's how it works...

Most investors determine stock valuations using a discounted cash flow ("DCF") model, which takes assumptions about the future and produces the "intrinsic value" of the stock.

However, here at Altimetry, we know models with garbage-in assumptions only come out as garbage. Therefore, we turn the DCF model on its head with our Embedded Expectations Framework. We use the current stock price to determine what returns the market expects.

In the chart below, the dark blue bars represent Regis' historical corporate performance levels in terms of ROA. The light blue bars are Wall Street analysts' expectations for the next two years. Finally, the white bars are the market's expectations for how the company's ROA will shift over the next five years.

Wall Street analysts are expecting Regis' Uniform ROA to recover strongly by 2022 – with a jump all the way to 6%. Regis hasn't seen a Uniform ROA that high in the past 11 years, but it might be understandable... If many mom-and-pop shops have gone under, Regis' brands might take market share in the short term. This would lead to a boost in profitability.

However, if Amazon does successfully enter this market, there's no way that Regis will consistently produce returns that are in line with levels it hasn't generated in more than a decade.

And when investors realize that, RGS shares could fall significantly.

Regards,

Rob Spivey

May 26, 2021

The size of the target market is one of the most important aspects of proper analysis on a particular company...

The size of the target market is one of the most important aspects of proper analysis on a particular company...