It took a pandemic to turbocharge Walmart's (WMT) e-commerce business...

It took a pandemic to turbocharge Walmart's (WMT) e-commerce business...

For nearly a decade, the retail giant claimed to be pursuing a dual strategy. It invested primarily in physical supercenters... but kept a toe in a fledgling online business.

Unfortunately for Walmart, few people were rushing to use its online platform back in 2010. And its e-commerce experience was subpar. So consumers flocked to competitors like online retail titan Amazon (AMZN).

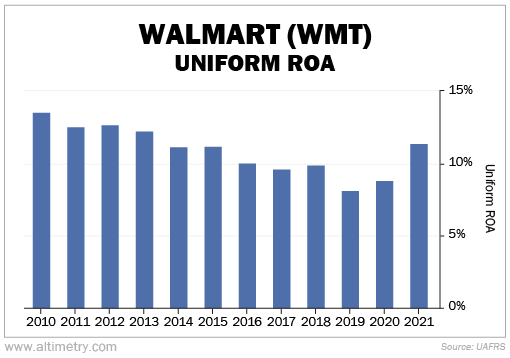

Walmart's profitability dropped for years. Its Uniform return on assets ("ROA") went from nearly 14% in 2010 to just above 8% by 2019. As investors watched its profitability fall apart, they became convinced that Walmart wouldn't be able to stop the tailspin.

Then, as you've undoubtedly heard many times before... COVID-19 changed everything.

In the late 2010s, Walmart started to really embrace at-home delivery. By 2020, thanks to the pandemic, it went full-bore into online ordering. And since consumers were stuck at home with plenty of stimulus money, they got comfortable buying from Walmart.

Investors noticed that shift. From the beginning of 2019 until the end of 2022, Walmart's stock was up 63%. That was much better than Amazon's 12% stock return in that time frame. Walmart was starting to make up lost ground.

But as I'll explain today, it looks like the "at-home revolution" tailwinds are petering out. Consumers are getting back to their old spending habits. They're moving on from the rush toward online shopping back to physical stores... And investors don't seem to have caught on.

E-commerce went into overdrive during COVID-19...

E-commerce went into overdrive during COVID-19...

And Walmart poured a ton of money into that side of the business. Revenue rose 20%, from $514 billion in Fiscal Year 2019 to $611 billion in Fiscal Year 2023.

The company's ROA had been falling for nearly a decade. But by beefing up its online offerings, Walmart was able to buck that trend. Uniform ROA rose from 8% in 2019 to 11% by 2021... near the 12% corporate average.

Take a look...

By 2021, Walmart had hit $75 billion in online sales. The company was growing its e-commerce segment five times faster than Amazon. At that growth rate, Walmart's e-commerce sales were projected to overtake Amazon's total retail sales in less than four years.

That higher revenue benefited Walmart's physical stores as well. Customers liked the option of buying items online and picking them up in person. For all of Amazon's incredible reach, it couldn't match that offering.

Investors were impressed by these changes and bought in aggressively. But now, cracks are starting to form in Walmart's bold e-commerce bet...

Earlier this month, the company announced 2,000 job cuts at its U.S. e-commerce fulfillment centers. Walmart is getting hit by the same e-commerce slowdown that has hurt Amazon and other peers.

Walmart suggested laid-off workers could find jobs in other parts of the business...

Walmart suggested laid-off workers could find jobs in other parts of the business...

We don't think that's likely. The economy is cooling off... And we wouldn't be surprised if Walmart has to make even more cuts.

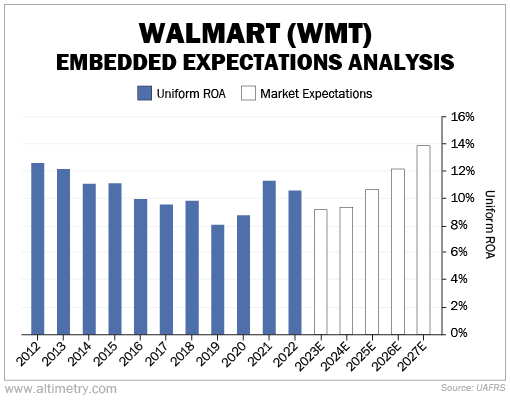

But investors are blindly hoping that things won't get worse. We can see this through our Embedded Expectations Analysis ("EEA") framework...

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from the company's future cash flows. We then compare that figure with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

We know Uniform ROA didn't bounce back until the pandemic hit. Walmart reversed its downtrend in 2020... and pulled off a stellar 2021, booking its highest returns since 2015.

But returns already started to roll over last year. Wall Street analysts forecast a further step back in 2023 and 2024. And investors, in all their blissful ignorance, still think Uniform ROA will jump to decade-high levels by 2027.

Take a look...

Walmart is sliding back from e-commerce. If the online business slows down – or even if the physical stores follow suit – its Uniform ROA might slip, too.

As a reminder, returns were in a steady decline before the e-commerce business took off. Investors are hoping that Walmart's adventure into e-commerce will bring it back to the "good old days." But this story has already played out... The company is spiraling down to the returns of the late 2010s.

Walmart's stock is up 6% so far in 2023. But don't get attached... Once investors recognize the company's plunging prospects, its stock will likely head south.

Regards,

Rob Spivey

April 27, 2023

It took a pandemic to turbocharge Walmart's (WMT) e-commerce business...

It took a pandemic to turbocharge Walmart's (WMT) e-commerce business...