The coronavirus pandemic has accelerated a science-fiction idea into the mainstream...

The coronavirus pandemic has accelerated a science-fiction idea into the mainstream...

For decades, science-fiction writers and ambitious business owners have dreamed of automation taking over manual labor in the workplace.

However, the actual speed of adoption across the western world has been much slower than many folks anticipated.

Before 2020, Japan was the only country that embraced automation research. It has been desperate to wean itself off its heightened labor needs caused by an aging population and a dearth of workers.

However, the pandemic flipped this status quo...

Quarantine and social-distancing guidelines have led to a surging implementation of automation and robotics across various industries.

With advancements in artificial intelligence ("AI"), machine learning, and robotics technology, businesses have begun to reassess the economics of automation. These advancements aren't just in hardware... but also in software.

Companies used to believe that the benefits of automation and robotics came in the form of lower costs and higher quality, which would steadily grow the bottom line.

However, companies now want to explore these tech advancements to prove business resiliency and lower factory risks as well.

Automation also allows firms to streamline the insights they recognize from the manufacturing process. The assembly line becomes easier to enhance, and management teams can gather signals about their businesses from self-reporting processes.

To figure out how to play this automation wave, find the companies selling the technology...

To figure out how to play this automation wave, find the companies selling the technology...

For decades, one firm has been at the heart of the move toward automation and robotics in the factory.

Rockwell Automation (ROK) was founded nearly 120 years ago in 1903 and has been an innovative force in machinery development ever since. Today, the company designs hardware and software to help businesses automate their factories and improve productivity.

Furthermore, Rockwell's services are geared for companies to maximize the value of the people who are still a part of the overall manufacturing process. By creating robots for specific repeatable tasks, Rockwell's customers ultimately save money, as robots reduce error and humans use intelligence and adaptability.

To see what Rockwell's place at the heart of the automation boom means for its performance and upside, we can turn to The Altimeter...

To see what Rockwell's place at the heart of the automation boom means for its performance and upside, we can turn to The Altimeter...

This is our software tool for simplifying how to understand how company performance and valuations, based on Uniform Accounting metrics.

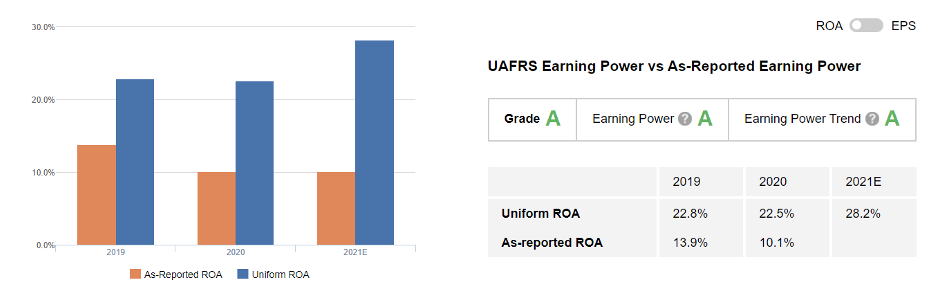

Investors stuck looking at the distorted as-reported numbers would see a firm with near average returns.

Meanwhile, after we clean up the GAAP data using Uniform Accounting, we can see that Rockwell generates robust return-on-asset ("ROA") levels at 23%... and this metric is forecasted to rise this year. Rockwell has impressive profitability and has been largely unaffected by any pandemic-related tailwinds. This is the main driver of the company's "A" grade for performance in The Altimeter.

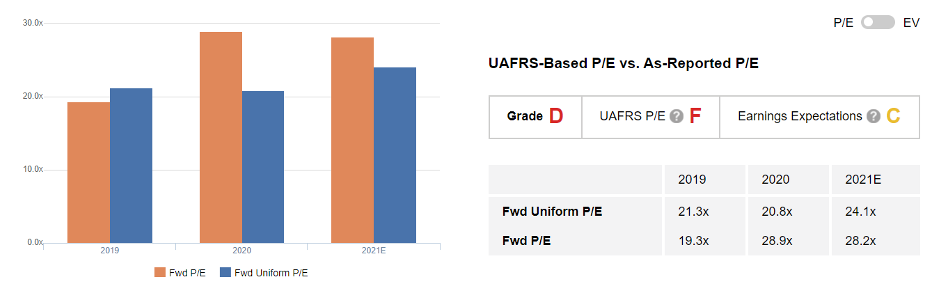

And yet, despite this strength in returns, Rockwell earns an "F" grade for UAFRS P/E. This is a result of its Uniform price-to-earnings (P/E) ratio of 24. That's less than its as-reported P/E ratio... but it's still a premium to corporate averages.

To justify such a high valuation, Rockwell would need to combine strong earnings with compounding earnings growth. So let's take a closer look...

To justify such a high valuation, Rockwell would need to combine strong earnings with compounding earnings growth. So let's take a closer look...

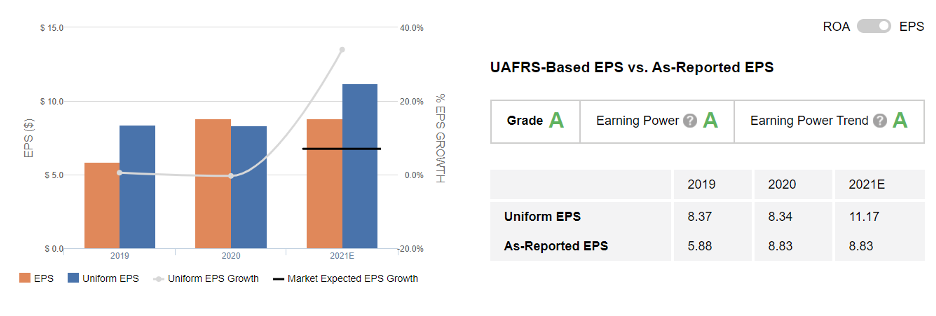

Due to the pace at which demand is growing, the company's earnings are growing as well. Rockwell's Uniform earnings per share ("EPS") are forecasted to grow from a healthy $8.37 in 2019 to $11.17 this year. Even though this metric is expected to come back down in 2022, it's only forecast to fall to $9.95 per share. That's still comfortably above 2020 levels, which justifies Rockwell's premium Uniform P/E ratio of 24.

So even though Rockwell has high valuations, The Altimeter shows that the company has strong profitability and earnings growth. Thanks to these solid fundamentals from its position in the midst of this automation wave, Rockwell looks like a compelling name.

Regards,

Rob Spivey

February 4, 2020

P.S. With The Altimeter, you can leverage the power of Uniform Accounting to take a look at thousands of U.S.-listed companies based on their real profitability and valuations. Using this veritable "stock truth detector" can help you determine which stocks in your own portfolio could be primed to move higher... and which ones could be poised to collapse. Learn more here.

The coronavirus pandemic has accelerated a science-fiction idea into the mainstream...

The coronavirus pandemic has accelerated a science-fiction idea into the mainstream...